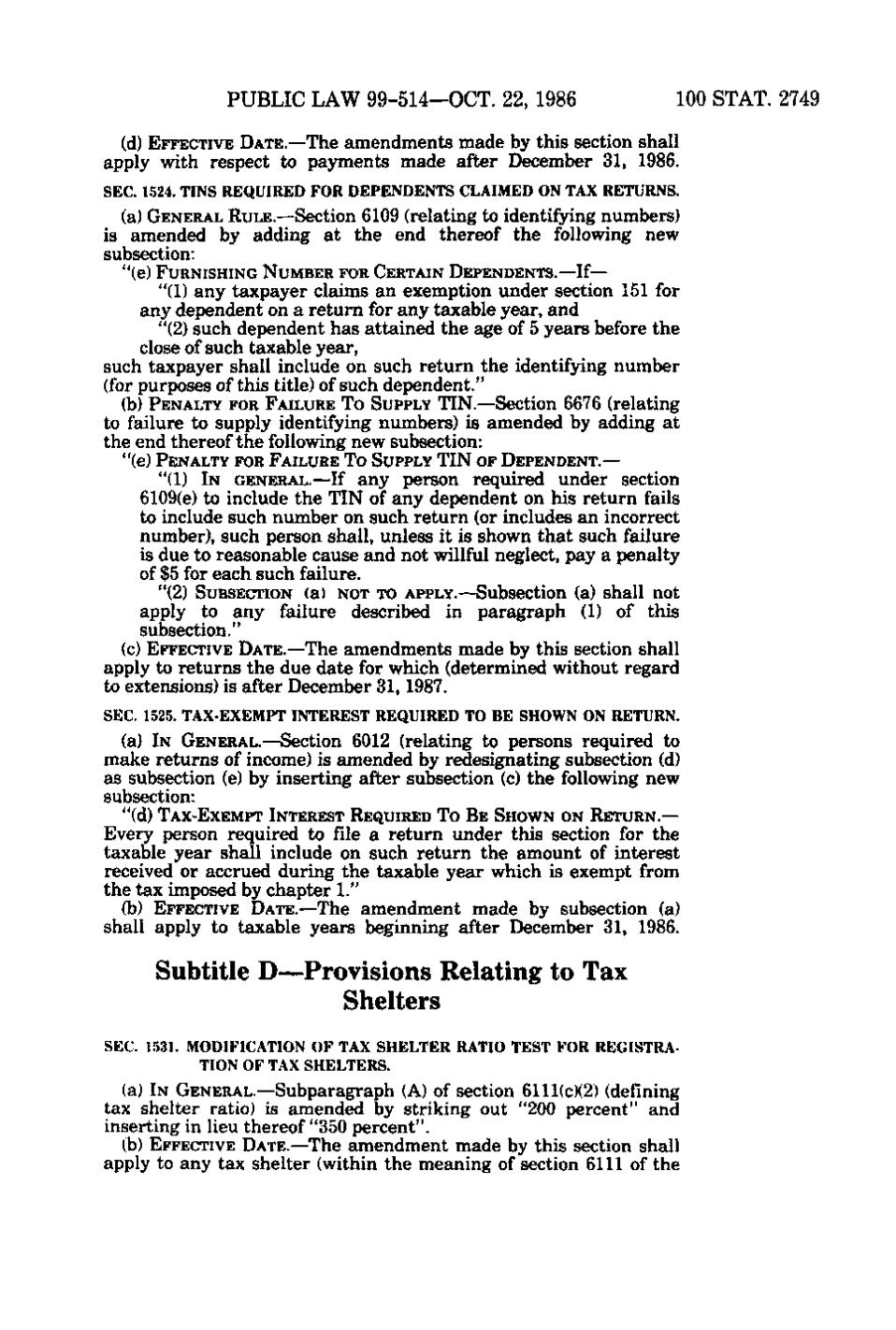

PUBLIC LAW 99-514—OCT. 22, 1986

100 STAT. 2749

(d) EFFECTIVE DATE.—The amendments made by this section shall apply with respect to payments made after December 31, 1986. SEC. 1524. TINS REQUIRED FOR DEPENDENTS CLAIMED ON TAX RETURNS.

(a) GENERAL RULE.—Section 6109 (relating to identifying numbers) is amended by adding at the end thereof the following new subsection: "(e) FURNISHING NUMBER FOR CERTAIN DEPENDENTS.—If—

"(1) any taxpayer claims an exemption under section 151 for any dependent on a return for any taxable year, and "(2) such dependent has attained the age of 5 years before the close of such taxable year, such taxpayer shall include on such return the identifying number (for purposes of this title) of such dependent." 03) PENALTY FOR FAILURE TO SUPPLY TIN.—Section 6676 (relating to failure to supply identifying numbers) is amended by adding at the end thereof the following new subsection: "(e) PENALTY FOR FAILURE TO SUPPLY TIN OF DEPENDENT.—

"(1) IN GENERAL.—If any person required under section 6109(e) to include the TIN of any dependent on his return fails 0 to include such number on such return (or includes an incorrect 1 number), such person shall, unless it is shown that such failure is due to reasonable cause and not willful neglect, pay a penalty i- of $5 for each such failure. "(2) SUBSECTION (a) NOT TO APPLY.—Subsection (a) shall not apply to any failure described in paragraph (1) of this subsection." (c) EFFECTIVE DATE.—The amendments made by this section shall apply to returns the due date for which (determined without regard to extensions) is after December 31, 1987. SEC. 1525. TAX-EXEMPT INTEREST REQUIRED TO BE SHOWN ON RETURN.

(a) IN GENERAL.—Section 6012 (relating to persons required to make returns of income) is amended by redesignating subsection (d) as subsection (e) by inserting after subsection (c) the following new subsection: "(d) TAX-EXEMPT INTEREST REQUIRED TO B E SHOWN ON RETURN.—

Every person required to file a return under this section for the taxable year shall include on such return the amount of interest received or accrued during the taxable year which is exempt from the tax imposed by chapter 1." (b) EFFECTIVE DATE.—The amendment made by subsection (a) shall apply to taxable years beginning after December 31, 1986.

Subtitle D—Provisions Relating to Tax Shelters SEC. 1531. MODIFICATION OF TAX SHELTER RATIO TEST FOR REGISTRATION OF TAX SHELTERS.

(a) IN GENERAL.—Subparagraph (A) of section 6111(c)(2) (defining tax shelter ratio) is amended by striking out "200 percent" and inserting in lieu thereof "350 percent". (b) EFFECTIVE DATE.—The amendment made by this section shall apply to any tax shelter (within the meaning of section 6111 of the

�