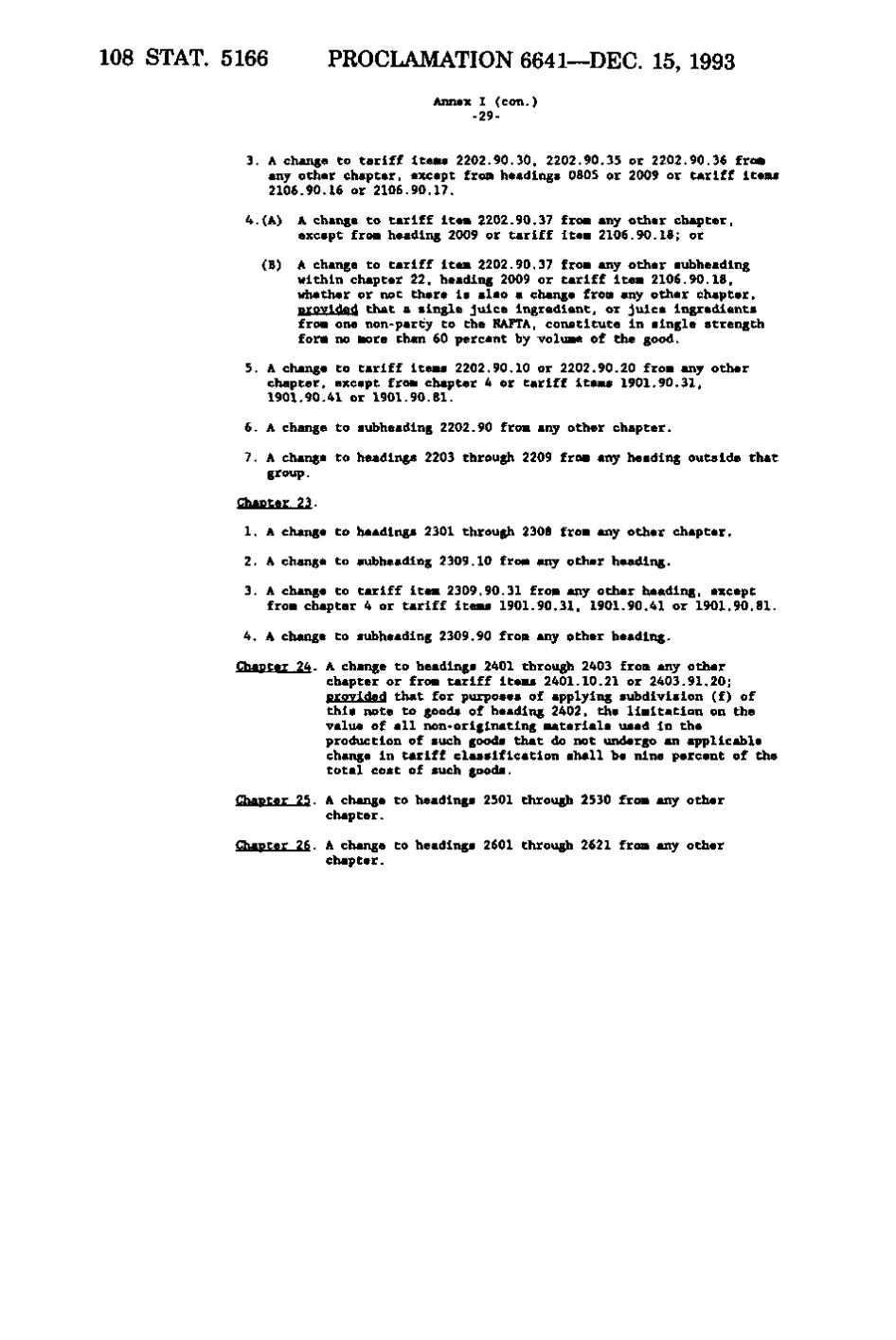

108 STAT. 5166 PROCLAMATION 6641—DEC. 15, 1993 Annex I (con.) - 29- 3. A change to tariff items 2202.90.30, 2202.90.35 or 2202.90.36 from any other chapter, except fron headings 0805 or 2009 or tariff Items 2106.90.16 or 2106.90.17. 4.(A) A change to tariff Item 2202.90.37 from any other chapter, except from heading 2009 or tariff Item 2106.90.18; or (B) A change to tariff Item 2202.90.37 from any other subheading within chapter 22, heading 2009 or tariff Item 2106.90.18, whether or not there Is also a change from any other chapter, provided that a single Juice Ingredient, or juice Ingredients from one non-party to the NAFTA, constitute In single strength form no more than 60 percent by volume of the good. 5. A change to tariff Items 2202.90.10 or 2202.90.20 from any other chapter, except from chapter 4 or tariff Items 1901.90.31, 1901.90.41 or 1901.90.81. 6. A change to subheading 2202.90 from any other chapter. 7. A change to headings 2203 through 2209 from any heading outside that group. Chanter 23. 1. A change to headings 2301 through 2308 from any other chapter. 2. A change to subheading 2309.10 from any other heading. 3. A change to tariff Item 2309.90.31 from any other heading, except from chapter 4 or tariff Items 1901.90.31, 1901.90.41 or 1901.90.81. 4. A change to subheading 2309.90 from any other heading. Chapter 24. A change to headings 2401 through 2403 from any other chapter or from tariff Items 2401.10.21 or 2403.91.20; provided that for purposes of applying subdivision (f) of this note to goods of heading 2402, the limitation on the value of all non-originating materials used In the production of such goods that do not undergo an applicable change In tariff classification shall be nine percent of the total cost of such goods. Chapter 25. A change to headings 2501 through 2530 from any other chapter. Chapter 26. A change to headings 2601 through 2621 from any other chapter.

�