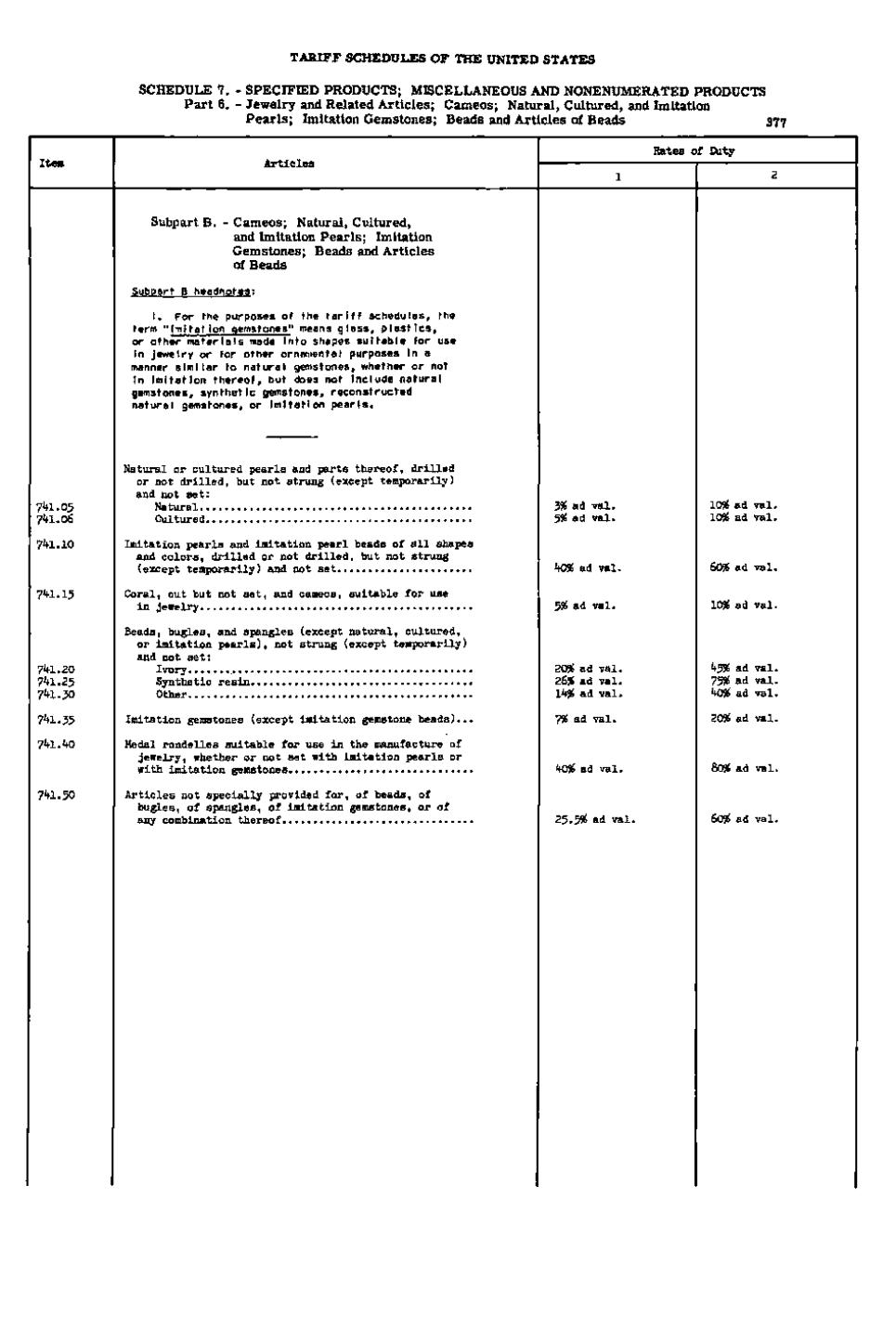

TARIFF SCHEDULES OF THE UNITED STATES SCHEDULE 7. - SPECIFIED PRODUCTS; MISCELLANEOUS AND NONENUMERATED PRODUCTS Part 6. - Jewelry and Related Articles; Cameos; Natural, Cultured, and Imitation P e a r l s; Imitation Gemstones; Beads and Articles of Beads 377 Rates of Duty

Subpart B. - Cameos; Natural, Cultured, and Imitation Pearls; Imitation Gemstones; Beads and Articles of Beads Subpart B headnotes: I. For the purposes of the tariff schedules, the term "iTiitation gemstones" means glass, plastics, or other materials made into shapes suitable for use In jewelry or for other ornamental purposes in a manner similar to natural gemstones, whether or not In Imitation thereof, but does not Include natural gemstones, synthetic gemstones, reconstructed natural gemstones, or Imitation pearls.

Natural or cultured pearls and parts thereof, drilled or not drilled, but not strung (except temporarily) and not set: Natural Cultured

3 ^ ad val. 3% ad val.

Imitation pearls and imitation pearl beads of all shapes and colors, drilled or not drilled, but not strung (except temporarily) and not set

40S^ ad val.

Coral, cut but not set, and cameos, suitable for use in jewelry

5S^ ad val.

1 0 % ad val.

741.20 741.25 741.30

Beads, bugles, and spangles (except natural, cultured, or imitation pearls), not strung (except temporarily) and not set: Ivory Synthetic resin Other

2 0 % ad val. 2 6 % ad val. l 4 % ad val.

4 5 % ad val. 7 5 % ad val. 4 0 % ad val.

741.35

Imitation gemstones (except imitation gemstone beads)...

7% ad val.

2 0 % ad val.

741.40

Medal rondelles suitable for use in the manufacture of jewelry, whether or not set with imitation pearls or with imitation gemstones

4 0 % ad val.

Articles not specially provided for, of beads, of bugles, of spangles, of imitation gemstones, or of any combination thereof

25.5% ad val.

7'tl.05 741.10

7'tl.l5

741.50

1 0 % ad val. 1 0 % ad val.

6 0 % ad val.

�