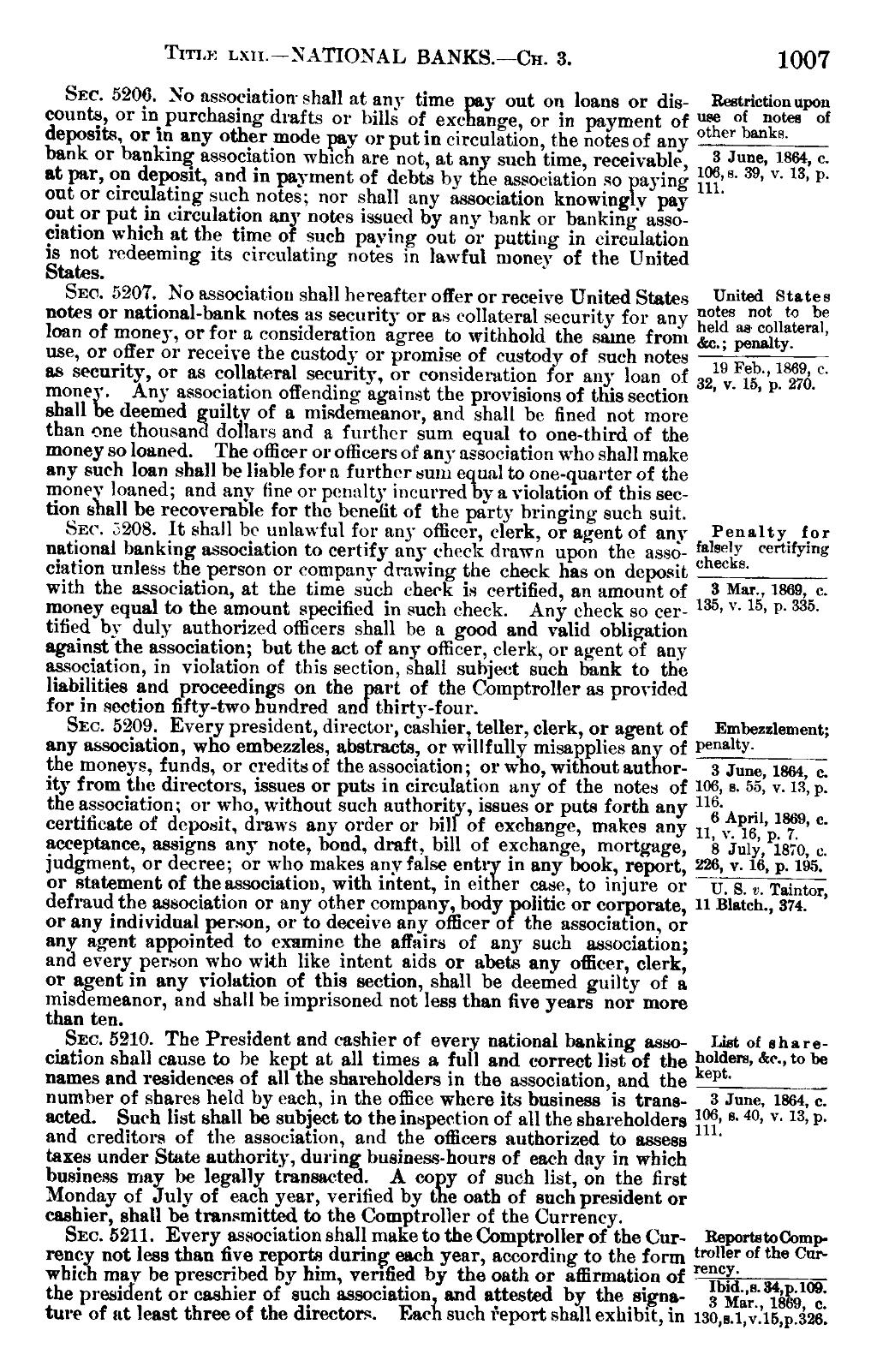

Trru: Lxrr.—NATI()NAL BANKS.~—Ch. 3. 1007 Sec. 5200. No association- shall at any time y out on loans or dis- R»¤¤¤‘i¢¤i¤¤¤P¤¤ counts, or 1D purchasing drafts or bills of exchange, or in payment of ““‘° °f “°”°” °f deposits, or in any other mode pay or put in circulation, the notes of any £_ bank or banking association which are not, at an i such time, receivable, 3 ·l“”°· 186*% °· at par, on deposit, and in payment of debts by the association so aying H32S` 39’ V' 13’ p` out or circulating such notes; nor shall any association knowingly pay I optor put in circulation notes issued by any bank or banking association which at the time o such paying out or putting in circulation gsuptpt redeeming its circulating notes in lawful money of the United s. Sec. 5207. No association shall hereafter offer or receive United States U¤i*·¤d $***0** notes or national-bank notes as security or as collateral security for any EO}? l'°t,,t‘,’B if loan of money, or for a consideration agree to withhold the same from &2_. gniflt; m’ use, or offer or receive the custody or promise of custody of such notes my as security, or as collateral security, or consideration for any loan of 321li,Fi°g°‘,,18_g?6 °` money; Any association offending against the provisions of this section` ’` shall deemed guilty of a misdemeanor, and shall be fined not more than one thousan dollars and a further sum equal to one~third of the money so loaned. The officer or officers of any association who shall make any such loan shall be liable for a further sum e ual to one-quarter of the moncv loaned; and any fine or penalty incurredlliy a violation of this section shall be recoverable for the benefit of the party bringing such suit. Sec. 5208. It shall be unlawful for any officer, clerk, or agent of any Penalty_ f_¢>r national banking association to certify any check drawn upon the asso- {‘g”"l{Y ""’“fY‘“g ciation unless the person or company drawing the check has on deposit ELA__ with the association, at the time such check is certified, an amount of 5 MM-.1869. ¢· money equal to the amount specified in such check. Any check so cer- 135* "‘ 15· V 335 tified by duly authorized officers shall be a good and valid obligation against the association; but the act of any officer, clerk, or agent of any association, in violation of this section, shall subject such bank to the liabilities and proceedings on the rt of the Comptroller as provided for in section fifty-two hundred andlthirty-four. Sec. 5209. Every president, director, cashier, teller, clerk, or agent of Embczzlement; any association, who embezzles, abstracts, or willfully misapplies an of P°“’·l*Y- the moneys, funds, or credits of the association; or who, without author- 3 June, 1864, c, ity from the directors, issues or puts in circulation any of the notes of 10Q. ¤· 55. v- 13. p. the association; or who, without such authorit r, issues or puts forth any 11g-A .1 1869 certificate of deposit, draws any order or bill) of exchange, makes any U v_};? ’P_ 7_ ’°‘ acceptance, assigns any note, bond, draft, bill of exchange, mortgage, s July, mc, C, judgment, or decree; or who makes any false entry in any book, report, 226, v. 16, p. 195. or statement of the association, with intent, in eit er case, to injure or U_ g_ ,,_ T,m,tO,., defraud the association or any other company, body politic or corporate, 11 Blatch., 374. or any individual person, or to deceive any officer o the association, or any agent appointed to examine the affairs of any such association; and every person who with like intent aids or abets any officer, clerk, or agent in any violation of this section, shall be deemed guilty of a mlfdemeanor, and shall be imprisoned not less than five years nor more t n ten. Sec. 5210. The President and cashier of every national banking asso- List of shareciation shall cause to be kept at all times a full and correct list of the £*°ld°'*’» &°-·*° be names and residences of all the shareholders in the association, and the L. number of shares held by each, in the office where its business is trans- 3 June, 1864, c. acted. Such list shall be subject to the inspection of all the shareholders {lf? “· 4°» V· 13, P- and creditors of the association, and the officers authorized to assess ` taxes under State authority, during business-hours of each dny in which business may be legally transacted. A coply of such list, on the first Monday of July of each year, verified by the oath of such president or cashier, shall be transmitted to the Comptroller of the Currency. Sec. 5211. Every association shall make to the Comptroller of the Cnr- Reportstofbmprenc not less than five reports during each year, according to the form *'°ll°*` °f *h° C'"` which may be prescribed by him, verified by the oath or affirmation of r%,%,>—§ the president or cashier of such association and attested by the signa- 3 M;:', lggg, ci ture of at least three of the directors. Each such feport shall exhibit, in 130,¤.1,v.15,p.:i26.

Page:United States Statutes at Large Volume 18 Part 1.djvu/1079

This page needs to be proofread.