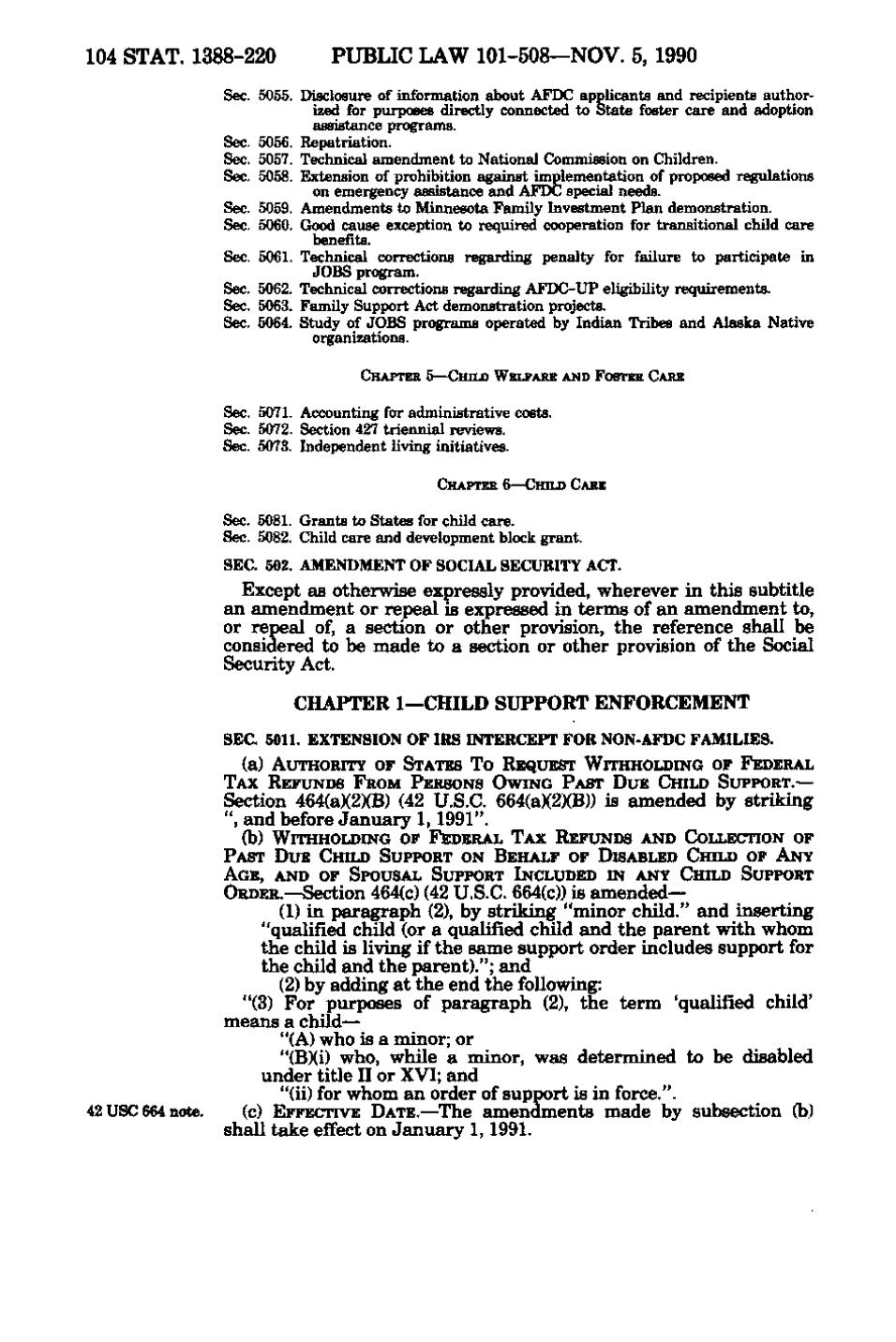

104 STAT. 1388-220 PUBLIC LAW 101-508—NOV. 5, 1990 Sec. 5055. Disclosure of information about AFDC applicants and recipients authorized for purposes directly connected to State foster care and adoption assistance programs. Sec. 5056. Repatriation. Sec. 5057. Technical amendment to National Commission on Children. Sec. 5058. Extension of prohibition against implementation of proposed regulations on emergency assistance and AFDC special needs. Sec. 5059. Amendments to Minnesota Family Investment Plan demonstration. Sec. 5060. Good cause exception to required cooperation for transitional child care benefits. Sec. 5061. Technical corrections regarding penalty for failure to participate in JOBS program. Sec. 5062. Technical corrections regarding AFDC-UP eligibility requirements. Sec. 5063. Family Support Act demonstration projects. Sec. 5064. Study of JOBS programs operated by Indian Tribes and Alaska Native organizations. CHAPTER 5—CHILD WELFARE AND FOSTER CARE Sec. 5071. Accounting for administrative costs. Sec. 5072. Section 427 triennial reviews. Sec. 5073. Independent living initiatives. CHAPTER 6—CHILD CARE Sec. 5081. Grants to States for child care. Sec. 5082. Child care and development block grant. SEC. 502. AMENDMENT OF SOCIAL SECURITY ACT. Except as otherwise expressly provided, wherever in this subtitle an amendment or repeal is expressed in terms of an amendment to, or repeal of, a section or other provision, the reference shall be considered to be made to a section or other provision of the Social Security Act. CHAPTER 1—CHILD SUPPORT ENFORCEMENT SEC. 5011. EXTENSION OF IRS INTERCEPT FOR NON-AFDC FAMILIES. (a) AUTHORITY OF STATES To REQUEST WITHHOLDING OF FEDERAL TAX REFUNDS FROM PERSONS OWING PAST DUE CHILD SUPPORT. — Section 464(a)(2)(B) (42 U.S.C. 664(a)(2)(B)) is amended by striking ", and before January 1, 1991". (b) WITHHOLDING OF FEDERAL TAX REFUNDS AND COLLECTION OF PAST DUE CHILD SUPPORT ON BEHALF OF DISABLED CHILD OF ANY AGE, AND OF SPOUSAL SUPPORT INCLUDED IN ANY CHILD SUPPORT ORDER.—Section 464(c) (42 U.S.C. 664(c)) is amended— (1) in paragraph (2), by striking "minor child." and inserting "qualified child (or a qualified child and the parent with whom the child is living if the same support order includes support for the child and the parent)."; and (2) by adding at the end the following: "(3) For purposes of paragraph (2), the term 'qualified child' means a child— "(A) who is a minor; or "(B)(i) who, while a minor, was determined to be disabled under title II or XVI; and "(ii) for whom an order of support is in force.". 42 USC 664 note. (c) EFFECTIVE DATE.— The amendments made by subsection (b) shall take effect on January 1, 1991.

�