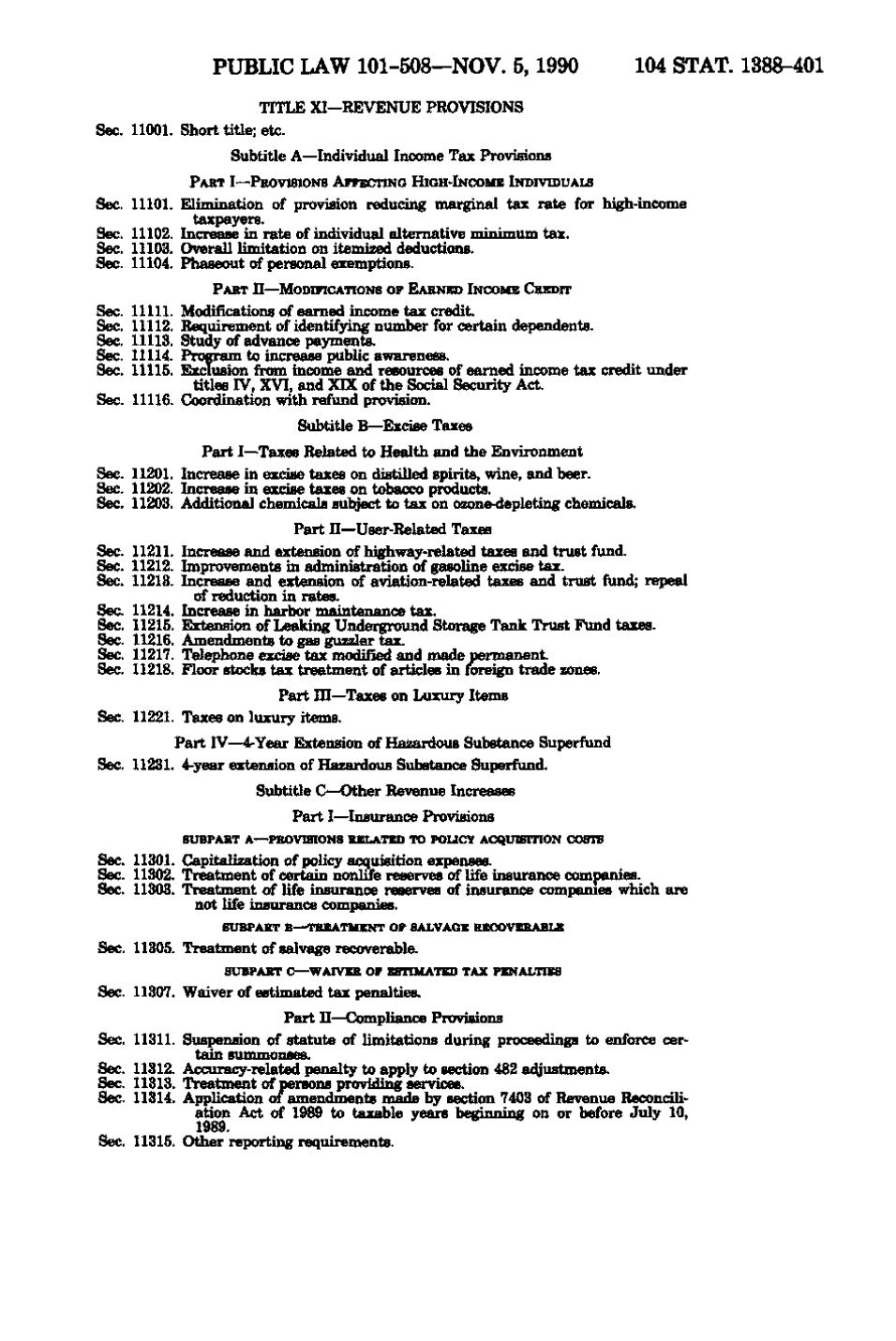

PUBLIC LAW 101-508—NOV. 5, 1990 104 STAT. 1388-401 TITLE XI—REVENUE PROVISIONS Sec. 11001. Short title; etc. Subtitle A—Individual Income Tax Provisions PART I—PROVISIONS AFFECTING HIGH-INCOME INDIVIDUALS Sec. 11101. Elimination of provision reducing marginal tax rate for high-income taxpayers. Sec. 11102. Increase in rate of individual alternative minimum tax. Sec. 11103. Overall limitation on itemized deductions. Sec. 11104. Phaseout of personal exemptions. PART II—MODIFICATIONS OF EARNED INCOME CREDIT Sec. mil. Modifications of earned income tax credit. Sec. 11112. Requirement of identifying number for certain dependents. Sec. 11113. Study of advance paymente. Sec. 11114. Program to increase public awareness. Sec. 11115. Exclusion from income and resources of earned income tax credit under titles rV, XVI, and XIX of the Social Security Act. Sec. 11116. C!oordination with refund provision. Subtitle B—Excise Taxes Part I—Taxes Related to Health and the Environment Sec. 11201. Increase in excise taxes on distilled spirits, wine, and beer. Sec. 11202. Increase in excise taxes on tobacco products. Sec. 11203. Additional chemicals subject to tfix on ozone-depleting chemicals. Part II—User-Related Taxes Sec. 11211. Increase and extension of highway-related taxes and trust fund. Sec. 11212. Improvements in administration of gasoline excise tax. Sec. 11213. Increase and extension of aviation-related taxes and trust fund; repeal of reduction in rates. Sec. 11214. Increase in harbor maintenance tax. Sec. 11215. Extension of Leaking Underground Storage Tank Trust Fund taxes. Sec. 11216. Amendments to gas guzzler tax. Sec. 11217. Telephone excise tax modified and made permanent. Sec. 11218. Floor stocks tax treatment of articles in foreign trade zones. Part III—Taxes on Luxury Items Sec. 11221. Taxes on luxury items. Part rV—4-Year Extension of Hazardous Substance Superfund Sec. 11231. 4-year extension of Hazardous Substance Superfund. Subtitle C—Other Revenue Increases ' Part I—Insurance Provisions SUBPART A—PROVISIONS RELATED TO POLICY ACQuismoN COSTS Sec. 11301. Capitalization of policy acquisition expenses. Sec. 11302. Treatment of certain nonlife reserves of life insurance companies. Sec. 11303. Treatment of life insurcuice reserves of insurance companies which are not life insurance companies. SUBPART B—TREATMENT OF SALVAGE RECOVERABLE Sec. 11305. Treatment of salvage recoverable. SUBPART C—WAIVER OF ESTIMATED TAX PENALTIES Sec. 11307. Waiver of estimated tax penalties. Part II—Compliance Provisions Sec. 11311. Suspension of statute of limitations during proceedings to enforce certain summonses. Sec. 11312. Accuracy-related penalty to apply to section 482 adjustments. Sec. 11313. Treatment of persons providing services. Sec. 11314. Application of amendments made by section 7403 of Revenue Reconciliation Act of 1989 to taxable years beginning on or before July 10, 1989. Sec. 11315. Other reporting requirements.

�