PUBLIC LAW 99-514—OCT. 22, 1986 T.-,

100 STAT. 2471

amended by subsection (a)) that the distribution be received after attaining age 59 ¥2 shall not apply. (B) COMPUTATION OF TAX.—If subparagraph (A) applies to

any lump sum distribution of any taxpayer for any taxable year, the tax imposed by section 1 of the Internal Revenue Code of 1986 on such taxpayer for such taxable year shall be equal to the sum of— (i) the tax imposed by such section 1 on the taxable income of the taxpayer (reduced by the portion of such lump sum distribution to which clause (ii) applies), plus (ii) 20 percent of the portion of such lump sum distribution to which the existing capital gains provisions continue to apply by reason of this paragraph.

f (]

(C) LUMP SUM DISTRIBUTIONS TO WHICH PARAGRAPH AP-

.*! 5<, "

- ' '

m^A,

PLIES.—This paragraph shall apply to any lump sum distribution if— (i) such lump sum distribution is received by an individual who has attained age 50 before January 1, 1986, and (ii) the taxpayer makes an election under this paragraph. Not more than 1 election may be made under this paragraph with respect to an employee. An election under this subparagraph shall be treated as an election under section 402(e)(4)(B) of such Code with respect to any other lump sum distribution. (4) 5-YEAR P H A S E - O U T OF CAPITAL GAINS TREATMENT.—

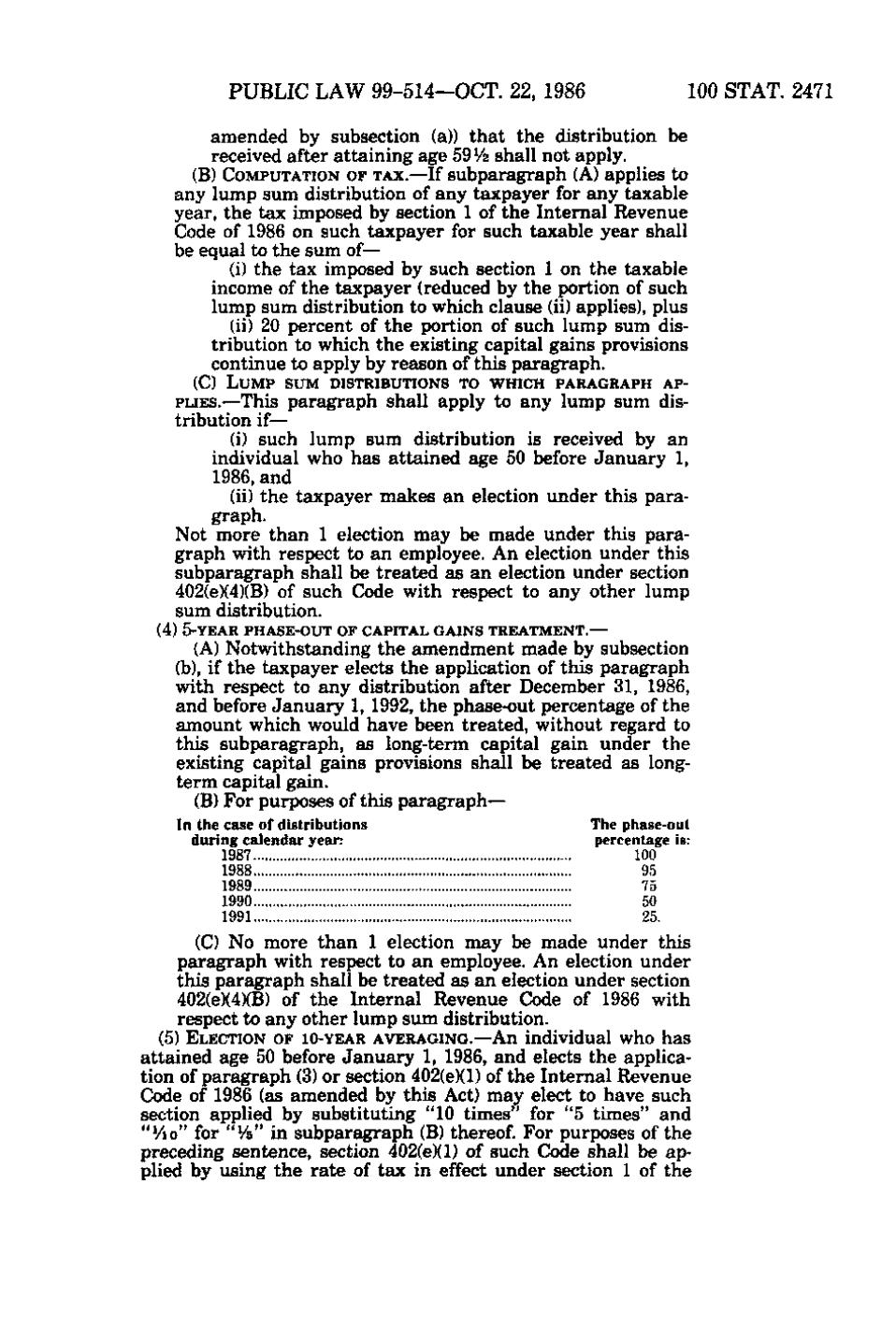

(A) Notwithstanding the amendment made by subsection (b), if the taxpayer elects the application of this paragraph with respect to any distribution after December 31, 1986, and before January 1, 1992, the phase-out percentage of the amount which would have been treated, without regard to this subparagraph, as long-term capital gain under the existing capital gains provisions shall be treated as longterm capital gain. (B) For purposes of this paragraph—

_(,

• lOi.S

iei/< Sfi' 5. i^ '^•^'^^ -:•-':--•

In the case of distributions during calendar year: 1987 1988 1989 1990 1991

The phase-out percentage is: 100 95 75 50 25.

(C) No more than 1 election may be made under this paragraph with respect to an employee. An election under this paragraph shall be treated as an election under section 402(e)(4)(B) of the Internal Revenue Code of 1986 with respect to any other lump sum distribution. (5) ELECTION OF IO-YEAR AVERAGING.—An individual who has attained age 50 before January 1, 1986, and elects the application of paragraph (3) or section 402(e)(1) of the Internal Revenue Code of 1986 (as amended by this Act) may elect to have such section applied by substituting "10 times" for "5 times" and "Vio" for "Vs" in subparagraph (B) thereof. For purposes of the preceding sentence, section 402(e)(1) of such Code shall be applied by using the rate of tax in effect under section 1 of the

�