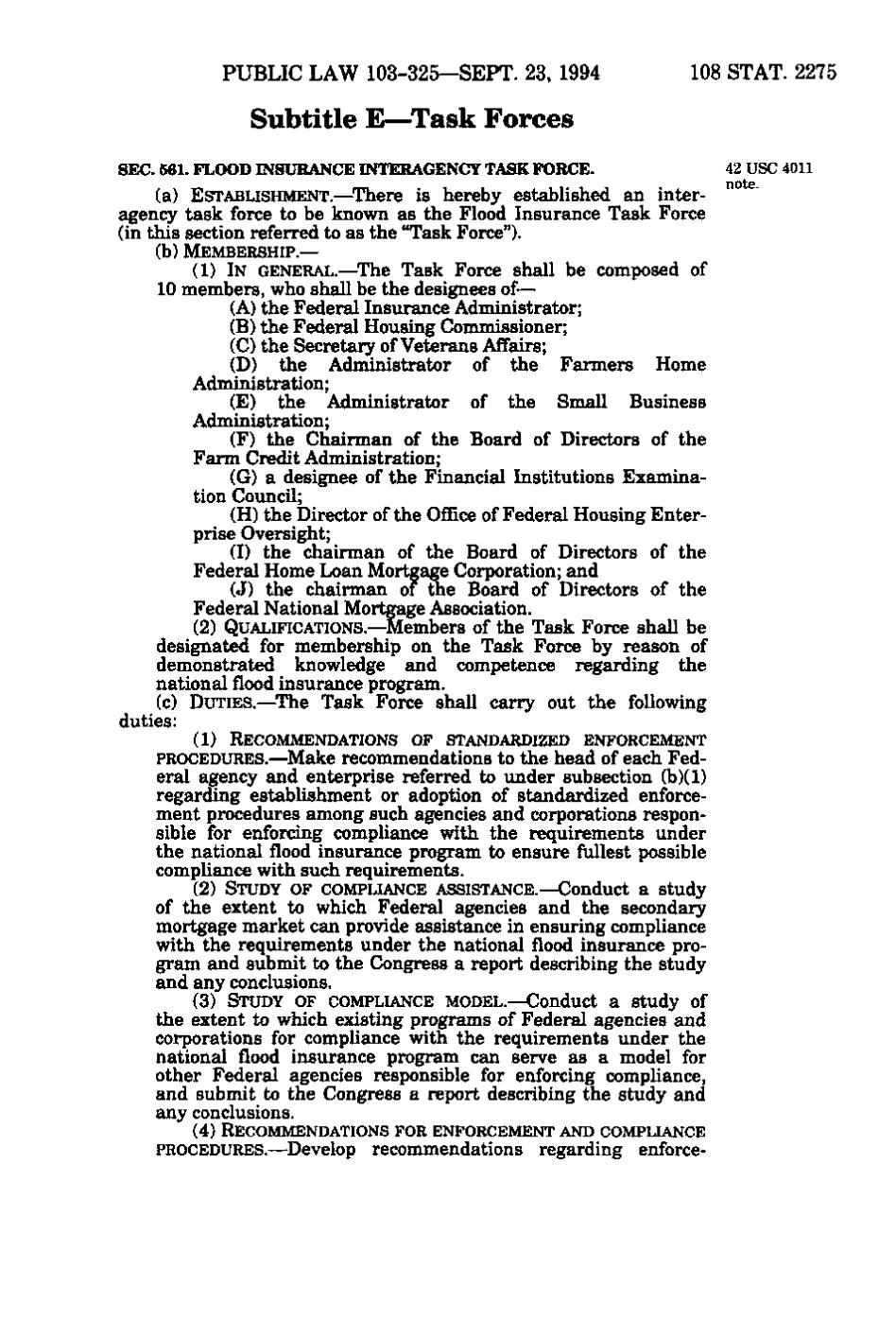

PUBLIC LAW 103-325—SEPT. 23, 1994 108 STAT. 2275 Subtitle E—Task Forces SEC. 561. FLOOD INSURANCE INTERAGENCY TASK FORCE. 42 USC 4011 (a) ESTABLISHMENT. —There is hereby established an interagency task force to be known as the Flood Insurance Task Force (in this section referred to as the "Task Force"). (b) MEMBERSHIP.— (1) IN GENERAL. — The Task Force shall be composed of 10 members, who shall be the designees of— (A) the Federal Insurance Administrator; (B) the Federal Housing Commissioner; (C) the Secretary of Veterans Affairs; (D) the Administrator of the Farmers Home Administration; (E) the Administrator of the Small Business Administration; (F) the Chairman of the Board of Directors of the Farm Credit Administration; (G) a designee of the Financial Institutions Examination Council; (H) the Director of the Office of Federal Housing Enterprise Oversight; (I) the chairman of the Board of Directors of the Federal Home Loan Mortgage Corporation; and (J) the chairman of the Board of Directors of the Federal National Mortgage Association. (2) QUALIFICATIONS.— Members of the Task Force shall be designated for membership on the Task Force by reason of demonstrated knowledge and competence regarding the national flood insurance program. (c) DUTIES. —The Task Force shall carry out the following duties: (1) RECOMMENDATIONS OF STANDARDIZED ENFORCEMENT PROCEDURES.—Make recommendations to the head of each Federal agency and enterprise referred to under subsection (b)(1) regarding establishment or adoption of standardized enforcement procedures among such agencies and corporations responsible for enforcing compliance with the requirements under the national flood insurance program to ensure fullest possible compliance with such requirements. (2) STUDY OF COMPLIANCE ASSISTANCE.— Conduct a study of the extent to which Federal agencies and the secondary mortgage market can provide assistance in ensuring compliance with the requirements under the national flood insurance program and submit to the Congress a report describing the study and any conclusions. (3) STUDY OF COMPLIANCE MODEL.—Conduct a study of the extent to which existing programs of Federal agencies and corporations for compliance with the requirements under the national flood insurance program can serve as a model for other Federal agencies responsible for enforcing compliance, and submit to the Congress a report describing the study and any conclusions. (4) RECOMMENDATIONS FOR ENFORCEMENT AND COMPLIANCE PROCEDURES.— Develop recommendations regarding enforce-

�