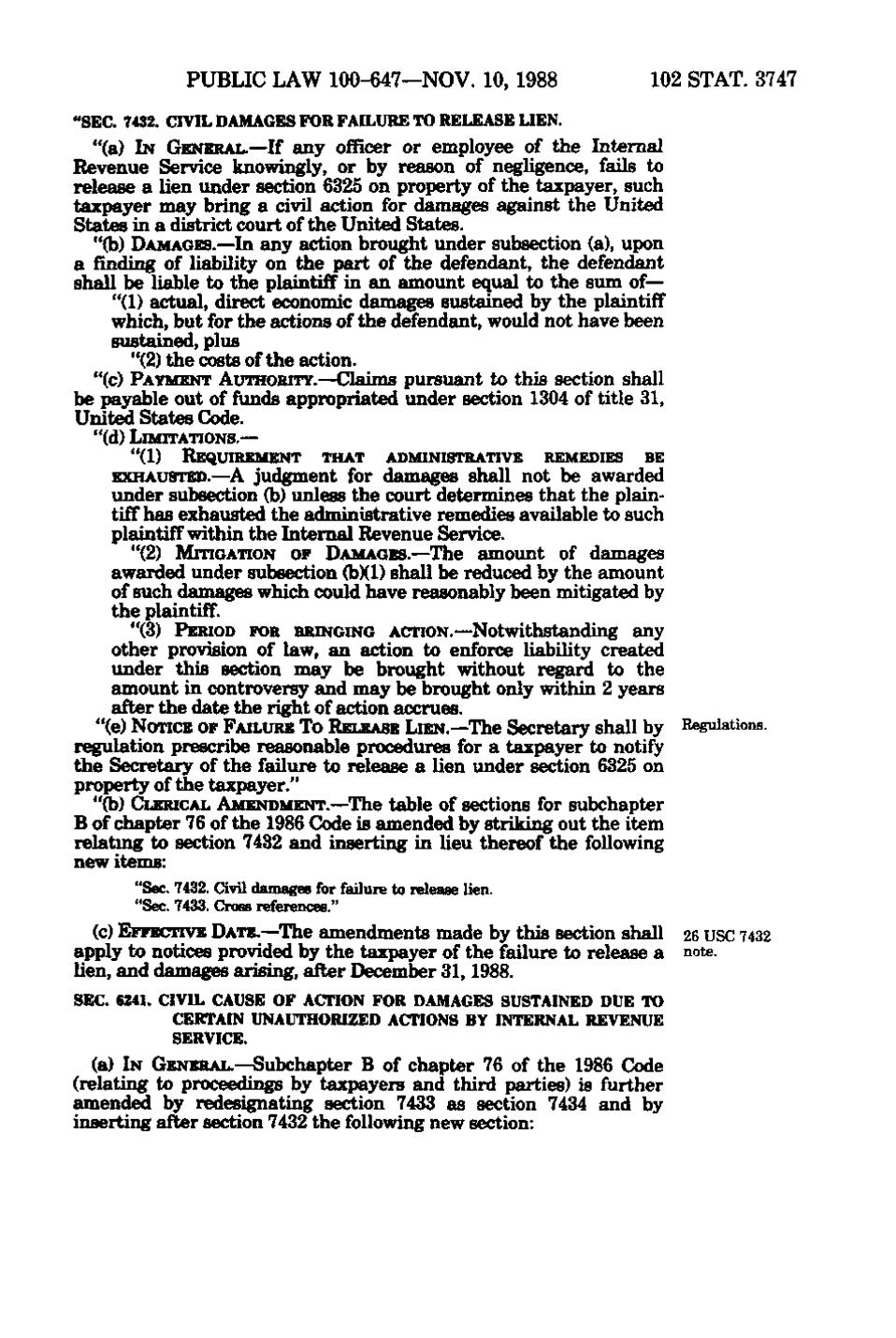

PUBLIC LAW 100-647—NOV. 10, 1988

102 STAT. 3747

"SEC. 7432. CIVIL DAMAGES FOR FAILURE TO RELEASE LIEN. "(a) IN GENERAL.—If any officer or employee of the Internal Revenue Service knowingly, or by reason of negligence, fails to release a lien under section 6325 on property of the taxpayer, such taxpayer may bring a civil action for damages against the United States in a district court of the United States. "(b) DAMAGES.—In any action brought under subsection (a), upon a finding of liability on the part of the defendant, the defendant shall be liable to the plaintiff in an amount equal to the sum of— "(1) actual, direct economic damages sustained by the plaintiff which, but for the actions of the defendant, would not have been sustained, plus "(2) the costs of the action. "(c) PAYMENT AUTHORITY.—Claims pursuant to this section shall be payable out of funds appropriated under section 1304 of title 31, United States Code. "(d) LIMITATIONS.— "(1) REQUIREMENT

THAT

ADMINISTRATIVE

REMEDIES

BE

EXHAUSTED.—A judgment for damages shall not be awarded under subsection (b) unless the court determines that the plaintiff has exhausted the administrative remedies available to such plaintiff within the Internal Revenue Service. "(2) MITIGATION OP DAMAGES.—The amount of damages

awarded under subsection (b)(1) shall be reduced by the amount of such damages which could have reasonably been mitigated by the plaintiff. "(3)

PERIOD FOR BRINGING ACTION.—Notwithstanding

any

other provision of law, an action to enforce liability created under this section may be brought without regard to the amount in controversy and may be brought only within 2 years after the date the right of action accrues. "(e) NOTICE OP FAILURE TO RELEASE LIEN.—The Secretary shall by Regulations. r^ulation prescribe reasonable procedures for a taxpayer to notify the Secretary of the failure to release a lien under section 6325 on property of the taxpayer." "(b) CLERICAL AMENDMENT.—The table of sections for subchapter B of chapter 76 of the 1986 (Dode is amended by striking out the item relating to section 7432 and inserting in lieu thereof the following new items: "Sec. 7432. CivU damages for failure to release lien. "Sec. 7433. Cross references." (c) EPPECTIVE DATE.—The amendments made by this section shall 26 USC 7432 apply to notices provided by the taxpayer of the failure to release a note. lien, and damages arising, after December 31, 1988. SEC. 6241. CIVIL CAUSE OF ACTION FOR DAMAGES SUSTAINED DUE TO CERTAIN UNAUTHORIZED ACTIONS BY INTERNAL REVENUE

SERVICE. (a) IN GENERAL.—Subchapter B of chapter 76 of the 1986 Code (relating to proceedings by taxpayers and third parties) is further amended by redesignating section 7433 as section 7434 and by inserting after section 7432 the following new section:

�