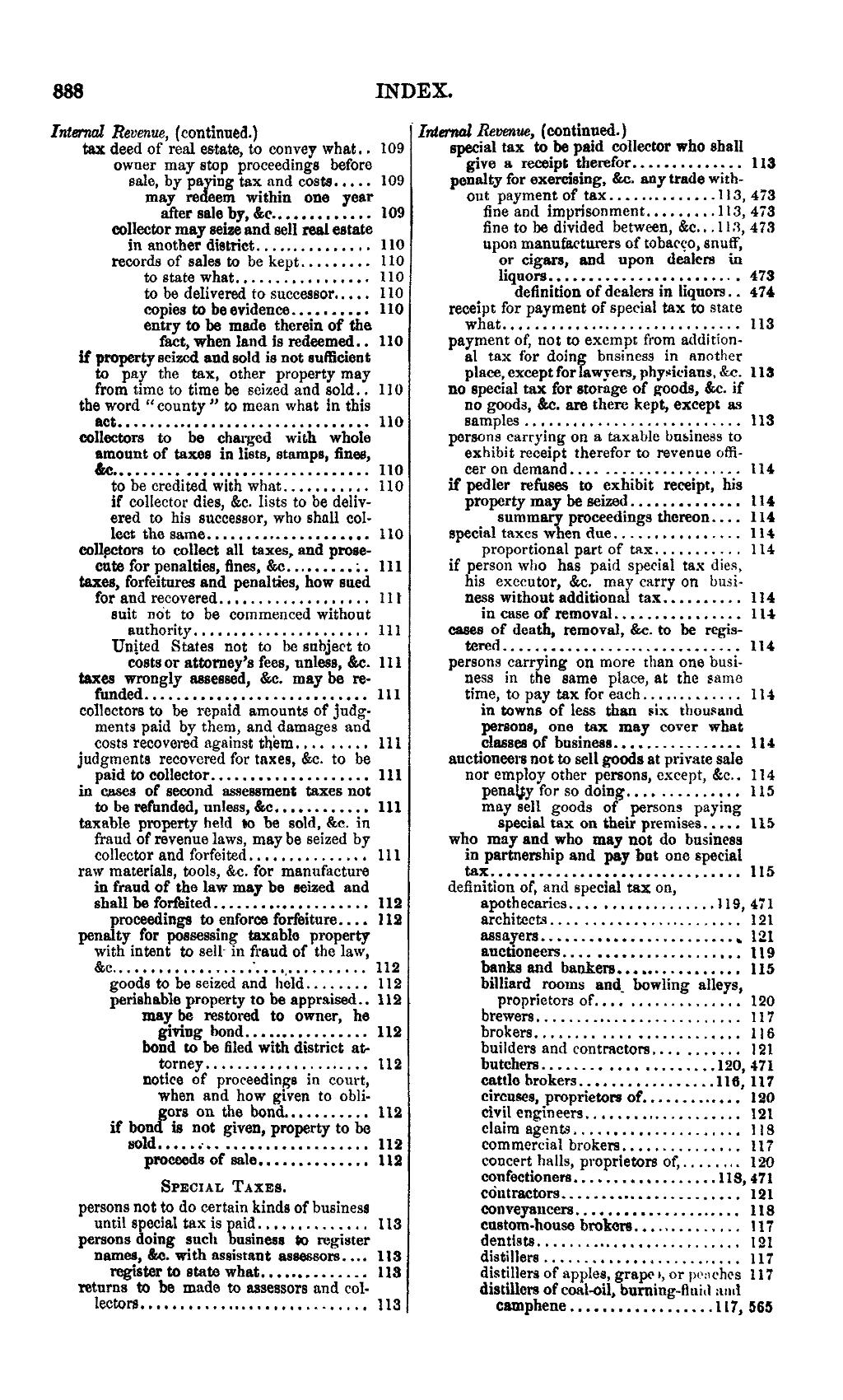

888 INDEX. Internal Revenue, (continued.) Internal Revenue, (continned.) tax deed of real estate, to convey what. . 109 special tax to_be paid collector who shall owner may stop proceedings before give a receipt. therefor ... , . . 113 Sale, by pngeiug tax and costs. . . . . 109 penalty for exercising, &c. any trade wrthmay re em within one year out payment of 'tax .. 113, 473 after sale by, &c. 109 fine and imprisonment . 113, 473 collector may seize and sell realestate fine to be divided between, &c.. .11:1, 473 in another district . . .. . . . 110 upon manufacturers of tobacco, snuff, records of sales to be kept . 110 or cigars, and upon dealers in to state what . 110 liquors .. _. . .' .. . 473 to be delivered to successor . 110 definition of dealers m hquors. . 474 copies to be evidence .. 110 receipt for payment of special tex to state entry to be mule therein of the what .. 113 fact, when land is redeemed. . 110 payment of; not to exempt from additionif propertyseizcd and sold is not sufficient al tax for doing business in another to pay the tex, other property may place, except for lawyers, physicians, Sec. 113 from time to time be seized and sold. . 110 no special tax for storage of goods, &c. if the word "county " to mean what in this no goods, &c. are there kept, except as act 110 samples ... 113 collectors to be charged with whole persons carrying on a taxable business to amount of taxes in lists, stamps, fines, exhibit receipt therefor to revenue oi1i— &.e ... . . ... 110 cer on demand . 114 to be credited with what ... 110 if pedler refuses to exhibit receipt, his if collector dies, &c. lists to be deliv- property may be seized .. 114 ered to his successor, who shall col- summary} proceedings thereon 114 lect the same . . . . . 110 special taxes w en due 114 collectors to collect all taxes, and prose- proportional part of tax ... 114 cute for penalties, fines, &c . ; . 111 if person who has paid special tax dies, taxes, forfeitnres and penalties, how sued his executor, &c. may carry on busifor and recovered ... 111 ness without additional tax .. 114 suit not to be commenced without in case of removal 11-1 authority .. . ... 111 cases of death, removal, &c. to be regis- United States not to be subject to tered .. 114 costs or attorney’s fees, unless, &c. 111 persons carrying on more than one busitaxes wrongly assessed, &e. may be re- ness in the same place, at the same funded 111 time, to pay tax for each . 114 collectors to be repaid amounts of judg· in towns of less than six thousand ments paid by them, and damages and persons, one tax may cover what costs recovered against them . 111 classes of business 114 judgments recovered for taxes, &c. to be auctioneeis not to sell goods st private sale paid to collector 111 nor employ other persons, except, &c.. 114 in cases of second assessment taxes not penatty for so doing . . 115 to be refunded, unless, &.c 111 muy sell goods of persons paying taxable property held so be sold, &e. in special tax on their premises . 115 fraud of revenue laws, may be seized by who may and who may not do business collector and forfeited ... 111 in partnership and pay but one special raw materials, tools, &c. for manufacture tax ... 115 in fraud of the law may be seized and definition of, and special tax on, shall be forfeited 112 epothecaries. . . . .. 119, 471 proceedings to enforce forfeiture 112 architects . . ., 121 penalty for possessing taxable property assayers . 121 with intent to se1l· in fraud of the law, snctioneers . . 119 &c. . , .. 112 banks and bankers . ... 115 goods to be seized and held ... . 112 billiard rooms and bowling alleys, perishable property to be appraised. . 112 proprietors of . . 120 may be restored to owner, he brewers . . 117 giving bond 112 broker . . . . .. . . . 116 bond to be tiled with district at- builders and contractors . .. 121 torney . 112 butchers . . . . . 120, 471 notice of proceedings in court, cattle brokers. 116, 117 when and how given to obli- circuscs, proprietors of . . . . . 120 (pers on the bond ... 112 civil engineers ... . 121 if bon is not given, property to be claim agents . 118 sold .. — . . .. 112 commercial brokers ... 117 proceeds of sale .. 112 concert halls, proprietors ot] 120 S=·¤¤¤·=¤ T¤=¤¤· Z$Kim°0'f§if.'.".`.`.`.'.Z I I I I I I I I I Z iii" iii persons not to do certain kinds of business conveymicers .. . . . 118 until special tax is plaid .. 113 custom-house brokers . . 117 persons doing such usiness to register dentists . . 121 names, &e. with assistant assessors. 113 distillers . . .., 117 register to state what . . 118 distillers of apples, grape 1, or peaches 117 returns to be made to assessors and col- distillers of coal-oil, burning-11n1d mul lectors . 113 csmpheue .. 117, 565

Page:United States Statutes at Large Volume 14.djvu/918

This page needs to be proofread.