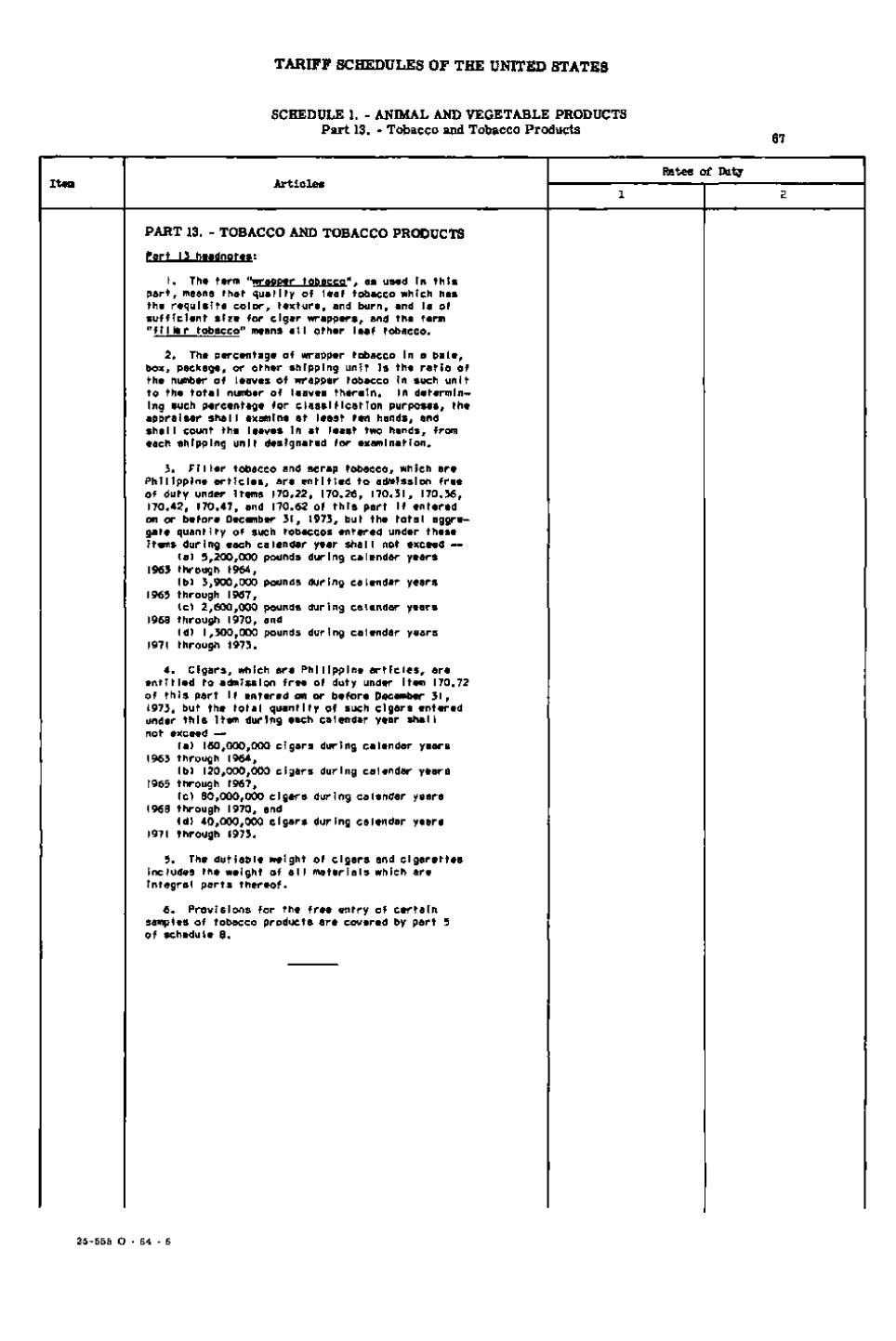

TARIFF SCHEDULES OF THE UNITED STATES

SCHEDULE I. - ANIMAL AND VEGETABLE PRODUCTS Part 13. - Tobacco and Tobacco Products

67 Rates of Duty

PART 13. - TOBACCO AND TOBACCO PRODUCTS Part 13 headnotes: 1. The term "wrapper tobacco"• as used In this part, means that quality of leaf tobacco which has the requisite color, texture, and burn, and Is of sufficient size for cigar wrappers, and the term "f 11 ler tobacco" means all other leaf tobacco. 2. The percentage of wrapper tobacco In a bale, box, package, or other shipping unit Is the ratio of the number of leaves of wrapper tobacco In such unit to the total number of leaves therein. In determining such percentage for classification purposes, the appraiser shall examine at least ten hands, and shall count the leaves In at least two hands, from each shipping unit designated for examination. 5. Filler tobacco and scrap tobacco, which are Philippine articles, are entitled to admission free of duty under Items 170.22, 170.26, 170.31, 170.36, 170,42, 170.47, and 170.62 of this part If entered on or before December 31, 1973, but the total aggregate quantity of such tobaccos entered under these Items during each calendar year shall not exceed — (al 5,200,000 pounds during calendar years 1963 through 1964, (b) 3,900,000 pounds during calendar years 1965 through 1967, (c) 2,600,000 pounds during calendar years 1968 through 1970, and Id) 1,300,000 pounds during calendar years 1971 through 1973. 4. Cigars, which are Philippine articles, are entitled to admission free of duty under Item 170.72 of this part if entered on or before December 31, 1973, but the total quantity of such cigars entered under this Item during each calendar year shall not exceed — (a) 160,000,000 cigars during calendar years 1963 through 1964, (b) 120,000,000 cigars during calendar years 1965 through 1967, Ic) 80,000,000 cigars during calendar years 1968 through 1970, and Id) 40,000,000 cigars during calendar years 1971 through 1973. 5. The dutiable weight of cigars and cigarettes Includes the weight of all materials which are Integral parts thereof. 6. Provisions for the free entry of certain samples of tobacco products are covered by part 5 of schedule 8.

25-555 O - 64

�