990

PUBLIC LAW 93-406-SEPT. 2, 1974

26 USC 401.

26 USC 403.

[88 STAT.

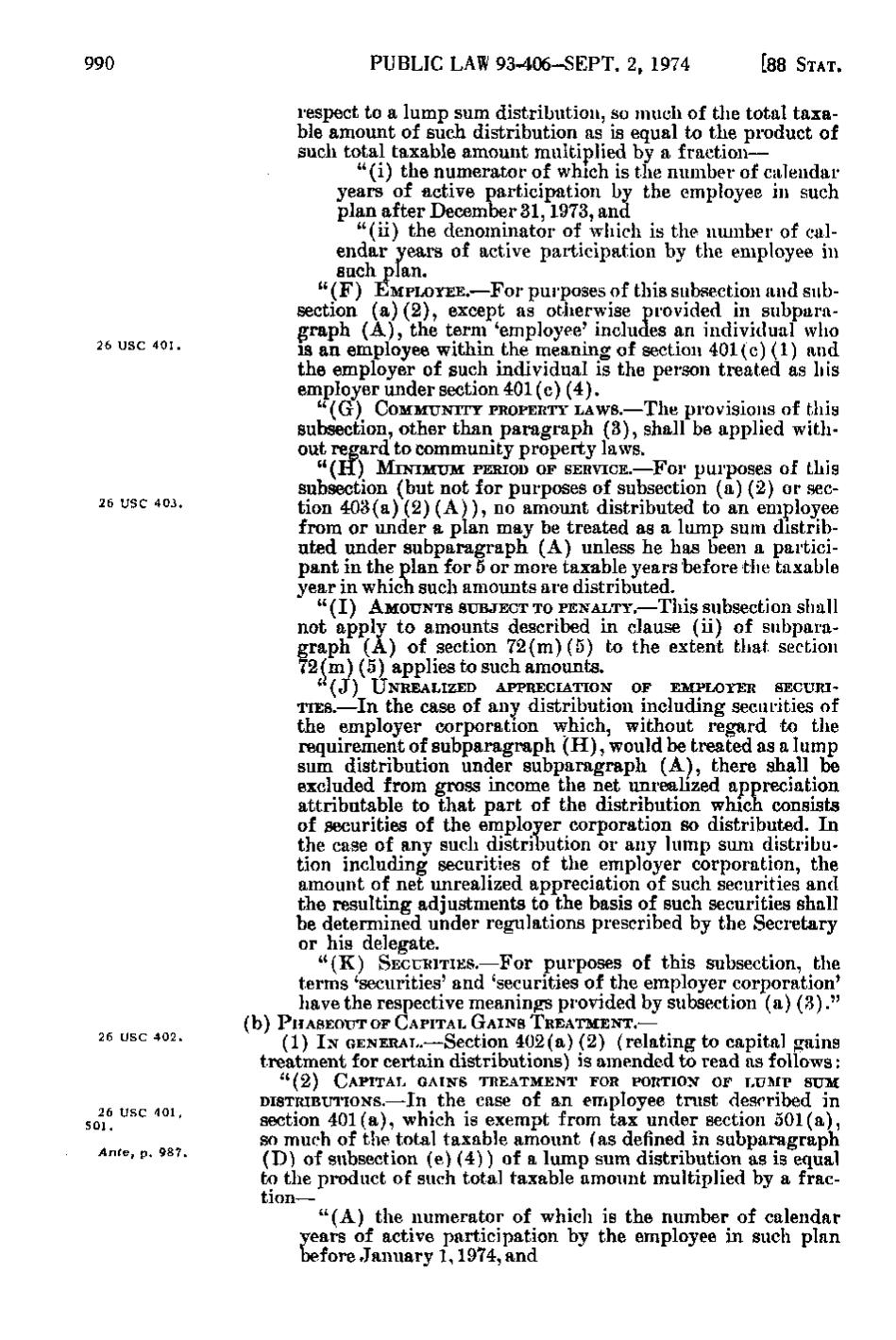

respect to a lump sum distribution, so much of the total taxable amount of such distribution as is equal to the product of such total taxable amount multiplied by a fraction— " (i) the numerator of which is the number of calendar years of active participation by the employee in such plan after December 31, 1973, and "(ii) the denominator of which is the number of calendar years of active participation by the employee in such plan. " (F) EMPLOYEE.—For purposes of this subsection and subsection (a)(2), except as otherwise provided in subparagraph (A), the term 'employee' includes an individual who jg j^jj employee within the meaning of section 401(c)(1) and the employer of such individual is the person treated as his employer under section 401(c)(4). " (G) COMMUNITY PROPERTY LAWS.—The provisions of this subsection, other than paragraph (3), shall be applied without regard to Community property laws. " (H) MINIMUM PERIOD or SERVICE.—For purposes of this subsection (but not for purposes of subsection (a)(2) or sec^JQjj 403(a)(2)(A)), no amount distributed to an employee from or under a plan may be treated as a lump sum distributed under subparagraph (A) unless he has been a participant in the plan for 5 or more taxable years before the taxable year in which such amounts are distributed. " (I) AMOUNTS SUBJECT TO PENALTY.—This subsection shall not apply to amounts described in clause (ii) of subparagraph (A) of section 72(m)(5) to the extent that section 72 (m)(5) applies to such amounts. "(J)

UNREALIZED

APPRECIATION

OF

EMPLOYER

SECURI-

TIES.—In the case of any distribution including securities of the employer corporation which, without regard to the requirement of subparagraph (H), would be treated as a lump sum distribution under subparagraph (A), there shall be excluded from gross income the net unrealized appreciation attributable to that part of the distribution which consists of securities of the employer corporation so distributed. In the case of any such distribution or any lump sum distribution including securities of the employer corporation, the amount of net unrealized appreciation of such securities and the resulting adjustments to the basis of such securities shall be determined under regulations prescribed by the Secretary or his delegate. " (K) SECURITIES.—For purposes of this subsection, the terms 'securities' and 'securities of the employer corporation' have the respective meanings provided by subsection (a)(3)." (b) PHASEOUT OF CAPITAL GAINS TREATMENT.—

26 USC 402.

^2^ IN GENERAL.—Section 402(a)(2) (relating to capital gains treatment for certain distributions) is amended to read as follows: "(2)

26 USC 4 0 1, 501. Ante,

p. 987.

CAPITAL GAINS TREATMENT FOR PORTION or

LUMP SUM

DISTRIBUTIONS.—lu the casc of an employee trust described in section 401(a), which is exempt from tax under section 501(a), so much of the total taxable amount (as defined in subparagraph (D) of subsection (e)(4)) of a lump sum distribution as is equal to the product of such total taxable amount multiplied by a fraction— " (A) the numerator of which is the number of calendar years of active participation by the employee in such plan before January 1, 1974, and

�