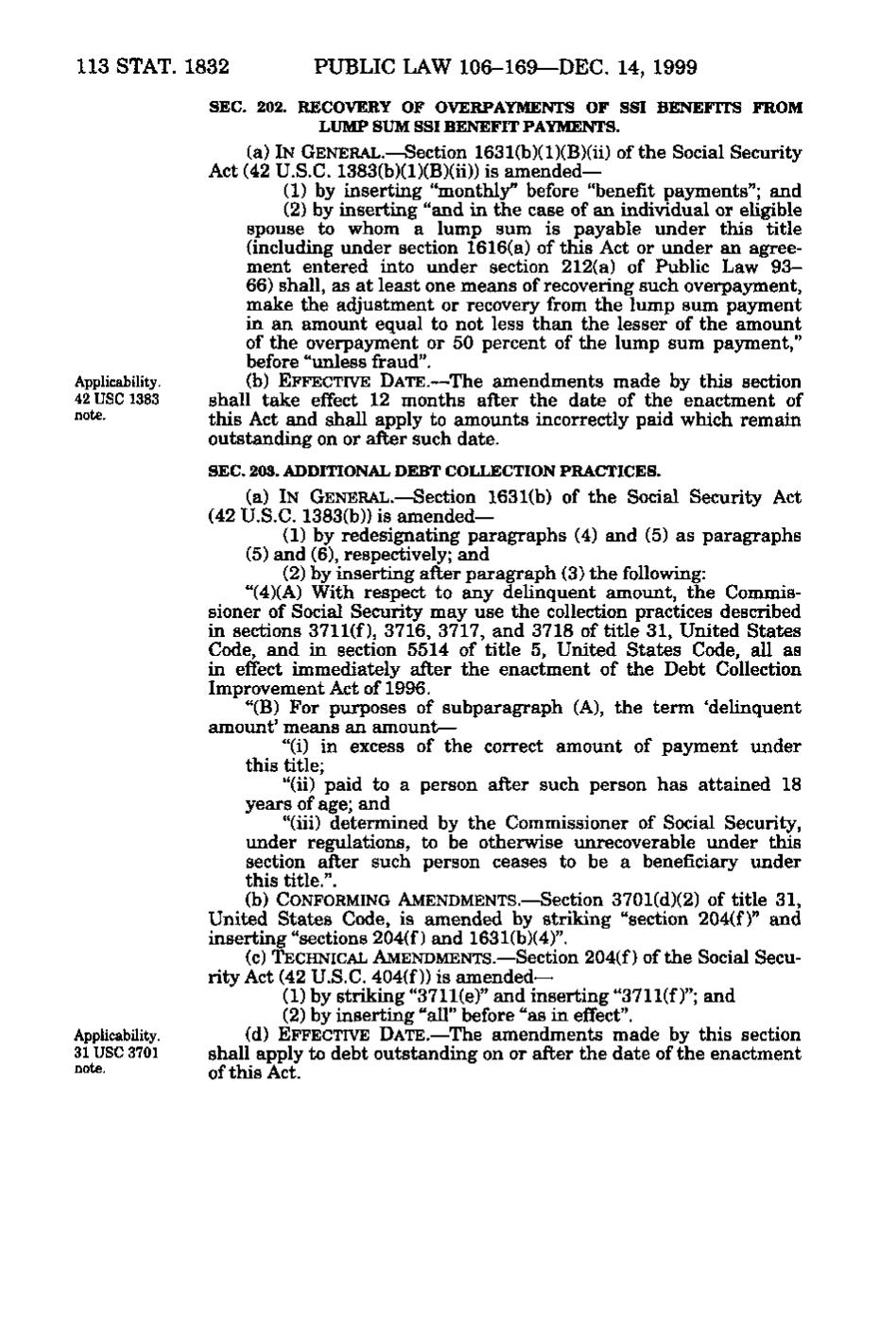

113 STAT. 1832 PUBLIC LAW 106-169—DEC. 14, 1999 Applicability. 42 USC 1383 note. SEC. 202. RECOVERY OF OVERPAYMENTS OF SSI BENEFITS FROM LUMP SUM SSI BENEFIT PAYMENTS. (a) IN GENERAL. —Section 1631(b)(l)(B)(ii) of the Social Security Act (42 U.S.C. 1383(b)(l)(B)(ii)) is amended— (1) by inserting "monthly before "benefit payments"; and (2) by inserting "and in the case of an individual or eligible spouse to whom a lump sum is payable under this title (including under section 1616(a) of this Act or under an agreement entered into under section 212(a) of Public Law 93- 66) shall, as at least one means of recovering such overpayment, make the adjustment or recovery from the lump sum pa3niient in an amount equal to not less than the lesser of the amount of the overpayment or 50 percent of the lump sum payment," before "unless fraud". (b) EFFECTIVE DATE.—The amendments made by this section shall take effect 12 months after the date of the enactment of this Act and shall apply to amounts incorrectly paid which remain outstanding on or after such date. SEC. 203. ADDITIONAL DEBT COLLECTION PRACTICES. (a) IN GENERAL.—Section 1631(b) of the Social Security Act (42 U.S.C. 1383(b)) is amended— (1) by redesignating paragraphs (4) and (5) as paragraphs (5) and (6), respectively; and (2) by inserting after paragraph (3) the following: "(4)(A) With respect to any delinquent amount, the Commissioner of Social Security may use the collection practices described in sections 3711(f), 3716, 3717, and 3718 of title 31, United States Code, and in section 5514 of title 5, United States Code, all as in effect immediately after the enactment of the Debt Collection Improvement Act of 1996. "(B) For purposes of subparagraph (A), the term 'delinquent amount' means an amount— "(i) in excess of the correct amount of payment under this title; "(ii) paid to a person after such person has attained 18 years of age; and "(iii) determined by the Commissioner of Social Security, under regulations, to be otherwise unrecoverable under this section after such person ceases to be a beneficiary under this title.". (b) CONFORMING AMENDMENTS.— Section 3701(d)(2) of title 31, United States Code, is amended by striking "section 204(f)" and inserting "sections 204(f) and 1631(b)(4)". (c) TECHNICAL AMENDMENTS.— Section 204(f) of the Social Security Act (42 U.S.C. 404(f)) is amended— (1) by striking "3711(e)" and inserting "3711(f)"; and (2) by inserting "all" before "as in effect". Applicability. (d) EFFECTIVE DATE. —The amendments made by this section 31 USC 3701 shall apply to debt outstanding on or after the date of the enactment "ote. of this Act.

�