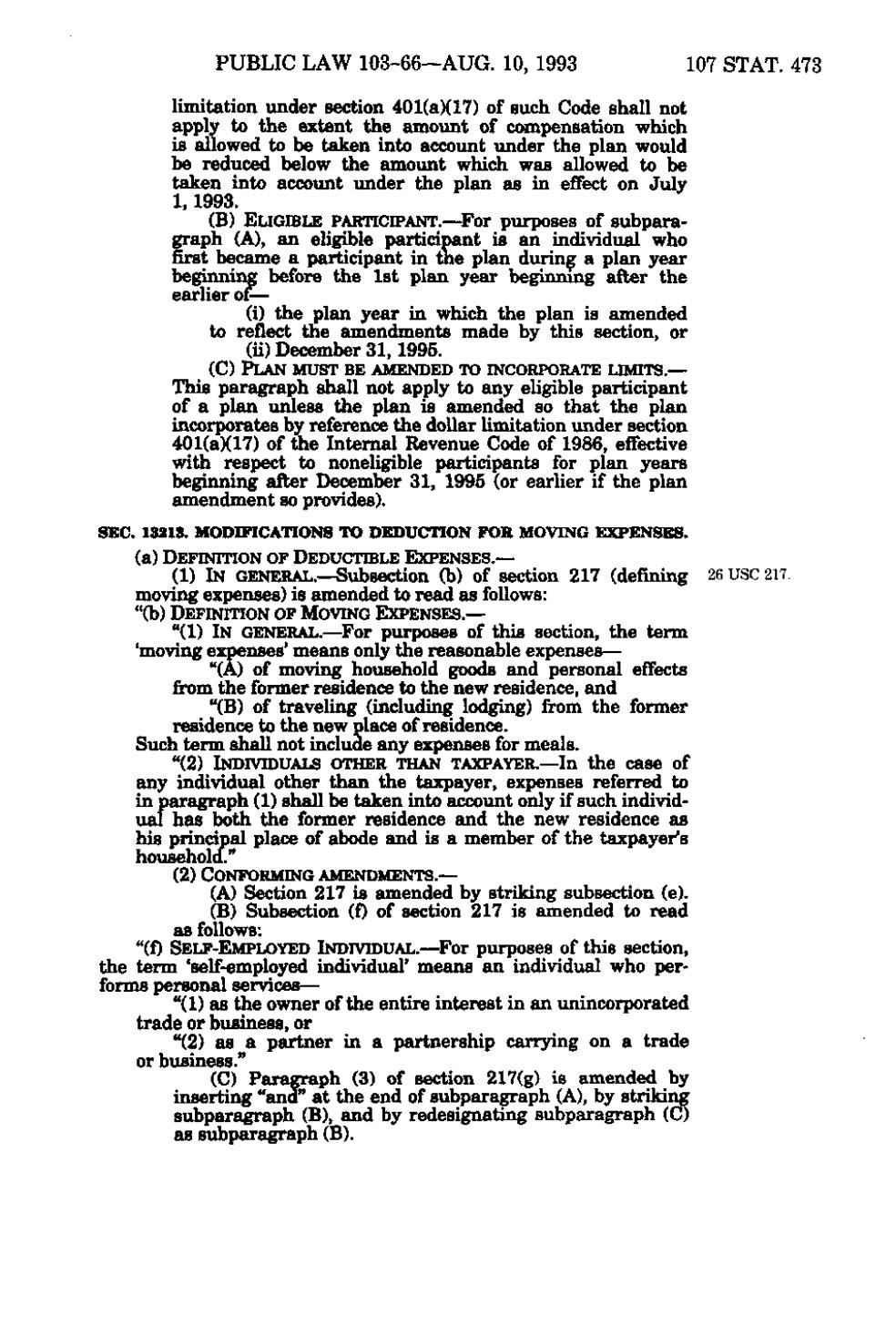

PUBLIC LAW 103-66—AUG. 10, 1993 107 STAT. 473 limitation under section 401(a)(17) of such Code shall not apply to the extent the amoiint of compensation which is allowed to be taken into account under the plan would be reduced below the amount which was allowed to be taken into account under the plan as in effect on July 1, 1993. (B) ELIGIBLE PARTICIPANT.— For purposes of subparagraph (A), an eligible participant is an individual who first became a participant in the plan during a plan year beginning before the 1st plan year beginning after the earlier of— (i) the plan year in which the plan is amended to reflect the amendments made by this section, or (ii) December 31, 1995. (C) PLAN MUST BE AMENDED TO INCORPORATE LIMITS. — This paragraph shall not apply to any eligible participant of a plan unless the plan is amended so that the plan incorporates by reference the dollar limitation under section 401(a)(17) of the Internal Revenue Code of 1986, effective with respect to noneligible participants for plan years beginning after December 31, 1995 (or earlier if the plan amendment so provides). SEC. 13213. MODIFICATIONS TO DEDUCTION FOR MOVING EXPENSES. (a) DEFINITION OF DEDUCTIBLE EXPENSES.— (1) IN GENERAL.-^ubsection (b) of section 217 (defining 26 USC 217. moving expenses) is amended to read as follows: "(b) DEFINITION OF MOVING EXPENSES. — "(1) IN GENERAL.— For purposes of this section, the term 'moving expenses' means only the reasonable expenses— "(A) of moving household goods and personal effects from the former residence to the new residence, and "(B) of traveling (including lodging) from the former residence to the new place of residence. Such term shall not include any expenses for meals. "(2) INDIVIDUALS OTHER THAN TAXPAYER. — In the case of any individual other than the taxpayer, expenses referred to in paragraph (1) shall be taken into account only if such individual has both the former residence and the new residence as his principal place of abode and is a member of the taxpayer's household" (2) CONFORMING AMENDMENTS.— (A) Section 217 is amended by striking subsection (e). (B) Subsection (f) of section 217 is amended to read as follows: "(f) SELF-EMPLOYED INDIVIDUAL. —For purposes of this section, the term 'self-employed individual' means an individual who performs personal services— "(1) as the owner of the entire interest in an unincorporated trade or business, or "(2) as a partner in a partnership carrying on a trade or business." (C) Paragraph (3) of section 217(g) is amended by inserting "and" at the end of subparagraph (A), by striking subparagraph (B), and by redesignating subparagraph (C) as subparagraph (B).

�