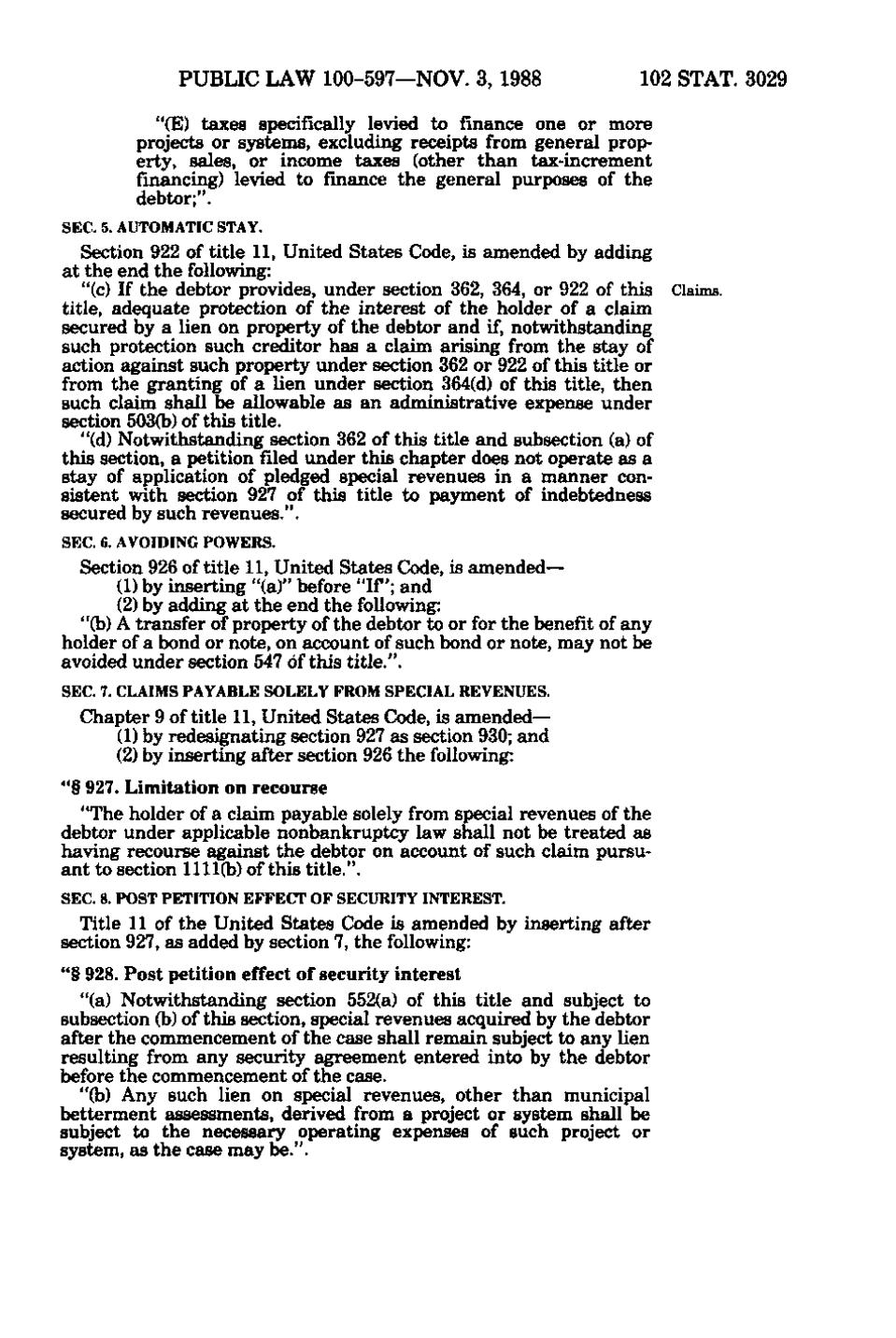

PUBLIC LAW 100-597—NOV. 3, 1988

102 STAT. 3029

"(E) taxes specifically levied to finance one or more projects or systems, excluding receipts from general property, sales, or income taxes (other than tax-increment financing) levied to finance the general purposes of the debtor;". SEC. 5. AUTOMATIC STAY.

Section 922 of title 11, United States Code, is amended by adding at the end the following: "(c) If the debtor provides, under section 362, 364, or 922 of this Claims, title, adequate protection of the interest of the holder of a claim secured by a lien on property of the debtor and if, notwithstanding such protection such creditor has a claim arising from the stay of action against such property under section 362 or 922 of this title or from the granting of a lien under section 364(d) of this title, then such claim shall be allowable as an administrative expense under section 503(b) of this title. "(d) Notwithstanding section 362 of this title and subsection (a) of this section, a petition filed under this chapter does not operate as a stay of application of pledged special revenues in a manner consistent with section 927 of this title to payment of indebtedness secured by such revenues.". SEC. 6. AVOIDING POWERS,

Section 926 of title 11, United States Code, is amended— (1) by inserting "(a)" before "If; and (2) by adding at the end the following: "(b) A transfer of property of the debtor to or for the benefit of any holder of a bond or note, on account of such bond or note, may not be avoided under section 547 of this title.". SEC. 7. CLAIMS PAYABLE SOLELY FROM SPECIAL REVENUES.

Chapter 9 of title 11, United States Code, is amended— (1) by redesignating section 927 as section 930; and (2) by inserting after section 926 the following: "§ 927. Limitation on recourse "The holder of a claim payable solely from special revenues of the debtor under applicable nonbankruptcy law shall not be treated as having recourse against the debtor on account of such claim pursuant to section 1111(b) of this title.". SEC. 8. POST PETITION EFFECT OF SECURITY INTEREST.

Title 11 of the United States Code is amended by inserting after section 927, as added by section 7, the following: "§ 928. Post petition effect of security interest "(a) Notwithstanding section 552(a) of this title and subject to subsection (b) of this section, special revenues acquired by the debtor after the commencement of the case shall remain subject to any lien resulting from any security agreement entered into by the debtor before the commencement of the case. "(b) Any such lien on special revenues, other than municipal betterment assessments, derived from a project or system shall be subject to the necessary operating expenses of such project or system, as the case may be.".

�