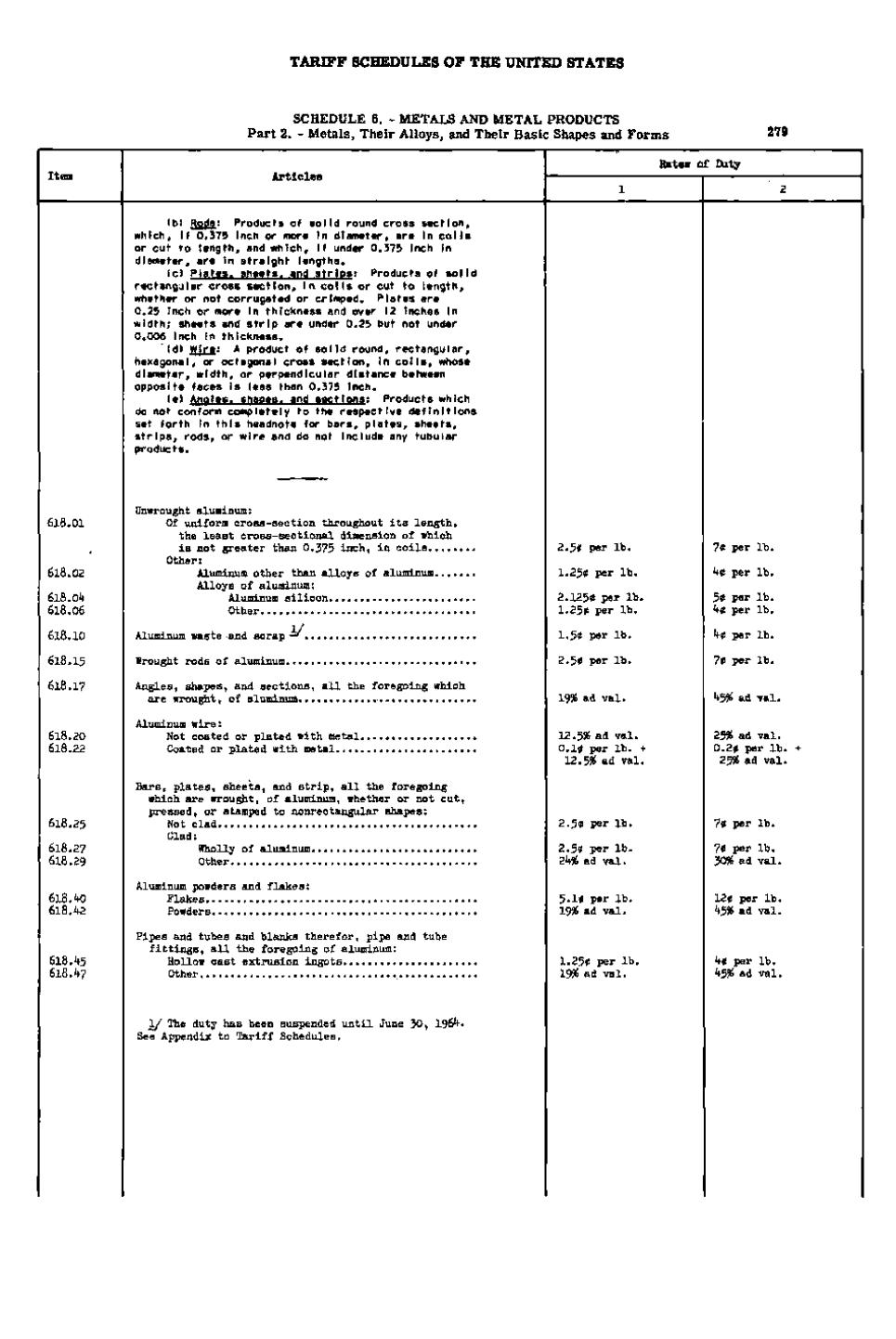

TARIFF SCHEDULES OF THE UNITED STATES

SCHEDULE 6. - METALS AND METAL PRODUCTS Part 2. - Metals, Their Alloys, and Their Basic Shapes and Forms

279

Rates of Duty

(b) Rods: Products of solid round cross s e c H o n, which, if 0.375 Inch or more In diameter, are In colls or cut to length, and which. If under 0.375 Inch in diameter, are in straight lengths. (c) Plates, sheets, and strips; Products of solid rectangular cross section, in colls or cut to length, whether or not corrugated or crimped. Plates are 0.25 Inch or more In thickness and over 12 Inches In width; sheets and strip are under 0.25 but not under 0.006 Inch in thickness. (d( Wire: A product of solid round, rectangular, hexagonal, or octagonal cross section. In colls, whose diameter, width, or perpendicular distance between opposite faces is less than 0.375 Inch. (e) Angles, shapes, and sections: Products which do not conform completely to the respective definitions set forth in this headnote for bars, plates, sheets, strips, rods, or wire and do not Include any tubular products.

618. Oit 618.06

Unwrought aluminum: Of uniform cross-section throughout its length, the least cross-sectional dimension of which is not greater than 0.375 inch, in coils Other: Aluminum other than alloys of aluminum Alloys of aluminum: Aluminum silicon Other

618.10

Aluminum waste and scrap —'

1.50 per lb.

40 per lb.

618.15

Wrought rods of aluminum

2.50 per lb.

70 per lb.

618.17

Angles, shapes, and sections, all the foregoing which are wrought, of aluminum

Y)% ad val.

455^ ad val.

12.5% ad val. 0.10 per lb. + 12.55^ ad val.

2 5 % ad val. 0.20 per lb. + 2 5 ^ ad val.

2.50 per lb.

70 per lb.

2.50 per lb. 2 4 % ad val.

70 per lb. 3 0 % ad val.

618.01

618.02

618.20 618.22

Aluminum wire: Not coated or plated with metal Coated or plated with metal

2.50 per lb.

70 per lb.

1.250 per lb.

40 per lb.

2.1250 per lb. 1,250 per lb.

50 per lb. 40 per lb.

618.27 618.29

Bars, plates, sheets, and strip, all the foregoing which are wrought, of aluminum, whether or not cut, pressed, or stamped to nonrectangular shapes: Not clad Clad: Wholly of aluminum Other

618.1*0 618.42

Aluminum powders and flakes: Flakes Powders

5.10 per lb. 195^ ad val.

120 per lb. 4 5 % ad val.

618.45 618.47

Pipes and tubes and blanks therefor, pipe and tube fittings, all the foregoing of aluminum: Hollow cast extrusion ingots Other

1.250 per lb. 1956 ad val.

40 per lb. h% ad val.

618.25

_!/ The duty has been suspended until June 30, 1964. See Appendix to Tariff Schedules.

�