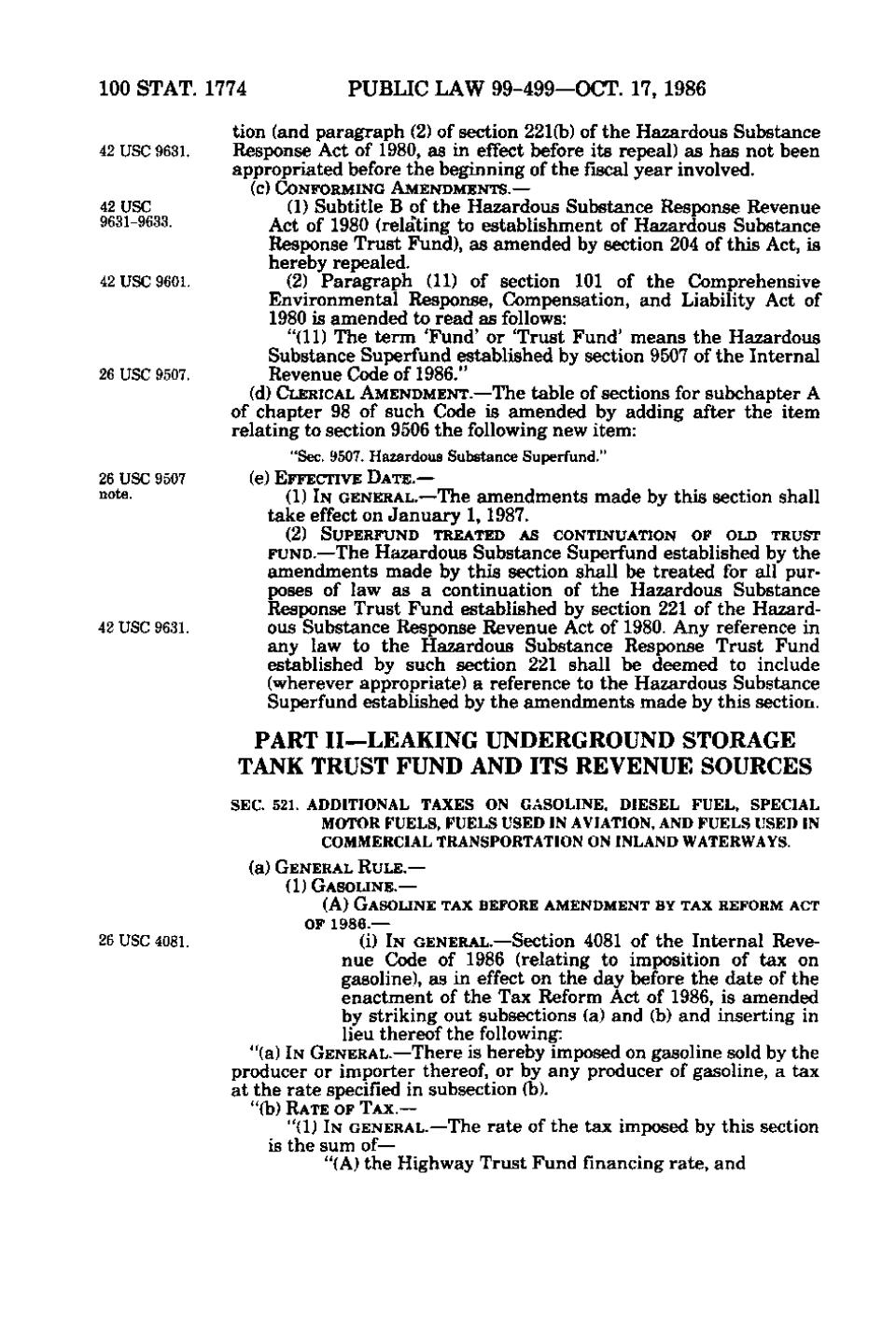

100 STAT. 1774

PUBLIC LAW 99-499—OCT. 17, 1986

tion (and paragraph (2) of section 221(b) of the Hazardous Substance Response Act of 1980, as in effect before its repeal) as has not been appropriated before the beginning of the fiscal year involved.

42 USC 9631.

(c) CONFORMING AMENDMENTS.—

42 USC 9631-9633.

(1) Subtitle B of the Hazardous Substance Response Revenue Act of 1980 (relating to establishment of Hazardous Substance "'* Response Trust Fund), as amended by section 204 of this Act, is hereby repealed. (2) Paragraph (11) of section 101 of the Comprehensive Environmental Response, Compensation, and Liability Act of 1980 is amended to read as follows: "(11) The term 'Fund' or 'Trust Fund' means the Hazardous Substance Superfund established by section 9507 of the Internal Revenue Code of 1986." (d) CLERICAL AMENDMENT.—The table of sections for subchapter A of chapter 98 of such Code is amended by adding after the item relating to section 9506 the following new item:

42 USC 9601.

26 USC 9507.

"Sec. 9507. Hazardous Substance Superfund." (e) EFFECTIVE DATE.—

26 USC 9507 note.

(1) IN GENERAL.—The amendments made by this section shall take effect on January 1, 1987. (2)

SUPERFUND TREATED AS CONTINUATION OF OLD TRUST

• FUND.—The Hazardous Substance Superfund established by the • amendments made by this section shall be treated for all purposes of law as a continuation of the Hazardous Substance Response Trust Fund established by section 221 of the Hazardous Substance Response Revenue Act of 1980. Any reference in any law to the Hazardous Substance Response Trust Fund established by such section 221 shall be deemed to include (wherever appropriate) a reference to the Hazardous Substance Superfund established by the amendments made by this section.

42 USC 9631.

PART II—LEAKING UNDERGROUND STORAGE TANK TRUST FUND AND ITS REVENUE SOURCES !'

SEC. 521. A D D I T I O N A L TAXES ON GASOLINE, DIESEL FUEL, SPECIAL MOTOR FUELS, FUELS USED IN AVIATION, AND FUELS USED IN COMMERCIAL TRANSPORTATION ON INLAND WATERWAYS. (a) GENERAL RULE.— (1) GASOLINE.— (A) GASOLINE TAX BEFORE AMENDMENT BY TAX REFORM ACT OF 1986.—

26 USC 4081.

(i) IN GENERAL.—Section 4081 of the Internal Revenue Code of 1986 (relating to imposition of tax on gasoline), as in effect on the day before the date of the enactment of the Tax Reform Act of 1986, is amended by striking out subsections (a) and (b) and inserting in lieu thereof the following: "(a) IN GENERAL.—There is hereby imposed on gasoline sold by the producer or importer thereof, or by any producer of gasoline, a tax at the rate specified in subsection (b). "(b) RATE OF TAX.—

"(1) IN GENERAL.—The rate of the tax imposed by this section is the sum of— "(A) the Highway Trust Fund financing rate, and

�