736

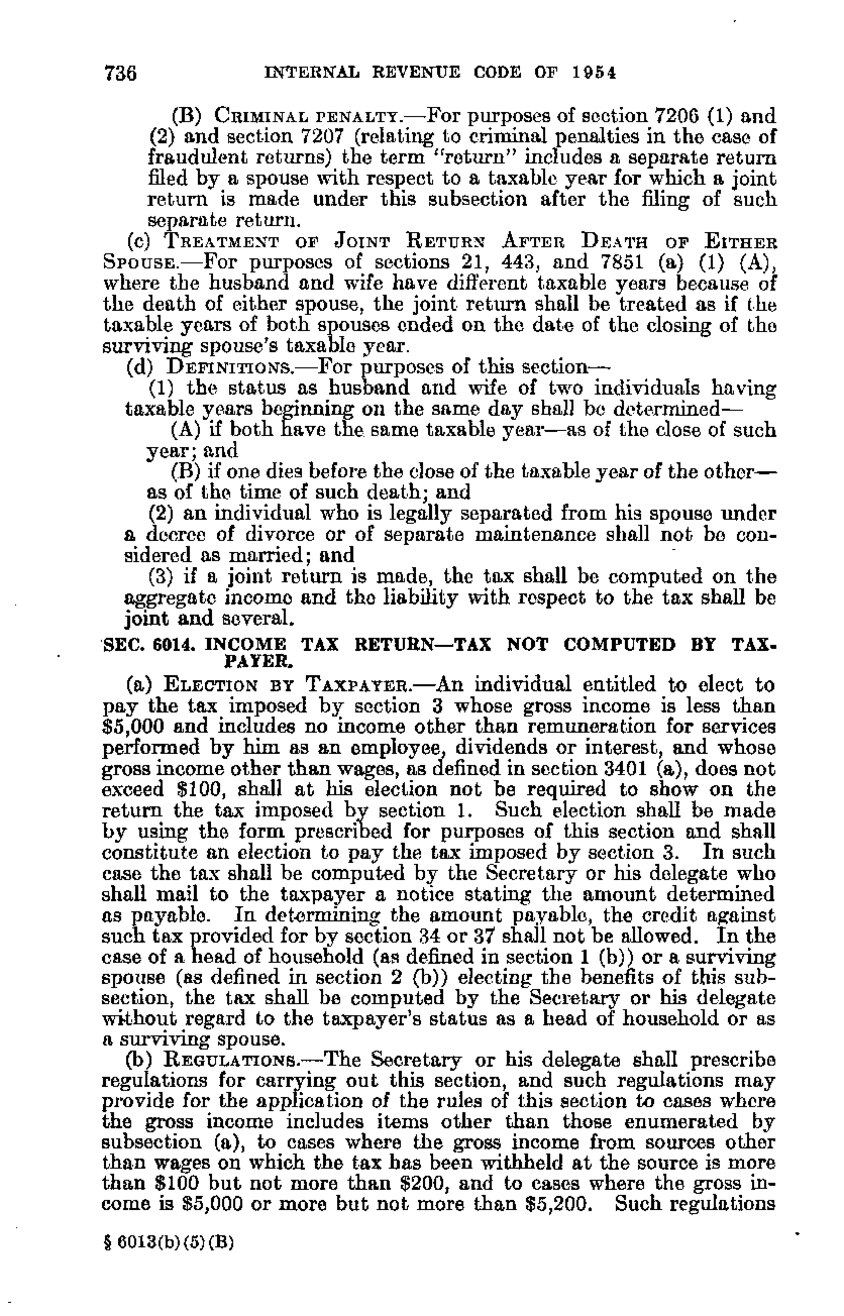

INTERNAL REVENUE CODE OF 1954 (B) CRIMINAL PENALTY.—For purposes of section 7206(1) and (2) and section 7207 (relating to criminal penalties in the case of fraudulent returns) the term "return" includes a separate return filed by a spouse with respect to a taxable year for which a joint return is made under this subsection after the filing of such separate return.

(c) TREATMENT

OF JOINT

RETURN

AFTER

DEATH

OF E I THE R

SPOUSE.—For purposes of sections 21, 443, and 7851 (a)(1)(A), where the husband and wife have different taxable years because of the death of either spouse, the joint return shall be treated as if the taxable years of both spouses ended on the date of the closing of the surviving spouse's taxable year. (d) DEFINITIONS.—For purposes of this section— (1) the status as husband and wife of two individuals having taxable years beginning on the same day shall be determined— (A) if both have the same taxable year—as of the close of such year; and (B) if one dies before the close of the taxable year of the other— as of the time of such death; and (2) an individual who is legally separated from his spouse under a decree of divorce or of separate maintenance shall not be considered as married; and (3) if a joint return is made, the tax shall be computed on the aggregate income and the liability with respect to the tax shall be joint and several. SEC. 6014. INCOME TAX RETURN—TAX NOT COMPUTED BY TAXPAYER. (a) ELECTION BY TAXPAYER.—An individual entitled to elect to

pay the tax imposed b}?^ section 3 whose gross income is less than $5,000 and includes no income other than remuneration for services performed by him as an employee, dividends or interest, and whose gross income other than wages, as defined in section 3401(a), does not exceed $100, shall at his election not be required to show on the return the tax imposed by section 1. Such election shall be made by using the form prescribed for purposes of this section and shall constitute an election to pay the tax imposed by section 3. I n such case the tax shall be computed by the Secretary or his delegate who shall mail to the taxpayer a notice stating the amount determined as payable. I n determining the amount payable, the credit against such tax provided for by section 34 or 37 shall not be allowed. I n the case of a head of household (as defined in section 1(b)) or a surviving spouse (as defined in section 2(b)) electing the benefits of this subsection, the tax shall be computed by the Secretary or his delegate without regard to the taxpayer's status as a head of household or as a surviving spouse. (b) REGULATIONS.—The Secretary or his delegate shall prescribe regulations for carrying out this section, and such regulations may provide for the application of the rules of this section to cases where the gross income includes items other than those enumerated by subsection (a), to cases where the gross income from sources other than wages on which the tax has been withheld a t the source is more than $100 but not more than $200, and to cases where the gross income is $5,000 or more but not more than $5,200. Such regulations § 6013(b)(5)(B)

�