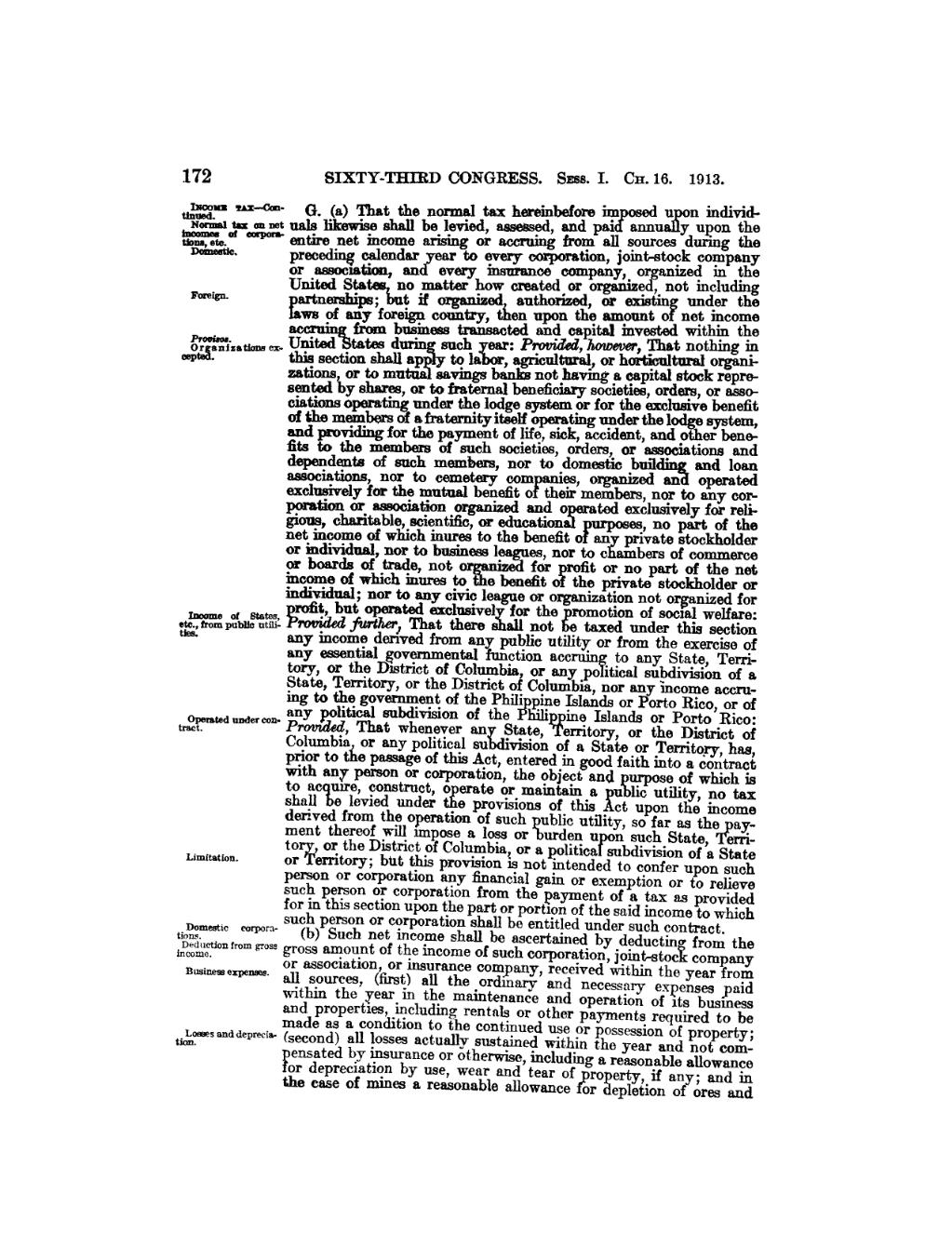

172 SIXTY-THIRD CONGRESS. Sess. I. Ch. 16. 1913. I¤°¤¤ ‘¤¤··°°¤· G. a That the normal tax hereinbefore u n individmicugiisi tz must uals shall be_ levied, assessed, and pai annually) upon gile E’T’.;'f"§'w,°' °°"’°”' entire net mcome arxsing or accruing from all_ sources during e D°¤¤¤¤¤- preceding calendar ear to every corporation, jomt-stock company or association, andy every insurance company,_ oiégamzed m the United States no matter how created or organize , not mcludmg Fmism artneiships; but if organized authorized, or existing under the laws of any foreign coimtry, then upon the amount o net income accrum%' from business transacted and capital mvested within the $3*;*;;-,m,m ,,,_ tates d suck; {xr: Prpzwlied, hmvefler, That nothing in wp - section a to a agnc , or organizations, or to m vings bzinks not having a capital stock represented by shares, or tlc beneficiary iocieges, orpers, olrcassgg ciationso ·` un er e esystemor or eexcusive ne of the m afraternity itself operating under the lodge system, and for bétllis pfaymelnt of life, sickidaccident, and pttlier benei its to e mem suc societies, o ers, or associa ions an dependents of such members, nor to domestic building and loan associations, nor to cemetery companies, organized an operated exclusively for the mutual benegp o ltiheir met1;1dbers,1nor tp xyny co; porationor association orgamz an_ opera excusivey orre 'ous charitable scientific or education es, no art of the gist iricome of which inures to the benefit oi an private Stockholder or individual, nor to business leagues, nor to cliiunbers of commerce or board; ogltrgde, not éior proltit or nompaatcg also net income w`c inuresto e tote riva s oeror individual; nor to any civic league or organizgision not organized for roiit, but operated exclusive} for the romotion of social welfare: •wI:°ri·:£ piiiiugtiixi further, That there shall not ge taxed under this section M- any income derived from any public utility or from the exercise of any e&e1g.1ialDgovernm§>n(§»al fupction accruing toalanybgpate, Teiérito or e istrict o oum ia, or an offic su `vision o a Stlaize, Territory, or the District of Columybiii, nor any income accruing to tlhecgpvwent of tl;e li’1hiIi>ph;$1e Islanlgi oiés Portci) Rico, lpr of an 'ti su 'vision o the ' ine an or orto ico: t,,,.,°¥T"""° “"°°'°°°` Prgvwldoed, That whenever anydptate, BFerritory, or the District of Columbia or any political su `vision of a State or Territory, has, prior to the passage of this Act, entered in good faith into a contract with any person or corporation, the object and psupose of which is to acluire, construct, pperate or_maintaiu a pu lic utility, no tax shall e levied under e provisions of this ct upon the income derived from the operation of such public utility, so far as the ay- ment thereof will impose a loss or xburden u n such State, Tpexritory, or the District of Columbia, or a politicalpgubdivision of a State Limimmn. or erritory; but provision is not intended to confer upon such person or corporation any Enancial gain or exemption or to relieve such person or corporation from the payment of a tax as provided for LD this section upontthe pgrtuog portiop pif the said ixécome to which _ suc erson or corpora ion s a e entitle un er suc contract. ,,§§,‘?}"°“"° °°'*""“‘ (b)PSuch not income shall be ascertained by deductin from the ,I1?cgg}g;=i¤¤ fr¤¤¤ sms gross aniopnt of the income of such corporatipéi, joint-stoci company _ or associa 1on, or insurance com an receiv within the r rom B""“°”°“’°“"”°‘ alltbsiiilnngiles, (first) sill} the o;d1iia.rg};, ang necessary expehggs Tpaid wi e ear ni e main enance an o eration of its busmess and properties, including rentals or other pgyments required to be made as a condition to the continued use or possession of property; tmimsmddarmir (second) all losses actually sustained within the year and not compensated by insurance or othermsc, mcluding a reasonable allowance or depreciation by use, wear and tear of ro erty, if any; and in the case of mmes a reasonable allowance fiir gepletion of ores and

Page:United States Statutes at Large Volume 38 Part 1.djvu/191

This page needs to be proofread.