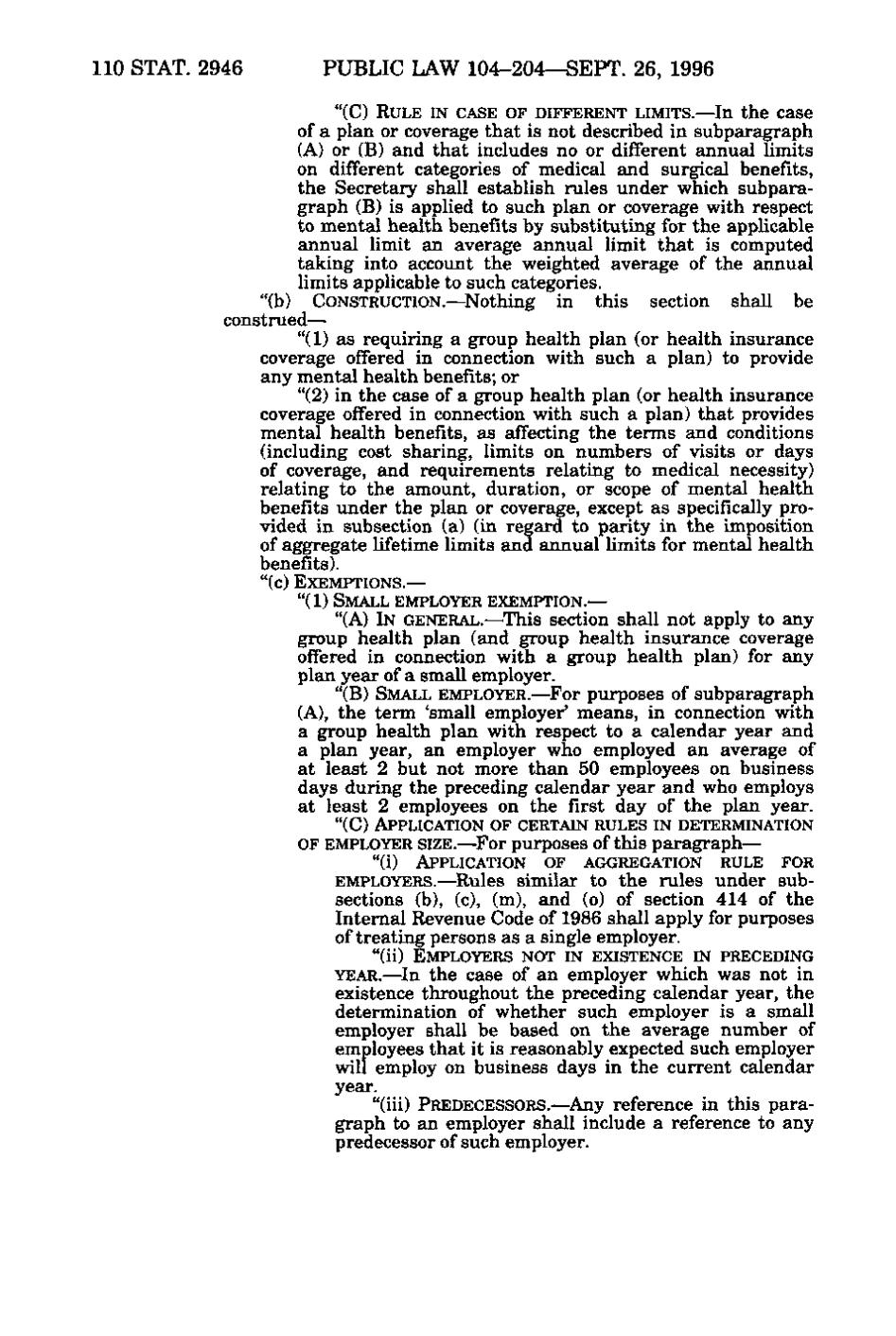

110 STAT. 2946 PUBLIC LAW 104-204—SEPT. 26, 1996 "(C) RULE IN CASE OF DIFFERENT LIMITS.— In the case of a plan or coverage that is not described in subparagraph (A) or (B) and that includes no or different annual limits on different categories of medical and surgical benefits, the Secretary shall establish rules under which subparagraph (B) is applied to such plan or coverage with respect to mental health benefits by substituting for the applicable annual limit an average annual limit that is computed taking into account the weighted average of the annual limits applicable to such categories. "(b) CONSTRUCTION. —Nothing in this section shall be construed— "(1) as requiring a group health plan (or health insurance coverage offered in connection with such a plan) to provide any mental health benefits; or "(2) in the case of a group health plan (or health insurance coverage offered in connection with such a plan) that provides mental health benefits, as affecting the terms and conditions (including cost sharing, limits on numbers of visits or days of coverage, and requirements relating to medical necessity) relating to the amount, duration, or scope of mental health benefits under the plan or coverage, except as specifically provided in subsection (a) (in regard to parity in the imposition of aggregate lifetime limits and annual limits for mental health benefits). " (c) EXEMPTIONS. — " (1) SMALL EMPLOYER EXEMPTION.— "(A) IN GENERAL. — This section shall not apply to any group health plan (and group health insurance coverage offered in connection with a group health plan) for any plan year of a small employer. " (B) SMALL EMPLOYER.— For purposes of subparagraph (A), the term 'small employer' means, in connection with a group health plan with respect to a calendar year and a plan year, an employer who employed an average of at least 2 but not more than 50 employees on business days during the preceding calendar year and who employs at least 2 employees on the first day of the plan year. "(C) APPLICATION OF CERTAIN RULES IN DETERMINATION OF EMPLOYER SIZE. —For purposes of this paragraph— "(i) APPLICATION OF AGGREGATION RULE FOR EMPLOYERS.—Rules similar to the rules under subsections (b), (c), (m), and (o) of section 414 of the Internal Revenue Code of 1986 shall apply for purposes of treating persons as a single employer. "(ii) EMPLOYERS NOT IN EXISTENCE IN PRECEDING YEAR.—In the case of an employer which was not in existence throughout the preceding calendar year, the determination of whether such employer is a small employer shall be based on the average number of employees that it is reasonably expected such employer will employ on business days in the current calendar year. "(iii) PREDECESSORS.—Any reference in this paragraph to an employer shall include a reference to any predecessor of such employer.

�