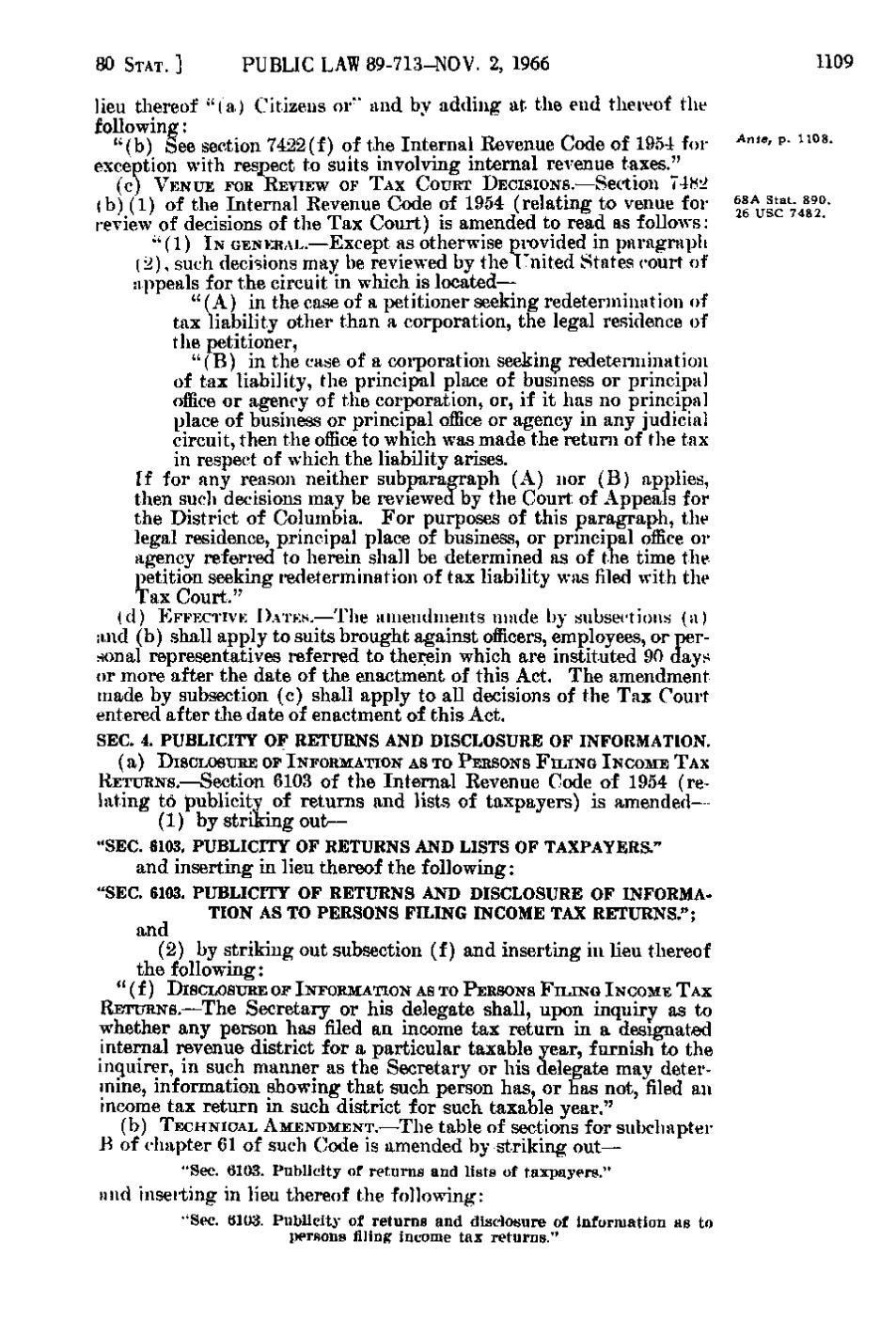

80 STAT. ]

PUBLIC LAW 89-713-NOV. 2, 1966

lieu thereof " (a) Citizens or"" and by adding at the end thereof the following:

- '(b) See section 7422(f) of the Internal Revenue Code of 1954 for

exception with respect to suits involving internal revenue taxes." (c) VENUE FOR EEVIEW or TAX COURT DECISIONS.—Section 7482 (b)(1) of the Internal Revenue Code of 1954 (relating to venue foireview of decisions of the Tax Court) is amended to read as follows: "(1) I N GENERAI..—Except as otherwise provided in paragraph (2), such decisions may be reviewed by the United States court of appeals for the circuit in which is located— " (A) in the case of a petitioner seeking redetermination of tax liability other than a corporation, the legal residence of the petitioner, " (B) in the case of a corporation seeking redetermination of tax liability, the principal place of business or principal office or agency of the corporation, or, if it has no principal place of business or principal office or agency in any judicial circuit, then the office to which was made the return of the tax in respect of which the liability arises. If for any reason neither subparagraph (A) nor (B) applies, then such decisions may be reviewed by the Court of Appeals for the District of Columbia. For purposes of this paragraph, the legal residence, principal place of business, or principal office or agency referred to herein shall be determined as of the time the petition seeking redetermination of tax liability was filed with the Tax Court." (d) EFFECTIVE DATES.—The amendments made by subsections (a) and (b) shall apply to suits brought against officers, employees, or personal representatives referred to therein which are instituted 90 days or more after the date of the enactment of this Act. The amendment made by subsection (c) shall apply to all decisions of the Tax Court entered after the date of enactment of this Act. SEC. 4. PUBLICITY OF RETURNS AND DISCLOSURE OF INFORMATION. (a) DISCLOSURE OF INFORMATION AS TO PERSONS FILING INCOME TAX

RETURNS.—Section 6103 of the Internal Revenue Code of 1954 (relating to publicity of returns and lists of taxpayers) is amended— (1) by striking out— "SEC. 6103. PUBLICITY OF RETURNS AND LISTS OF TAXPAYERS." and inserting in lieu thereof the following: "SEC. 6103. PUBLICITY OF RETURNS AND DISCLOSURE OF INFORMATION AS TO PERSONS FILING INCOME TAX RETURNS."; and (2) by striking out subsection (f) and inserting in lieu thereof the following: " (f) DISCLOSURE OF INFORMATION AS TO PERSONS F I L I N G INCOME TAX

RETURNS.—The Secretary or his delegate shall, upon inquiry as to whether any person has filed an income tax return in a designated internal revenue district for a particular taxable year, furnish to the inquirer, in such manner as the Secretary or his delegate may determine, information showing that such person has, or has not, filed an income tax return in such district for such taxable year." (b) TECHNICAL AMENDMENT.—The table of sections for subchapter i^ of chapter 61 of such Code is amended by striking out— "Sec. 6103. Publicity of returns and lists of taxpayers." and inserting in lieu thereof the following: •'Sec. 6103. Publicity of returns and disclosure of information as to persons filing income tax returns."

1109

Ante, p. 1 108. 68A Stat. 890. 26 USC 7482.

�