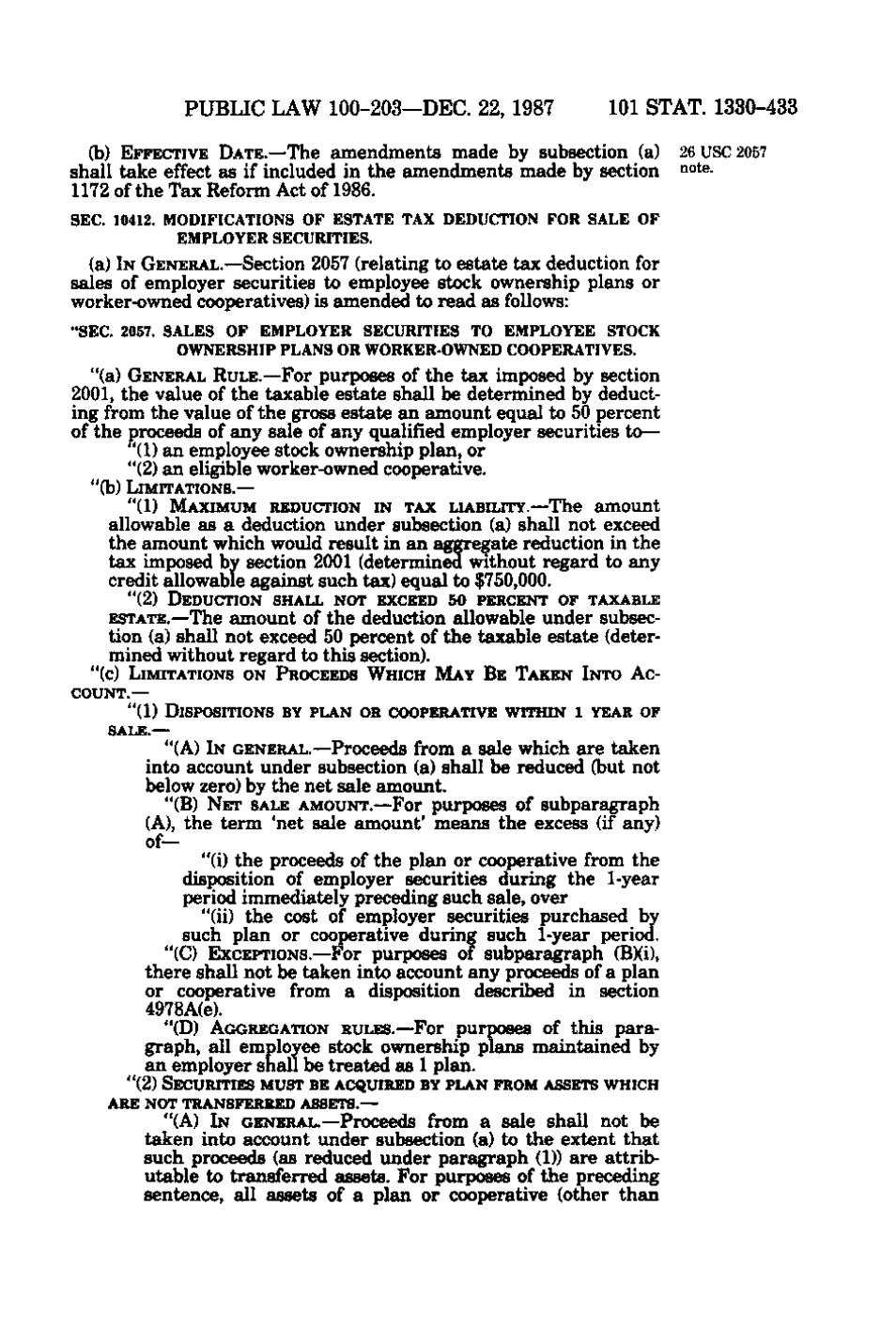

PUBLIC LAW 100-203—DEC. 22, 1987

101 STAT. 1330-433

(b) EFFECTIVE DATE.—The amendments made by subsection (a) 26 USC 2057 shall take effect as if included in the amendments made by section ^°^^1172 of the Tax Reform Act of 1986. SEC. 10412. MODIFICATIONS OF ESTATE TAX DEDUCTION FOR SALE OF EMPLOYER SECURITIES.

(a) IN GENERAL.—Section 2057 (relating to estate tax deduction for sales of employer securities to employee stock ownership plans or worker-owned cooperatives) is amended to read as follows: "SEC. 2057. SALES OF EMPLOYER SECURITIES TO EMPLOYEE STOCK OWNERSHIP PLANS OR WORKER-OWNED COOPERATIVES. "(a) GENERAL RULE.—For purposes of the tax imposed by section

2001, the value of the taxable estate shall be determined by deducting from the value of the gross estate an amount equal to 50 percent of the proceeds of any sale of any qualified employer securities to— '(1) an employee stock ownership plan, or "(2) an eligible worker-owned cooperative. "(b) LIMITATIONS.— "(1) MAXIMUM REDUCTION IN TAX LIABILITY.—The

amount allowable as a deduction under subsection (a) shall not exceed the amount which would result in an aggregate reduction in the tax imposed by section 2001 (determined without regard to any u • credit allowable against such tax) equal to $750,000. "(2) DEDUCTION SHALL NOT EXCEED 50 PERCENT OF TAXABLE

ESTATE.—The amount of the deduction allowable under subsection (a) shall not exceed 50 percent of the taxable estate (determined without regard to this section). "(c) LIMITATIONS ON PROCEEDS WHICH MAY B E TAKEN INTO ACCOUNT.— "(1) DISPOSITIONS BY PLAN OR COOPERATIVE WITHIN i YEAR OF SALE.—

"(A) IN GENERAL.—Proceeds from a sale which are taken ,,^. into account under subsection (a) shall be reduced (but not -••r i^. below zero) by the net sale amount. "(B) NET SALE AMOUNT.—For purposes of subparagraph

s

(A), the term 'net sale amount' means the excess (if any) of— "(i) the proceeds of the plan or cooperative from the fr: '. •• disposition of employer securities during the 1-year period immediately preceding such sale, over "(ii) the cost of employer securities purchased by such plan or cooperative during such 1-year period. "(C) EXCEPTIONS.—For purposes of subparagraph (B)(i), J., there shall not be taken into account any proceeds of a plan or cooperative from a disposition described in section ,bf£i 4978A(e). ,y "(D) AGGREGATION RULES.—For purposes of this paragraph, all employee stock ownership plans maintained by ,i; an employer shall be treated as 1 plan. "(2) SECURITIES MUST BE ACQUIRED BY PLAN FROM ASSETS WHICH ARE NOT TRANSFERRED ASSETS.—

j If

"(A) IN GENERAL.—Proceeds from a sale shall not be taken into account under subsection (a) to the extent that such proceeds (as reduced under paragraph (1)) are attributable to transferred sissets. For purposes of the preceding sentence, all assets of a plan or cooperative (other than

�