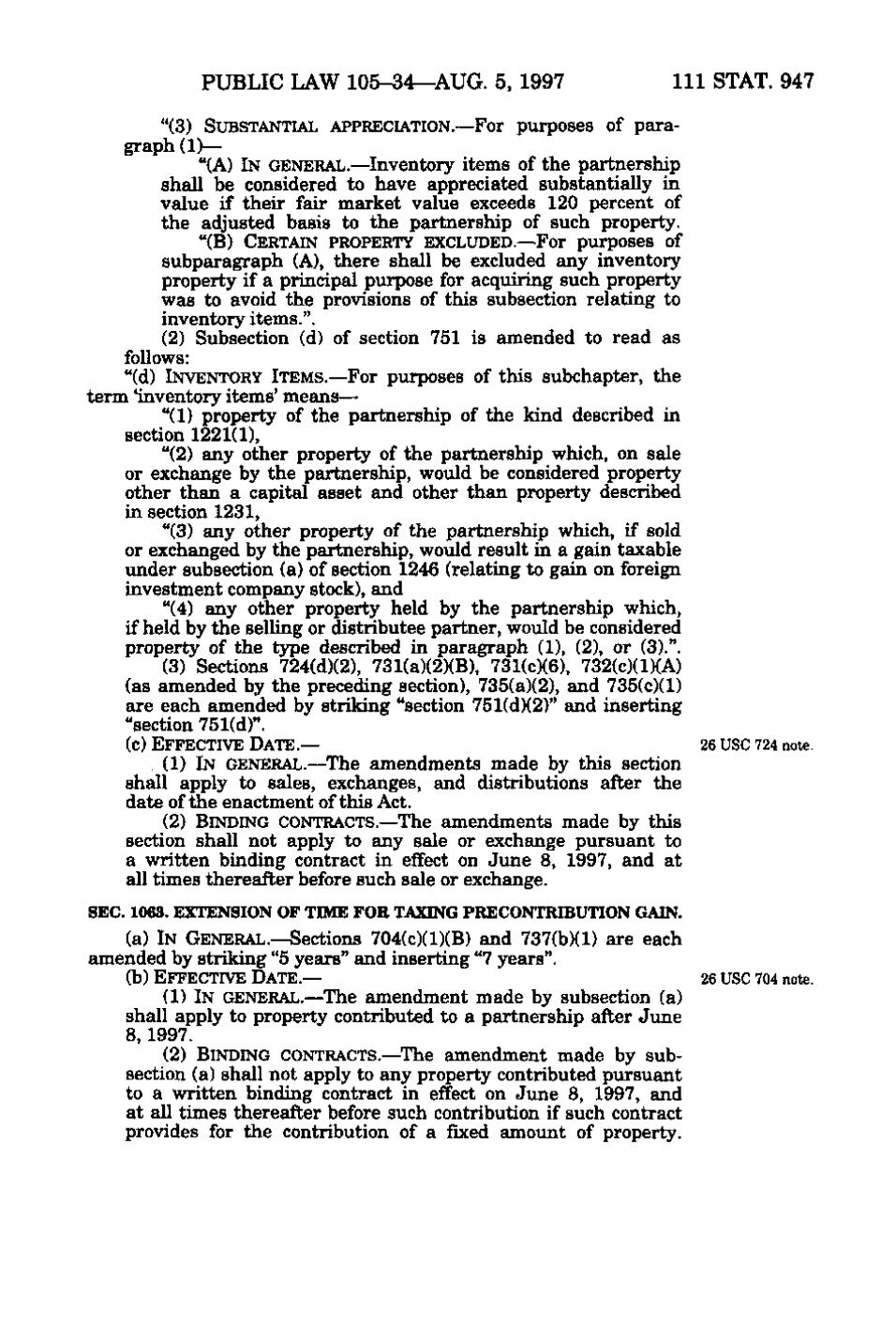

PUBLIC LAW 105-34—AUG. 5, 1997 111 STAT. 947 "(3) SUBSTANTIAL APPRECIATION.—For purposes of paragraph (1)— "(A) IN GENERAL.— Inventory items of the partnership shall be considered to have appreciated substantially in value if their fair market value exceeds 120 percent of the adjusted basis to the partnership of such property. "(B) CERTAIN PROPERTY EXCLUDED.— For purposes of subparagraph (A), there shall be excluded any inventory property if a principal purpose for acquiring such property was to avoid the provisions of this subsection relating to inventory items.". (2) Subsection (d) of section 751 is amended to read as follows: "(d) INVENTORY ITEMS.— For purposes of this subchapter, the term 'inventory items' means— "(1) property of the partnership of the kind described in section 1221(1), "(2) any other property of the partnership which, on sale or exchange by the partnership, would be considered property other than a capital asset and other than property described in section 1231, "(3) any other property of the partnership which, if sold or exchanged by the partnership, would result in a gain taxable under subsection (a) of section 1246 (relating to gain on foreign investment company stock), and "(4) any other property held by the partnership which, if held by the selling or distributee partner, would be considered property of the t3T)e described in paragraph (1), (2), or (3).". (3) Sections 724(d)(2), 731(a)(2)(B), 731(c)(6), 732(c)(1)(A) (as amended by the preceding section), 735(a)(2), and 735(c)(1) are each amended by striking "section 751(d)(2)" and inserting " se ction 751(d)". (c) EFFECTIVE DATE. — 26 USC 724 note. (1) IN GENERAL. —The amendments made by this section shall apply to sales, exchanges, and distributions after the date of the enactment of this Act. (2) BINDING CONTRACTS. —The amendments made by this section shall not apply to any sale or exchange pursuant to a written binding contract in effect on June 8, 1997, and at all times thereafter before such sale or exchange. SEC. 1063. EXTENSION OF TIME FOR TAXING PRECONTRIBUTION GAIN. (a) IN GENERAL.—Sections 704(c)(1)(B) and 737(b)(1) are each amended by striking "5 years" and inserting "7 years". (b) EFFECTIVE DATE.— 26 USC 704 note. (1) IN GENERAL.— The amendment made by subsection (a) shall apply to property contributed to a partnership after June 8, 1997. (2) BINDING CONTRACTS. —The amendment made by subsection (a) shall not apply to any property contributed pursuant to a written binding contract in effect on June 8, 1997, and at all times thereafter before such contribution if such contract provides for the contribution of a fixed amount of property.

�