determines at a time between the date when such income became due.

(A) With regard to the former of these classes, it may be noticed that although apportioned rent becomes payable only when the whole rent is due, the landlord, in the case of the bankruptcy of an ordinary tenant, may prove for a proportionate part of the rent up to the date of the receiving order (Bankruptcy Act 1883, Sched. ii. r. 19); and that a similar rule holds good in the winding up of a company (in re South Kensington Co-operative Stores, 1881, 17 Ch.D. 161); and further that the act of 1870 applies to the liability to pay, as well as to the right to receive, rent (in re Wilson, 1893, 62 L.J.Q.B. 628, 632). Accordingly where an assignment of a lease is made between two half-yearly rent-days, the assignee is not liable to pay the full amount of the half-year’s rent falling due on the rent-day next after the date of the assignment, but only an apportioned part of that half-year’s rent, computed from the last mentioned date (Glass v. Patterson, 1902, 2 Ir.R. 660).

(B.) With regard to the apportionment of income, the only points requiring notice here are that all dividends payable by public companies are apportionable, whether paid at fixed periods or not, unless the payment is, in effect, a payment of capital (§ 5).

The Apportionment Act 1870 extends to Scotland and Ireland. It has been followed in many of the British colonies (e.g. Ontario, Rev. Stats., 1897, c. 170, §§ 4-8; New Zealand, No. 4 of 1886; Tasmania, No. 8 of 1871; Barbados, No. 12 of 1891, §§ 9-12). Similar legislation has been adopted in many of the states of the American Union, where, as in England, rent was not, at common law, apportionable as to time (Kent, Comm. iii. 469-472).

An equitable apportionment, apart from statute law, arises where property is bequeathed on trust to pay the income to a tenant for life and the reversion to others, and the realization of the property in the form of a fund capable of producing income is postponed for the benefit of the estate. In such cases there is an ultimate apportionment between the persons entitled to the income and those entitled to the capital of the accumulations for the period of such postponement. The rule followed is this: the proceeds, when realized, are apportionable between capital and income by ascertaining the sum which, put out and accumulated at 3% per annum from the day of the testator’s death (with yearly rents and deducting income tax) would have produced at the day of receipt the sum actually received. The sum so ascertained should be treated as capital and the residue as income. (In re Earl of Chesterfield’s Trusts, 1883, 24 Ch.D. 643; In re Goodenough, 1895, 2 Ch. 537; Rowlls v. Bebb, 1900, 2 Ch. 107.)

In addition to the authorities cited in the text, see Stroud, Jud. Dict. (2nd ed., London, 1903), s.v. “Apportion”; Bouvier, Law Dict. (London and Boston, 1897), s.v. “Apportionment”; Ruling Cases (London, 1895), tit. “Apportionment”; Fawcett, Landlord and Tenant (London, 1905), pp. 238 et seq.; Foa, Landlord and Tenant (3rd ed., London, 1901), pp. 112 et seq.

(A. W. R.)

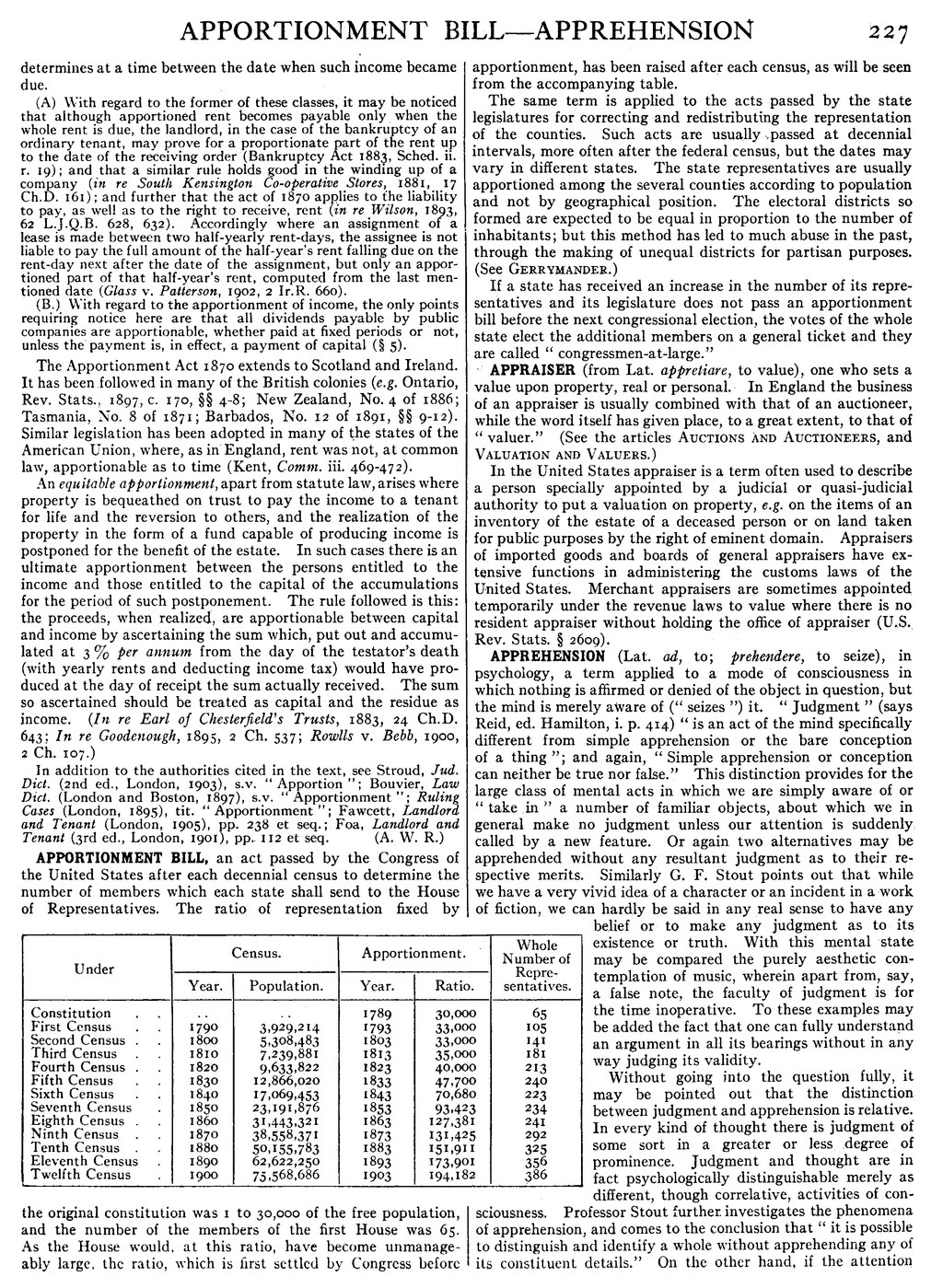

APPORTIONMENT BILL, an act passed by the Congress of the United States after each decennial census to determine the number of members which each state shall send to the House of Representatives. The ratio of representation fixed by the original constitution was 1 to 30,000 of the free population, and the number of the members of the first House was 65. As the House would, at this ratio, have become unmanageably large, the ratio, which is first settled by Congress before apportionment, has been raised after each census, as will be seen from the accompanying table.

| Under | Census. | Apportionment. | Whole Number of Repre- sentatives. | ||

| Year. | Population. | Year. | Ratio. | ||

| Constitution First Census Second Census Third Census Fourth Census Fifth Census Sixth Census Seventh Census Eighth Census Ninth Census Tenth Census Eleventh Census Twelfth Census |

· · 1790 1800 1810 1820 1830 1840 1850 1860 1870 1880 1890 1900 |

· · 3,929,214 5,308,483 7,239,881 9,633,822 12,866,020 17,069,453 23,191,876 31,443,321 38,558,371 50,155,783 62,622,250 75,568,686 |

1789 1793 1803 1813 1823 1833 1843 1853 1863 1873 1883 1893 1903 |

30,000 33,000 33,000 35,000 40,000 47,700 70,680 93,423 127,381 131,425 151,911 173,901 194,182 |

65 105 141 181 213 240 223 234 241 292 325 356 386 |

The same term is applied to the acts passed by the state legislatures for correcting and redistributing the representation of the counties. Such acts are usually passed at decennial intervals, more often after the federal census, but the dates may vary in different states. The state representatives are usually apportioned among the several counties according to population and not by geographical position. The electoral districts so formed are expected to be equal in proportion to the number of inhabitants; but this method has led to much abuse in the past, through the making of unequal districts for partisan purposes. (See Gerrymander.)

If a state has received an increase in the number of its representatives and its legislature does not pass an apportionment bill before the next congressional election, the votes of the whole state elect the additional members on a general ticket and they are called “congressmen-at-large.”

APPRAISER (from Lat. appretiare, to value), one who sets a value upon property, real or personal. In England the business of an appraiser is usually combined with that of an auctioneer, while the word itself has given place, to a great extent, to that of “valuer.” (See the articles Auctions and Auctioneers, and Valuation and Valuers.)

In the United States appraiser is a term often used to describe a person specially appointed by a judicial or quasi-judicial authority to put a valuation on property, e.g. on the items of an inventory of the estate of a deceased person or on land taken for public purposes by the right of eminent domain. Appraisers of imported goods and boards of general appraisers have extensive functions in administering the customs laws of the United States. Merchant appraisers are sometimes appointed temporarily under the revenue laws to value where there is no resident appraiser without holding the office of appraiser (U.S. Rev. Stats. § 2609).

APPREHENSION (Lat. ad, to; prehendere, to seize), in psychology, a term applied to a mode of consciousness in which nothing is affirmed or denied of the object in question, but the mind is merely aware of (“seizes”) it. “Judgment” (says Reid, ed. Hamilton, i. p. 414) “is an act of the mind specifically different from simple apprehension or the bare conception of a thing”; and again, “Simple apprehension or conception can neither be true nor false.” This distinction provides for the large class of mental acts in which we are simply aware of or “take in” a number of familiar objects, about which we in general make no judgment unless our attention is suddenly called by a new feature. Or again two alternatives may be apprehended without any resultant judgment as to their respective merits. Similarly G. F. Stout points out that while we have a very vivid idea of a character or an incident in a work of fiction, we can hardly be said in any real sense to have any belief or to make any judgment as to its existence or truth. With this mental state may be compared the purely aesthetic contemplation of music, wherein apart from, say, a false note, the faculty of judgment is for the time inoperative. To these examples may be added the fact that one can fully understand an argument in all its bearings without in any way judging its validity.

Without going into the question fully, it may be pointed out that the distinction between judgment and apprehension is relative. In every kind of thought there is judgment of some sort in a greater or less degree of prominence. Judgment and thought are in fact psychologically distinguishable merely as different, though correlative, activities of consciousness. Professor Stout further investigates the phenomena of apprehension, and comes to the conclusion that “it is possible to distinguish and identify a whole without apprehending any of its constituent details.” On the other hand, if the attention