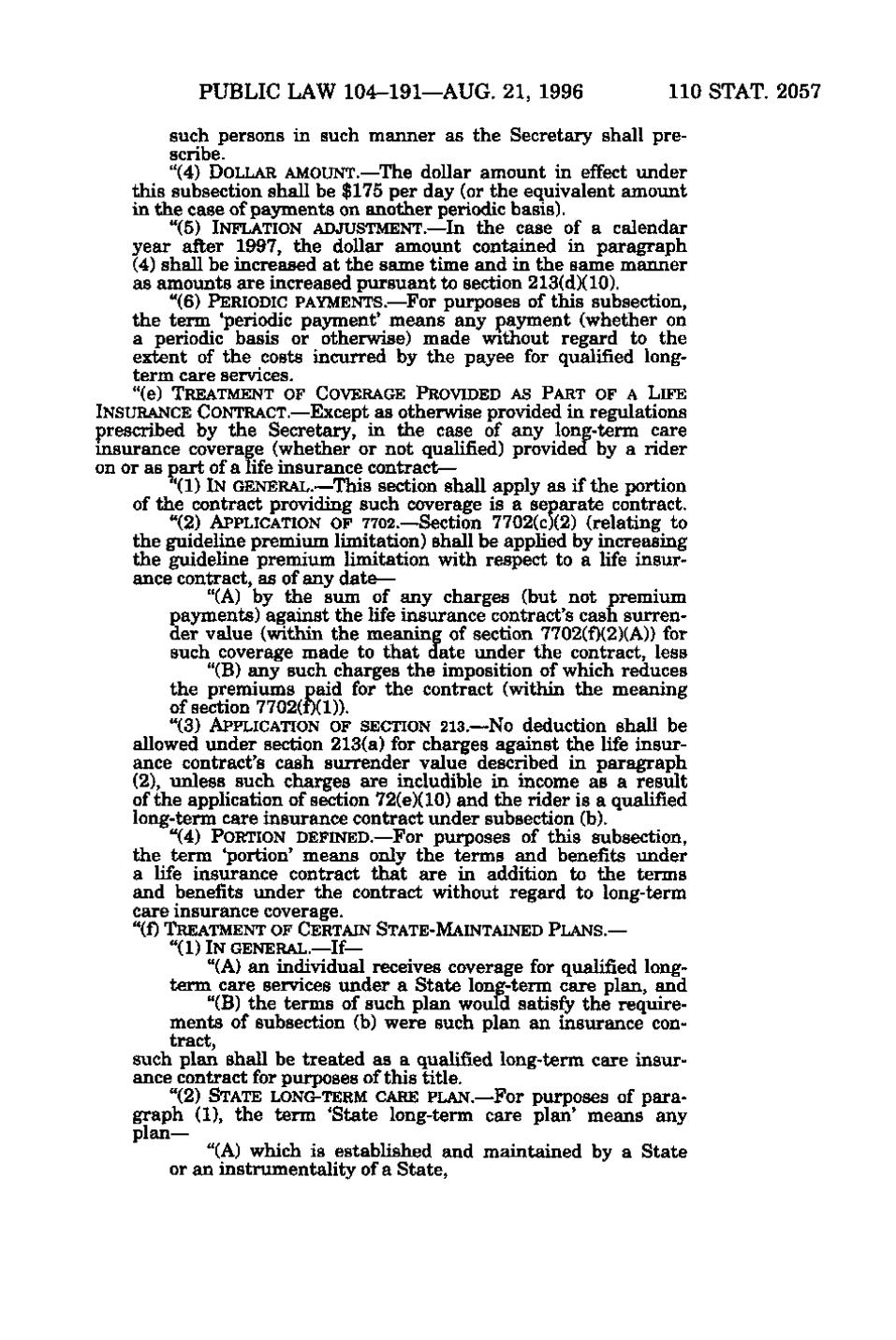

PUBLIC LAW 104-191—AUG. 21, 1996 110 STAT. 2057 such persons in such manner as the Secretary shall prescribe. "(4) DOLLAR AMOUNT.—The dollar amount in effect under this subsection shall be $175 per day (or the equivalent amount in the case of payments on another periodic basis). "(5) INFLATION ADJUSTMENT.— In the case of a calendar year after 1997, the dollar amount contained in paragraph (4) shall be increased at the same time and in the same manner as amounts are increased pursuant to section 213(d)(10). "(6) PERIODIC PAYMENTS.—For purposes of this subsection, the term 'periodic pa3anent' means any payment (whether on a periodic basis or otherwise) made without regard to the extent of the costs incurred by the payee for qualified longterm care services. "(e) TREATMENT OF COVERAGE PROVIDED AS PART OF A LIFE INSURANCE CONTRACT.— Except as otherwise provided in regulations prescribed by the Secretary, in the case of any long-term care insurance coverage (whether or not qualified) provided by a rider on or as part of a life insurance contract— "(1) IN GENERAL. —T his section shall apply as if the portion of the contract providing such coverage is a separate contract. "(2) APPLICATION OF 7702. —Section 7702(c)(2) (relating to the guideline premium limitation) shall be applied by increasing the guideline premium limitation with respect to a life insurance contract, as of any date— "(A) by the sum of any charges (but not premium payments) against the life insurance contract's cash surrender value (within the meaning of section 7702(f)(2)(A)) for such coverage made to that date under the contract, less "(B) any such charges the imposition of which reduces the premiums paid for the contract (within the meaning of section 7702(f)(1)). "(3) APPLICATION OF SECTION 213.—N O deduction shall be allowed under section 213(a) for charges against the life insurance contract's cash surrender value described in paragraph (2), unless such charges sire includible in income as a result of the application of section 72(e)(10) and the rider is a qualified long-term care insurance contract under subsection (b). "(4) PORTION DEFINED.— For purposes of this subsection, the term 'portion' means only the terms and benefits under a life insurance contract that are in addition to the terms and benefits under the contract without regard to long-term care insurance coverage. "(f) TREATMENT OF CERTAIN STATE-MAINTAINED PLANS.— "(1) IN GENERAL.~ I f— "(A) an individual receives coverage for qualified longterm care services under a State long-term care plan, and "(B) the terms of such plan would satisfy the requirements of subsection (b) were such plan an insurance contract, such plan shall be treated as a qualified long-term care insurance contract for purposes of this title. "(2) STATE LONG-TERM CARE PLAN. — For purposes of paragraph (1), the term 'State long-term care plan' means any plan— "(A) which is established and maintained by a State or an instrumentality of a State,

�