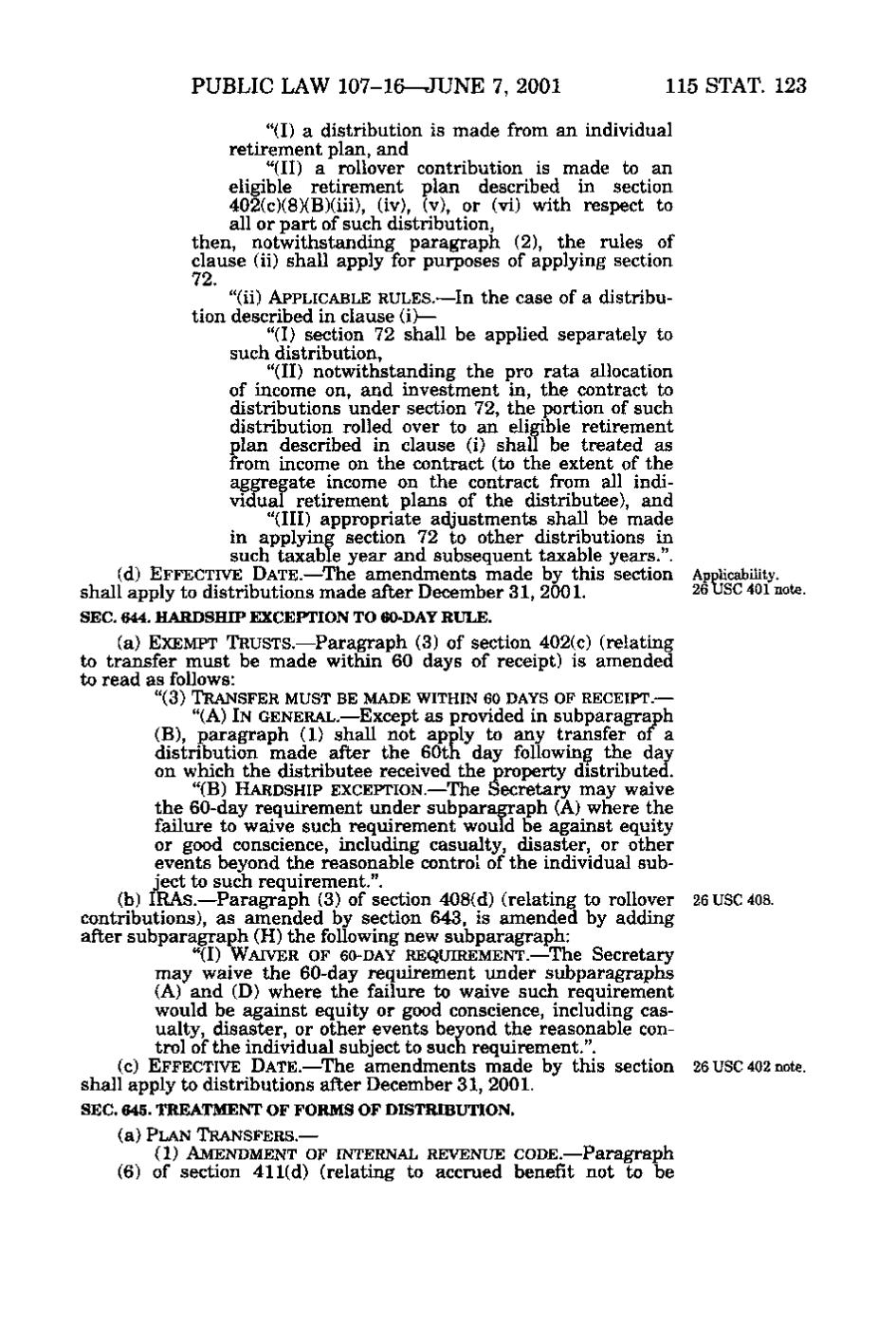

PUBLIC LAW 107-16^JUNE 7, 2001 115 STAT. 123 "(I) a distribution is made from an individual retirement plan, and "(II) a rollover contribution is made to an eligible retirement plan described in section 402(c)(8)(B)(iii), (iv), (v), or (vi) with respect to all or part of such distribution, then, notwithstanding paragraph (2), the rules of clause (ii) shall apply for purposes of applying section 72. "(ii) APPLICABLE RULES.— In the case of a distribution described in clause (i)— "(I) section 72 shall be applied separately to such distribution, "(II) notwithstanding the pro rata allocation of income on, and investment in, the contract to distributions under section 72, the portion of such distribution rolled over to an eligible retirement plan described in clause (i) shall be treated as from income on the contract (to the extent of the aggregate income on the contract from all individual retirement plans of the distributee), and "(III) appropriate adjustments shall be made in applying section 72 to other distributions in such taxable year and subsequent taxable years.", (d) EFFECTIVE DATE.—The amendments made by this section Applicability. shall apply to distributions made after December 31, 2001. 26 USC 401 note. SEC. 644. HARDSHIP EXCEPTION TO 60-DAY RULE. (a) EXEMPT TRUSTS. —Paragraph (3) of section 402(c) (relating to transfer must be made within 60 days of receipt) is amended to read as follows: " (3) TRANSFER MUST BE MADE WITHIN GO DAYS OF RECEIPT. — "(A) IN GENERAL.— Except as provided in subparagraph , (B), paragraph (1) shall not apply to any transfer of a distribution made after the 60th day following the day on which the distributee received the property distributed. "(B) HARDSHIP EXCEPTION.—The Secretary may waive the 60-day requirement under subparagraph (A) where the failure to waive such requirement would be against equity or good conscience, including casualty, disaster, or other events beyond the reasonable control of the individual subject to such requirement.". (b) IRAs. —Paragraph (3) of section 408(d) (relating to rollover 26 USC 408. contributions), as amended by section 643, is amended by adding after subparagraph (H) the following new subparagraph: " (I) WAIVER OF 60-DAY REQUIREMENT. —The Secretary may waive the 60-day requirement under subparagraphs " (A) and (D) where the failure to waive such requirement "^ would be against equity or good conscience, including cas- '• ualty, disaster, or other events beyond the reasonable control of the individual subject to such requirement.". (c) EFFECTIVE DATE. —The amendments made by this section 26 USC 402 note, shall apply to distributions after December 31, 2001. SEC. 645. TREATMENT OF FORMS OF DISTRIBUTION. (a) PLAN TRANSFERS.— (1) AMENDMENT OF INTERNAL REVENUE CODE. —Paragraph (6) of section 411(d) (relating to accrued benefit not to be

�