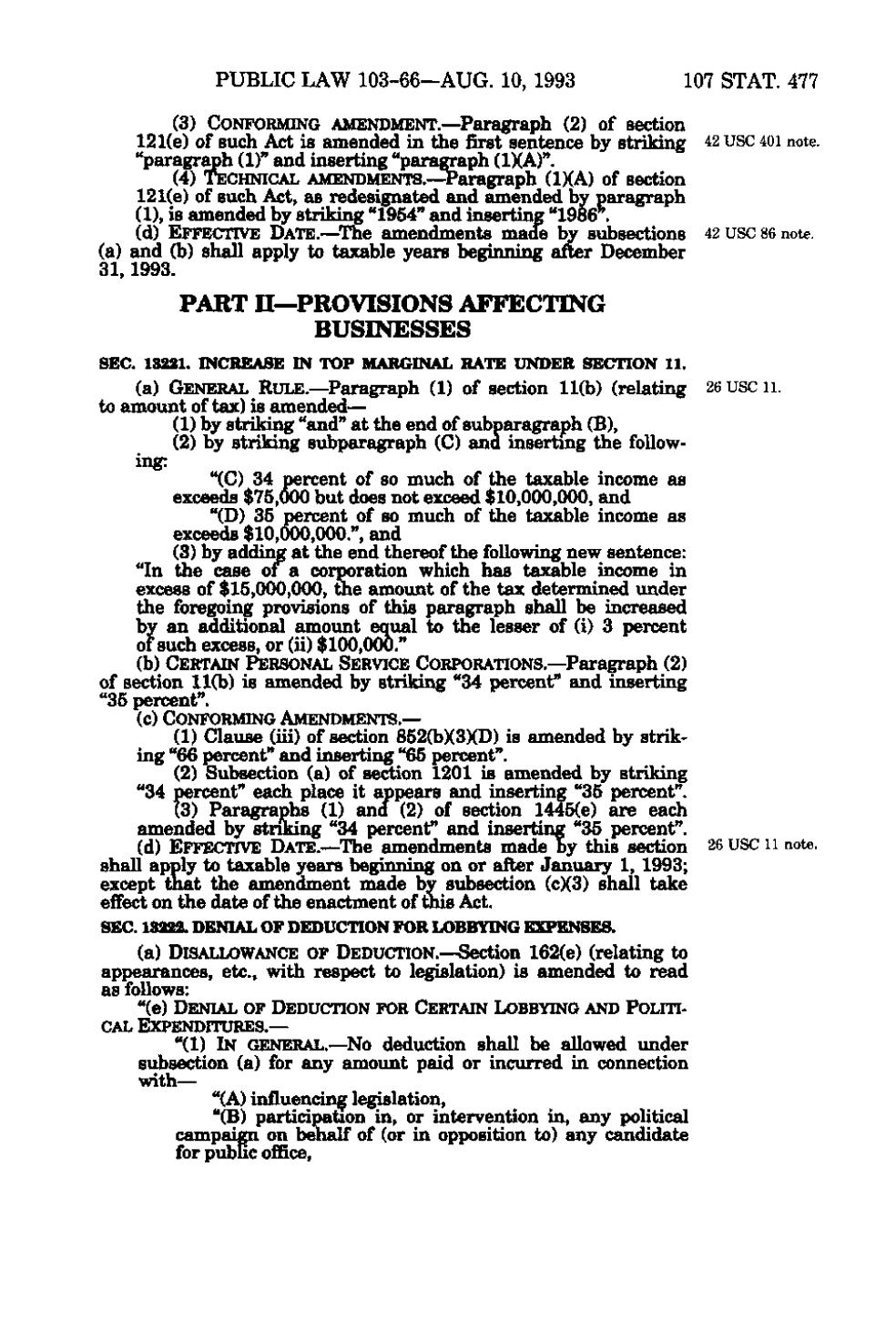

PUBLIC LAW 103-66 —AUG. 10, 1993 107 STAT. 477 (3) CONFORMING AMENDMENT. —Paragraph (2) of section 121(e) of such Act is amended in the first sentence by striking 42 USC 40i note. "paragraph (1)" and inserting "paragraph (I)(A)". (4) TECHNICAL AMENDMENTS. — Paragraph (I)(A) of section 121(e) of such Act, as redesignated and amended by paragraph (1), is amended by striking "1954" and inserting "1986^. (d) EFFECTIVE DATE.—The amendments made by subsections 42 USC 86 note. (a) and (b) shall apply to taxable years beginning after December 31, 1993. PART II—PROVISIONS AFFECTING BUSINESSES SEC. 13221. INCREASE IN TOP MARGINAL RATE UNDER SECTION 11. (a) GENERAL RULE.— Paragraph (1) of section 11(b) (relating 26 USC ii. to amount of tax) is amended— (1) by striking "and" at the end of subparagraph (B), (2) by striking subparagraph (C) and inserting the following: "(C) 34 percent of so much of the taxable income as exceeds $75,000 but does not exceed $10,000,000, and "(D) 35 percent of so much of the taxable income as exceeds $10,000,000.", and (3) by adding at the end thereof the following new sentence: "In the case of a corporation which has taxable income in excess of $15,000,000, the amount of the tax determined under the foregoing provisions of this paragraph shall be increased by an additional amount equal to the lesser of (i) 3 percent of such excess, or (ii) $ 100,000." (b) CERTAIN PERSONAL SERVICE CORPORATIONS.— Paragraph (2) of section 11(b) is amended by striking "34 percent" and inserting "35 percent". (c) CONFORMING AMENDMENTS.— (1) Clause (iii) of section 852(b)(3)(D) is amended by striking "66 percent" and inserting "65 percent". (2) Subsection (a) of section 1201 is amended by striking "34 percent" each place it appears and inserting "35 percent". (3) Paragraphs (1) and (2) of section 1445(e) are each amended by striking "34 percent" and inserting "35 percent". (d) EFFECTIVE DATE.—The amendments made by this section 26 USC ii note. shall apply to taxable years beginning on or after January 1, 1993; except that the amendment made by subsection (c)(3) shall take effect on the date of the enactment of this Act. SEC. 13222. DENIAL OF DEDUCTION FOR LOBBYING EXPENSES. (a) DISALLOWANCE OF DEDUCTION. — Section 162(e) (relating to appearances, etc., with respect to legislation) is amended to read as follows: "(e) DENIAL OF DEDUCTION FOR CERTAIN LOBBYING AND POLITI- CAL EXPENDITURES. — "(1) IN GENERAL.— No deduction shall be allowed under subsection (a) for any amount paid or incurred in connection with— "(A) influencing legislation, "(B) participation in, or intervention in, any political campaign on behalf of (or in opposition to) any candidate for public office,

�