PUBLIC LAW 99-498—OCT. 17, 1986

100 STAT. 1463

"FAMILY CONTRIBUTION FOR INDEPENDENT STUDENTS WITHOUT DEPENDENTS "SEC. 476. (a) COMPUTATION OF EXPECTED FAMILY CONTRIBUTION.—

For each independent student without dependents (including a spouse), the expected family contribution is equal to the sum of— "(1) the student's contribution from income (determined in accordance with subsection (b)); and "(2) the student's income supplemental amount from assets (determined in accordance with subsection (c)). "(b) STUDENT'S CONTRIBUTION FROM INCOME.—

"(1) IN GENERAL.—The student's contribution from income is determined by— "(A) computing the student's available taxable income by deducting from the student's adjusted gross income— "(i) Federal income taxes; "(ii) an allowance for State and local income taxes, determined in accordance with paragraph (2); "(iii) the allowance for social security taxes, determined in accordance with paragraph (3); and "(iv) a maintenance allowance for periods of nona>,' enrollment not to exceed $600 per month; "(B) assessing such available taxable income in accordance with paragraph (4); and "(C) adding to the assessment resulting under subparagraph (B) the amount of the untaxed income and benefits of the student (determined in accordance with section 480(c)), except that the student's contribution from income shall not be less than $1,200. "(2) ALLOWANCE FOR STATE AND LOCAL INCOME TAXES.—The

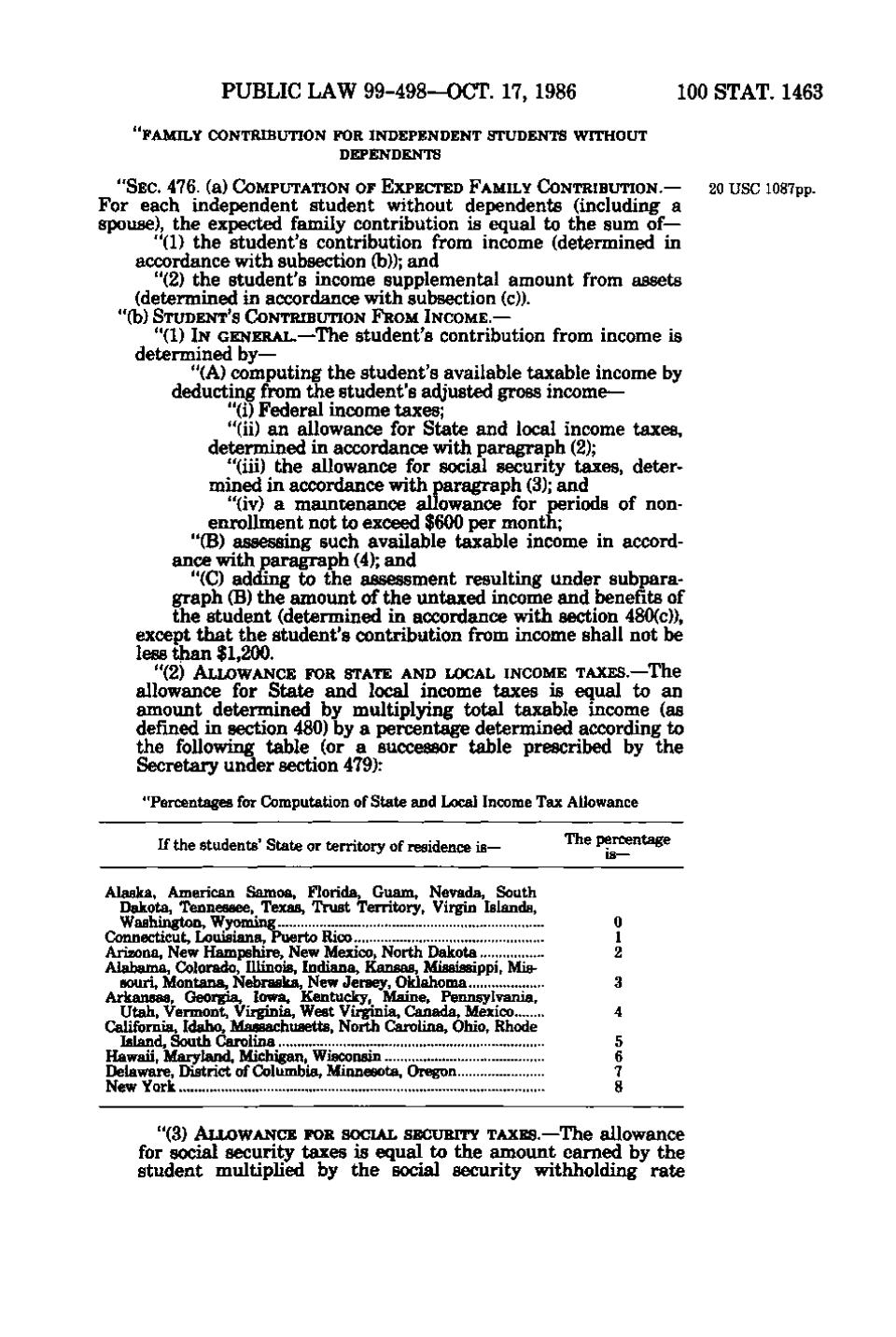

allowance for State and local income taxes is equal to an amount determined by multiplying total taxable income (as defined in section 480) by a percentage determined according to the following table (or a successor table prescribed by the Secretary under section 479): "Percentages for Computation of State and Local Income Tax Allowance If the students' State or territory of residence is— Alaska, American Samoa, Florida, Guam, Nevada, South Dakota, Tennessee, Texas, Trust Territory, Virgin Islands, Washington, Wyoming Connecticut, Louisiana, Puerto Rico Arizona, New Hampshire, New Mexico, North Dakota Alabama, Colorado, Illinois, Indiana, Kansas, Mississippi, Missouri, Montana, Nebraska, New Jersey, Oklahoma Arkansas, Georgia, Iowa, Kentucky, Maine, Pennsylvania, Utah, Vermont, Virginia, West Virginia, Canada, Mexico Cedifornia, Idaho, Massachusetts, North Carolina, Ohio, Rhode Mand, South Carolina Hawaii, Maryland, Michigan, Wisconsin Delaware, District of Columbia, Minnesota, Oregon New York

'^^^ p^centage

0 1 2 3 4 5 6 7 8

"(3) ALLOWANCE FOR SOCIAL SECURITY TAXES.—The allowance

for social security taxes is equal to the amount earned by the student multiplied by the social security withholding rate

20 USC lOSTpp.

�