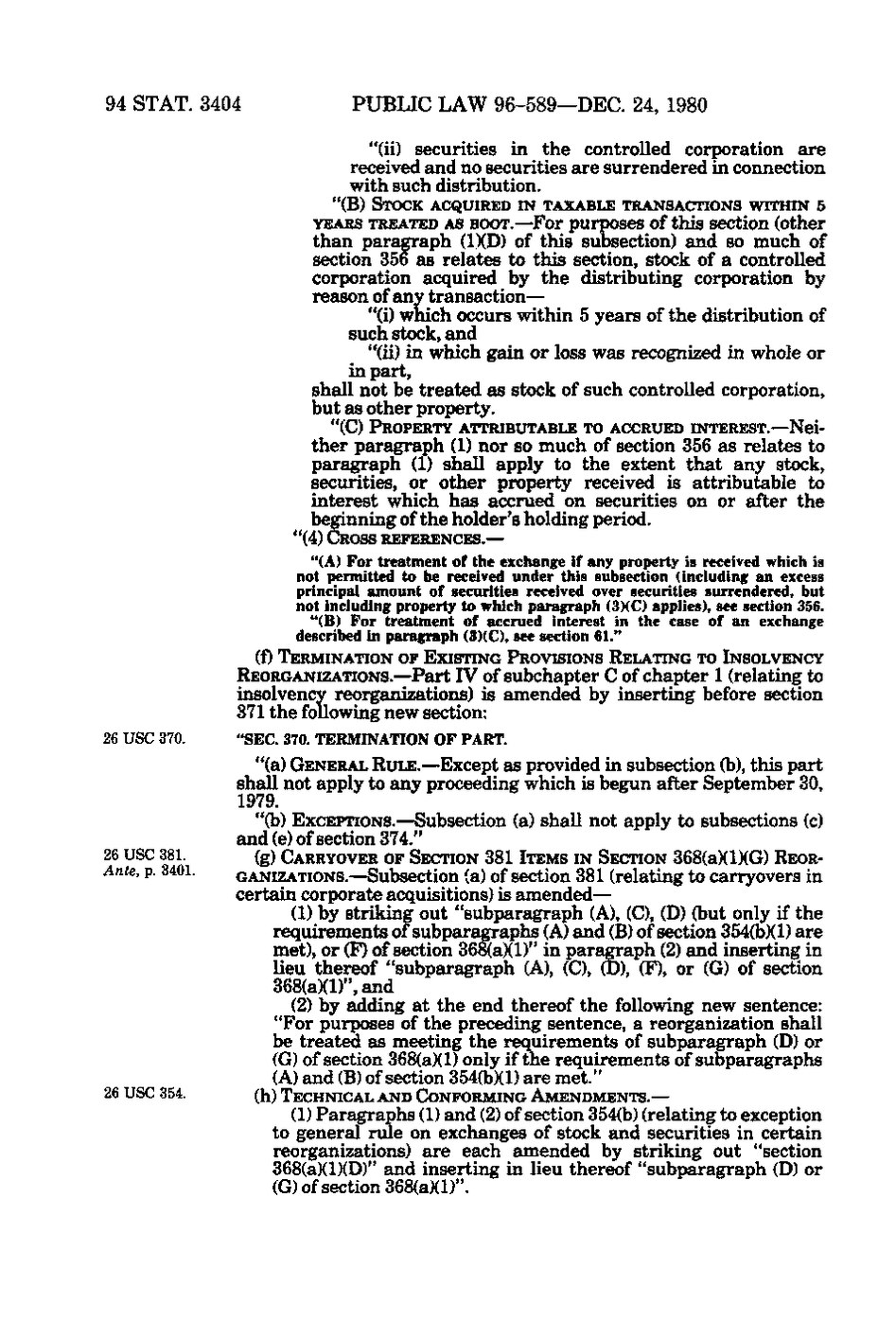

94 STAT. 3404

PUBLIC LAW 96-589—DEC. 24, 1980 "(ii) securities in the controlled corporation are received and no securities are surrendered in connection with such distribution. "(B) STOCK ACQUIRED IN TAXABLE TRANSACTIONS WITHIN 5

YEARS TREATED AS BOOT.—For purposes of this section (other than paragraph (1)(D) of this subsection) and so much of section 356 as relates to this section, stock of a controlled corporation acquired by the distributing corporation by reason of any transaction— "(i) which occurs within 5 years of the distribution of such stock, and "(ii) in which gain or loss was recognized in whole or in part, shall not be treated as stock of such controlled corporation, but as other property. "(C) PROPERTY ATTRIBUTABLE TO ACCRUED INTEREST.—Nei-

ther paragraph (1) nor so much of section 356 as relates to paragraph (1) shall apply to the extent that any stock, securities, or other property received is attributable to interest which has accrued on securities on or after the beginning of the holder's holding period. "(4) CROSS REFERENCES.— "(A) For treatment of the exchange if any property is received which is not permitted to be received under this subsection (including an excess principal amount of securities received over securities surrendered, but not including property to which paragraph (3)(C) applies), see section 356. "(B) For treatment of accrued interest in the case of an exchange described in paragraph (3)(C), see section 61." (f) TERMINATION OF EXISTING PROVISIONS RELATING TO INSOLVENCY

REORGANIZATIONS,—Part IV of subchapter C of chapter 1 (relating to insolvency reorganizations) is amended by inserting before section 371 the following new section: 26 USC 370.

26 USC 381. Ante, p. 3401.

26 USC 354.

"SEC. 370. TERMINATION OF PART.

"(a) GENERAL RULE.—Except as provided in subsection (b), this part shall not apply to any proceeding which is begun after September 30, 1979. "(b) EXCEPTIONS.—Subsection (a) shall not apply to subsections (c) and (e) of section 374." (g) CARRYOVER OF SECTION 381 ITEMS IN SECTION 368(a)(1)(G) REORGANIZATIONS.—Subsection (a) of section 381 (relating to carryovers in certain corporate acquisitions) is amended— (1) by striking out "subparagraph (A), (C), (D) (but only if the requirements of subparagraphs (A) and (B) of section 354(b)(1) are met), or (F) of section 368(a)(1)" in paragraph (2) and inserting in lieu thereof "subparagraph (A), (C), (D), (F), or (G) of section 368(a)(1)", and (2) by adding at the end thereof the following new sentence: "For purposes of the preceding sentence, a reorganization shall be treated as meeting the requirements of subparagraph (D) or (G) of section 368(a)(1) only if the requirements of subparagraphs (A) and (B) of section 354(b)(1) are met." (h) TECHNICAL AND CONFORMING AMENDMENTS.—

(1) Paragraphs (1) and (2) of section 354(b) (relating to exception to general rule on exchanges of stock and securities in certain reorganizations) are each amended by striking out "section 368(a)(1)(D)" and inserting in lieu thereof "subparagraph (D) or (Oof section 368(a)(1)".

�