101 STAT. 1330-400

,^, ». i M i.::

PUBLIC LAW 100-203—DEC. 22, 1987

i •,* «jr any item described in either such paragraph which may be taken into account for purposes of computing the taxable income of a partner or shareholder shall be disregarded. J«

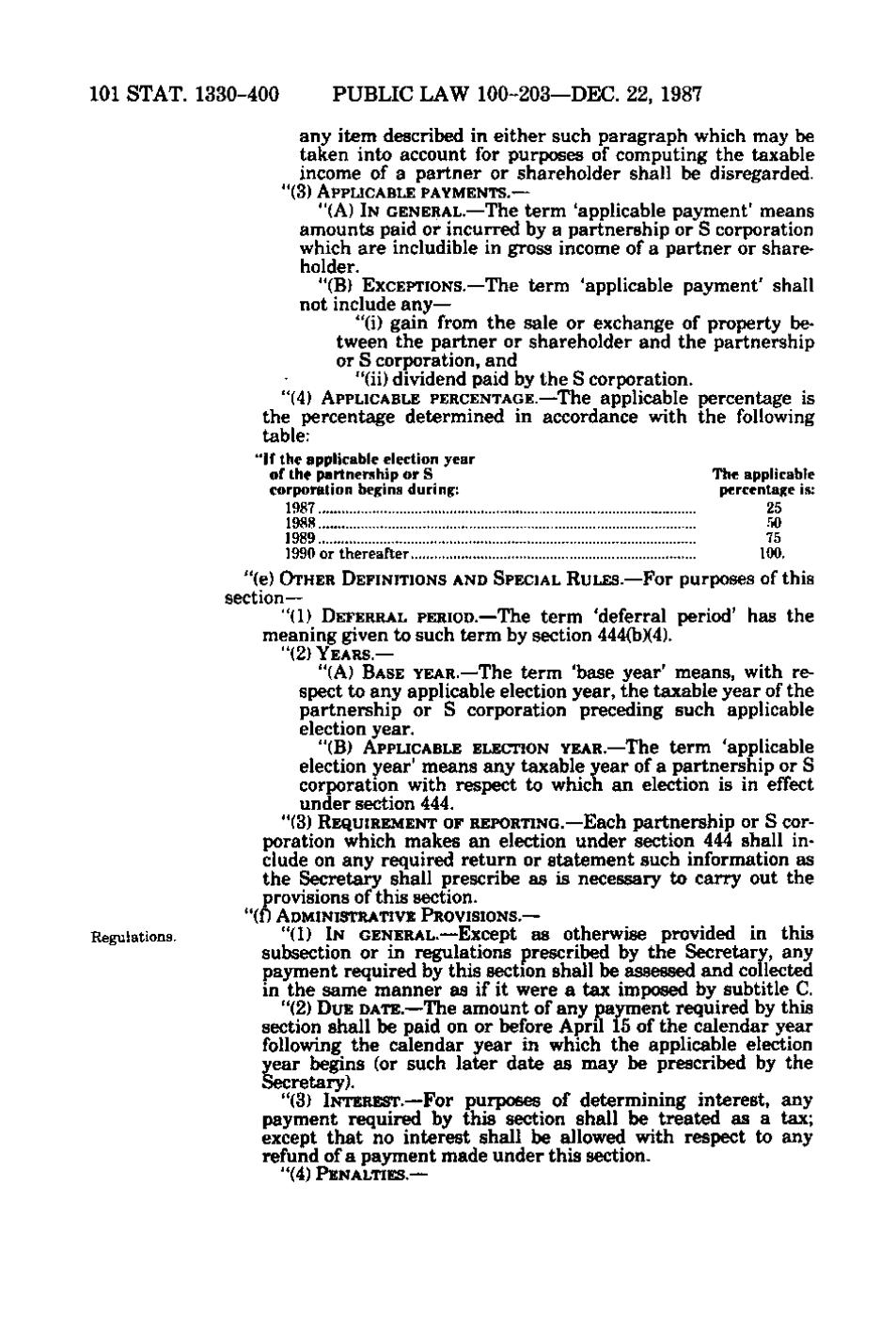

"(3) A P P L I C A B L E PAYMENTS.—

"(A) IN GENERAL.—The term 'applicable payment' means 8 fo C amounts paid or incurred by a partnership or S corporation f which are includible in gross income of a partner or share&(:<; a holder. "(B) EXCEPTIONS.—The term 'applicable payment' shall Gl '.# not include any— M:'"' "(i) gain from the sale or exchange of property beixf tween the partner or shareholder and the partnership r>Qor S corporation, and "(ii) dividend paid by the S corporation. "(4) APPLICABLE PERCENTAGE.—The applicable percentage is -' the percentage determined in accordance with the following table: • > "If the applicable election year »f- of the partnership or S corporation begins during: m 1987 %r, 1988 •' 1989

^^ "

/ •i

.,'

'

1990 or thereafter"!!!"!'"!!!!!!"!!!!!!!!!!!!!!!!!!!!!!!!!!"!!!"!"!^

^

The applicable percentage is: 25 50 75

loo.

"(e) OTHER DEFINITIONS AND SPECIAL RULES.—For purposes of this section— ,;,: "(1) DEFERRAL PERIOD.—The term 'deferral period' has the meaning given to such term by section 444(b)(4). ac

"(2) YEARS.— "(A) BASE YEAR.—The

term 'base year' means, with reiso a spect to any applicable election year, the taxable year of the partnership or S corporation preceding such applicable election year. If "(B) APPLICABLE ELECTION YEAR.—The term 'applicable /t. election year' means any taxable year of a partnership or S corporation with respect to which an election is in effect •V; under section 444. 3

"(3) REQUIREMENT OF REPORTING.—Each partnership or S cor-

- poration which makes an election under section 444 shall inia elude on any required return or statement such information as

•' the Secretary shall prescribe as is necessary to carry out the provisions of this section.

- ,

"(f) ADMINISTRATIVE PROVISIONS.—

Regulations. fe v; 1 M » ) b' 'C

- !/

in hc

"(1) IN GENERAL.—Except as Otherwise provided in this subsection or in regulations prescribed by the Secretary, any payment required by this section shall be assessed and collected in the same manner as if it were a tax imposed by subtitle C, "(2) DUE DATE.—The amount of any payment required by this section shall be paid on or before April 15 of the calendar year following the calendar year in which the applicable election year begins (or such later date as may be prescribed by the Secretary). "(3) INTEREST.—For purposes of determining interest, any payment required by this section shall be treated as a tax; except that no interest shall be allowed with respect to any refund of a payment made under this section. "(4) PENALTIES.—

�