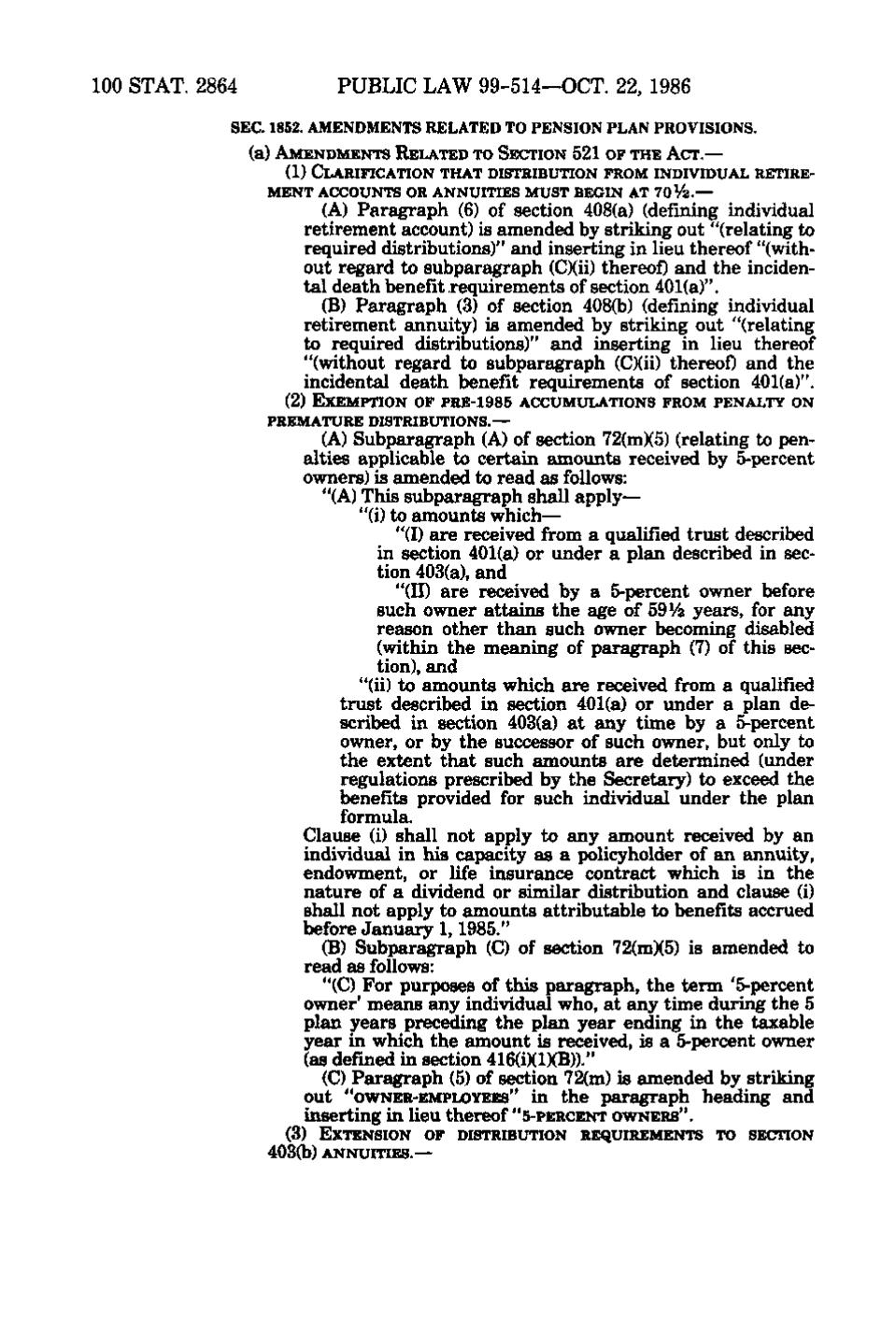

100 STAT. 2864

PUBLIC LAW 99-514—OCT. 22, 1986

SEC. 1852. AMENDMENTS RELATED TO PENSION PLAN PROVISIONS. (a) AMENDMENTS RELATED TO SECTION 521 OF THE ACT.— (1) CLARIFICATION THAT DISTRIBUTION FROM INDIVIDUAL RETIREMENT ACCOUNTS OR ANNUITIES MUST BEGIN AT 70 V2.—

(A) Paragraph (6) of section 408(a) (defining individual retirement account) is amended by striking out "(relating to required distributions)" and inserting in lieu thereof "(without regard to subparagraph (C)(ii) thereof) and the incidental death benefit j-equirements of section 401(a)". (B) Paragraph (3) of section 408(b) (defining individual retirement annuity) is amended by striking out "(relating to required distributions)" and inserting in lieu thereof "(without regard to subparagraph (C)(ii) thereof) and the incidental death benefit requirements of section 401(a)". (2) EXEMPTION OF PRE-1985 ACCUMULATIONS FROM PENALTY ON PREMATURE DISTRIBUTIONS.—

(A) Subparagraph (A) of section 72(m)(5) (relating to penalties applicable to certain amounts received by 5-percent owners) is amended to read as follows: "(A) This subparagraph shall apply— "(i) to amounts which— "(I) are received from a qualified trust described in section 401(a) or under a plan described in section 403(a), and "(II) are received by a 5-percent owner before such owner attains the age of 59 ¥2 years, for any reason other than such owner becoming disabled (within the meaning of paragraph (7) of this section), and "(ii) to amounts which are received from a qualified trust described in section 401(a) or under a plan described in section 403(a) at any time by a 5-percent owner, or by the successor of such owner, but only to the extent that such amounts are determined (under regulations prescribed by the Secretary) to exceed the benefits provided for such individual under the plan formula. Clause (i) shall not apply to any amount received by an individual in his capacity as a policyholder of an annuity, endowment, or life insurance contract which is in the nature of a dividend or similar distribution and clause (i) shall not apply to amounts attributable to benefits accrued before January 1, 1985." (B) Subparagraph (C) of section 72(m)(5) is amended to read as follows: "(C) For purposes of this paragraph, the term '5-percent owner' means any individual who, at any time during the 5 plan years preceding the plan year ending in the taxable year in which the amount is received, is a 5-percent owner (as defined in section 416(i)(l)(B))." (C) Paragraph (5) of section 72(m) is amended by striking out "owNER-EMPLOYEEs" in the paragraph heading and inserting in lieu thereof "5-PERCENT OWNERS". (3) EXTENSION OF DISTRIBUTION REQUIREMENTS TO SECTION

4030t)) ANNUITIES.—

�