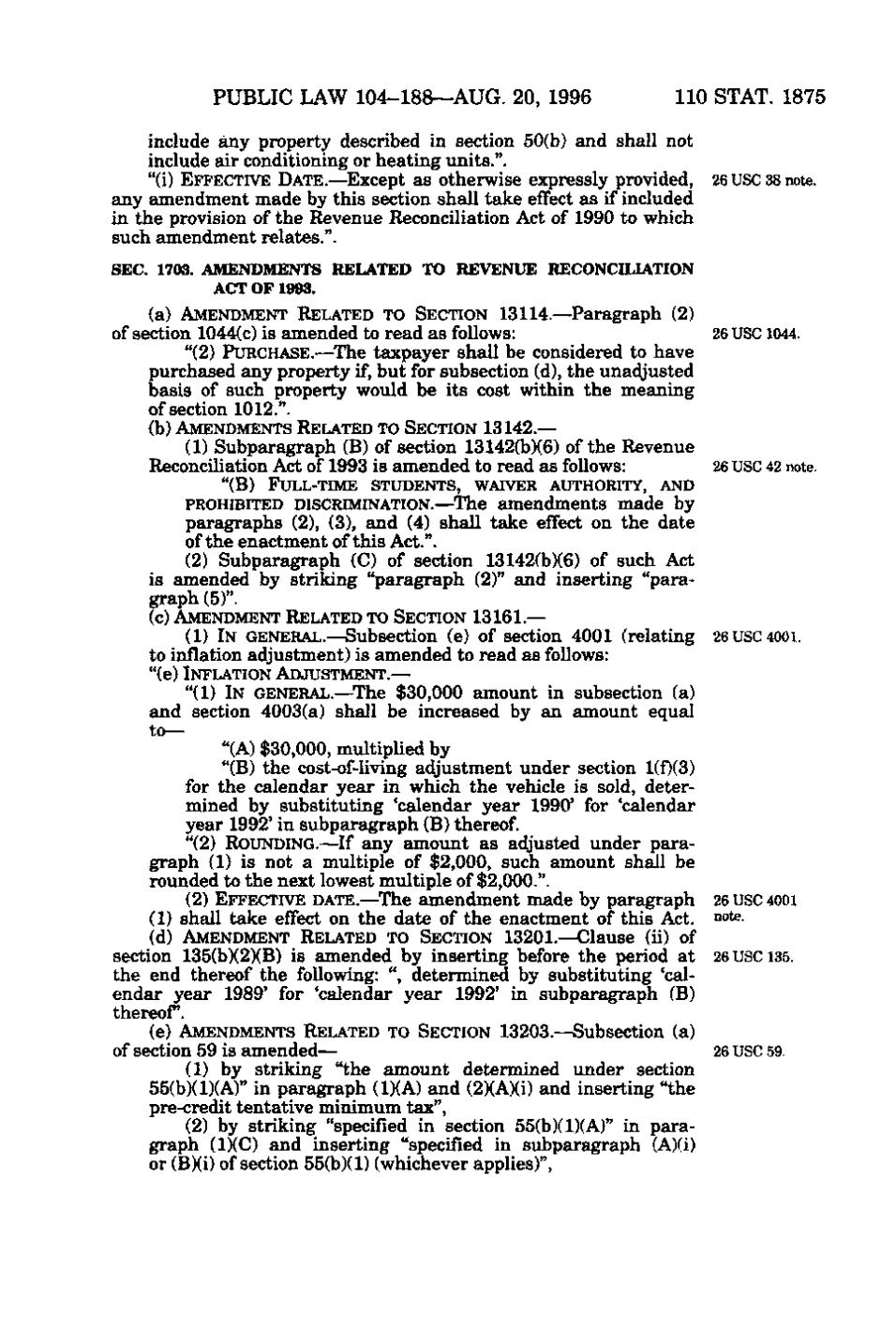

PUBLIC LAW 104-188—AUG. 20, 1996 110 STAT. 1875 include any property described in section 50(b) and shall not include air conditioning or heating units.". "(i) EFFECTIVE DATE. —Except as otherwise expressly provided, 26 USC 38 note, any amendment made by this section shall take effect as if included in the provision of the Revenue Reconciliation Act of 1990 to which such amendment relates.". SEC. 1703. AMENDMENTS RELATED TO REVENUE RECONCILIATION ACT OF 1993. (a) AMENDMENT RELATED TO SECTION 13114. — Paragraph (2) of section 1044(c) is amended to read as follows: 26 USC 1044. "(2) PURCHASE.— The taxpayer shall be considered to have purchased any property if, but for subsection (d), the unadjusted basis of such property would be its cost within the meaning of section 1012.". (b) AMENDMENTS RELATED TO SECTION 13142. — (1) Subparagraph (B) of section 13142(b)(6) of the Revenue Reconciliation Act of 1993 is amended to read as follows: 26 USC 42 note. " (B) FULL-TIME STUDENTS, WAIVER AUTHORITY, AND PROHIBITED DISCRIMINATION. — The amendments made by paragraphs (2), (3), and (4) shall take effect on the date of the enactment of this Act.". (2) Subparagraph (C) of section 13142(b)(6) of such Act is amended by striking "paragraph (2)" and inserting "paragraph (5)". (c) AMENDMENT RELATED TO SECTION 13161.— (1) IN GENERAL,.—Subsection (e) of section 4001 (relating 26 USC 400i. to inflation adjustment) is amended to read as follows: "(e) INFLATION ADJUSTMENT.— "(1) IN GENERAL.— The $30,000 amount in subsection (a) and section 4003(a) shall be increased by an amount equal to— " (A) $30,000, multiplied by "(B) the cost-of-living adjustment under section 1(f)(3) for the calendar year in which the vehicle is sold, determined by substituting 'calendar year 1990' for 'calendar year 1992' in subparagraph (B) thereof. "(2) ROUNDING.—I f any amount as adjusted under paragraph (1) is not a multiple of $2,000, such amount shall be rounded to the next lowest multiple of $2,000.". (2) EFFECTIVE DATE. — The amendment made by paragraph 26 USC 400i (1) shall take effect on the date of the enactment of this Act. note. (d) AMENDMENT RELATED TO SECTION 13201. —Clause (ii) of section 135(b)(2)(B) is amended by inserting before the period at 26 USC 135. the end thereof the following: ", determined by substituting 'calendar year 1989' for 'calendar year 1992' in subparagraph (B) thereof. (e) AMENDMENTS RELATED TO SECTION 13203.—Subsection (a) of section 59 is amended— 26 USC 59. (1) by striking "the amount determined under section 55(b)(1)(A)" in paragraph (1)(A) and (2)(A)(i) and inserting "the pre-credit tentative minimum tax", (2) by striking "specified in section 55(b)(1)(A)" in paragraph (1)(C) and inserting "specified in subparagraph (A)(i) or (B)(i) of section 55(b)(1) (whichever applies)".

�