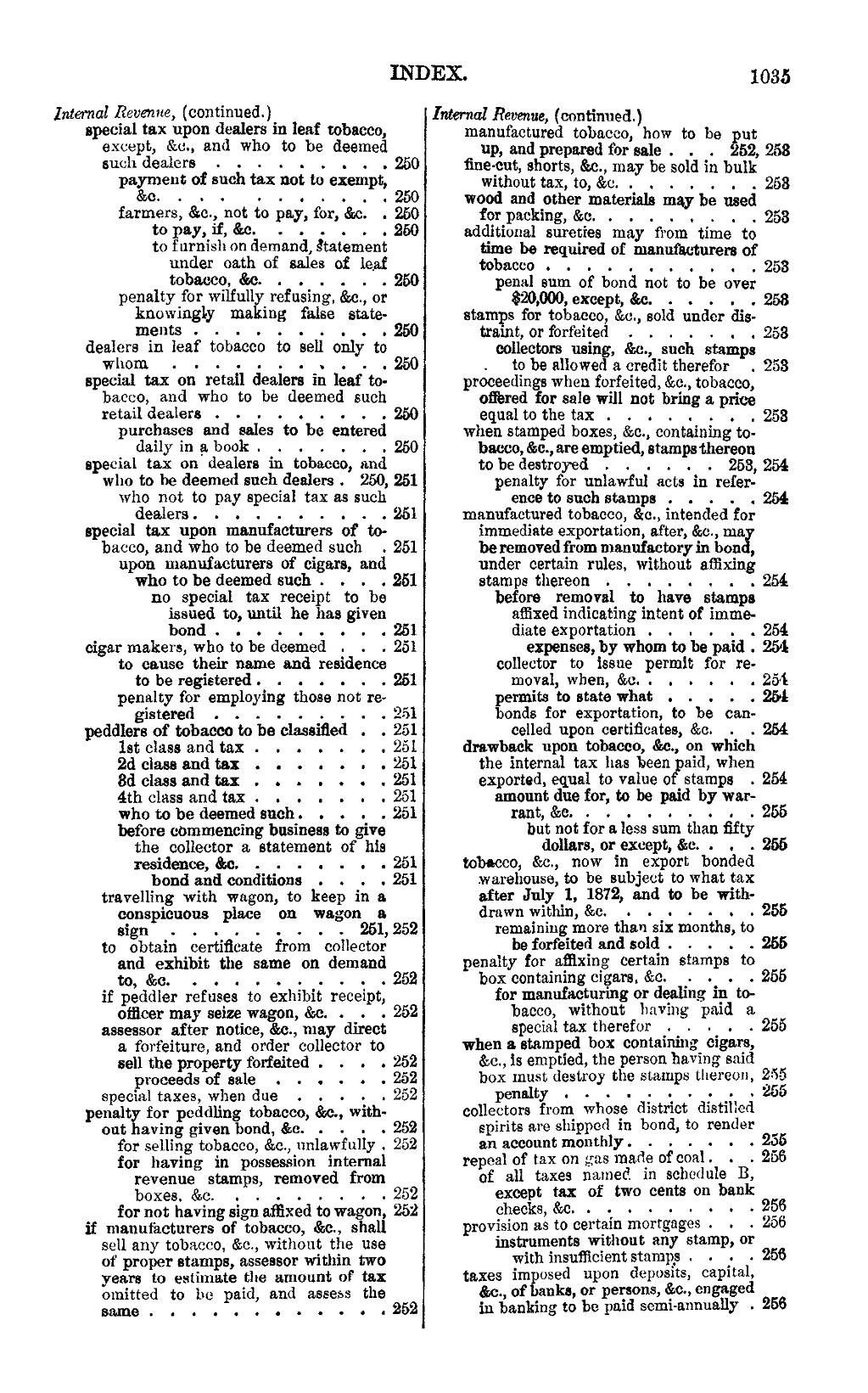

INDEX. 1035 Internal Revenue, (continued.) Internal Revenue, (continued_) special tax upon dealers in leaf tobacco, manufactured tobacco how to be put except, &c., and who to be deemed up, and prepared fmjsale . . . 252, 253 such dealers . 250 fine-cut, shorts, &c., may be sold in bulk payment of such tax not to exempt, without tax, to, &c. ... 258 &c . .. 250 wood and other materials may be used farmers, &c., not to pay, for, &c. . 250 for packing, &c. 253 to pay, if, &c. .. 260 additional sureties may from time to to furnish on demand, statement time be required of manufacturers of under oath of sales of leaf tobacco ... 253 tobacco, &c. . ._ 250 penal sum of bond not to be over penalty for w1lfully_ refusing, &c., or $20,000, except, &c .. 258 knowingly making false state- stamps for tobacco, &c., sold under disments .. 250 tmlnt, or forfeited . . . 253 dealers in leaf tobacco to sell only to collectors using, &c., such stamps whom . . . : . . . _. . . . 250 . to be allowed a credit therefor . 253 special tax on retail dealers in leaf to- proceedings when forfeited, &c.,tobacco, bacco, and who to be deemed such offered for sale will not bring a. price retail dealers . 250 equal to the tax 253 purchases and sales to be entered when stamped boxes, &c., containing todaily in a book ... 250 bacco, &c., are emptied, stampsthereon special tax on dealers in tobacco, and to be destroyed .. 253, 254 who to be deemed such dealers . 250, 251 penalty for unlawful acts in referwho not to pay special tax as such ence to such stamps . 254 _ dealers .. 251 manufactured tobacco, &c., intended for special tax upon manufacturers of to- immediate exportation, ax"ter,&c.,may bacco, and who to be deemed such . 251 be removedfrom nmnufactoryin bond, upon manufacturers of cigars, and under certain rules, without aiiixing who to be deemed such 251 stamps thereon 254 no special tax receipt to be before removal to have stamps issued to, until he has given atlixed indicating intent of immebond . 251 diate exportation .. 254 cigar makers, who to be deemed . . . 251 expenses, by whom to be paid . 254 to cause their name and residence collector to issue permit for reto be registered ... 251 moval, when, &c. .. 254 penalty for employing those not re- permits to state what . 254 gistered . 251 bonds for exportation, to be canpeddlers of tobacco to be classified . . 251 celled upon certificates, &c. . . 264 1st class and tax ... 25l drawback upon tobacco, &c., on which 2d class and tax ... 251 the internal tax has been {paid, when 8d class and tax . . . 251 exported, equal to value 0 stamps . 254 4th class and tax ... 251 amount due for, to be paid by warwho to be deemed such . 251 rant, &c. . 255 before commencing business to give but not for s. less sum than fifty the collector a, statement of his dollars, or except, &c. . . . 255 residence, &c 251 tobacco, &c., now in export bonded bond and conditions 251 warehouse, to be subject to what tax travelling with wagon, to keep in v. after July 1, 1872, and to be witheonspicuous place on wagon a. drawn within, &c .. . . 255 sign . 251, 252 remaining more than six months, to to obtain certificate from collector be forfeited and sold . 255 and exhibit the same on demand penalty for anlxing certain stamps to to, &c. .. 252 box containing cigars, &c. 255 if peddler refuses to exhibit receipt, for manufacturing or dealing in toofiicer may seize wagon, &c. . . . 252 bacco, without having pmd a assessor after notice, &c., may direct special tax therefor _. _ . .. . . 255 a forfeiture, and order collector to when :1. stamped box containing_ cigars, sell the property forfeited 252 &c., is emptied, the person having said proceeds of sale . . . . . . 252 box must destroy the stamps thereon, 255 special taxes, when due . 252 penalty I 2 . : ·.` . 255 penalty for peddling tobacco, &c., with- collectors from whose district distilled out having given bond, &c. 252 spirits are shipped in bond, to render _ for selling tobacco, &c., unlawfully . 252 an account monthly ... 255 for having in possession intemal repeal of tax on gas made of coal . . . 206 revenue stamps, removed from of all taxes named in schedule B, boxes. &c. 252 except mx of two cents on bank for not having sign aflixed to wagon, 252 checks, &c. . t ... if manufacturers of tobacco, &c., shall provision as to certam mortgages . . . Zoo sell any tobacco, &c., without the use instruments without any stamp, or of proper stamps, assessor within two with msufficient stamps . . _. . 256 years to estimate the amount of tax taxes imposed upon deposits, capital, omitted to be paid, and assess the &c., of banks, or persons, Qc., engaged some .. . . . . . . 252 in banking to be paid semi-annually . 256

Page:United States Statutes at Large Volume 17.djvu/1075

This page needs to be proofread.