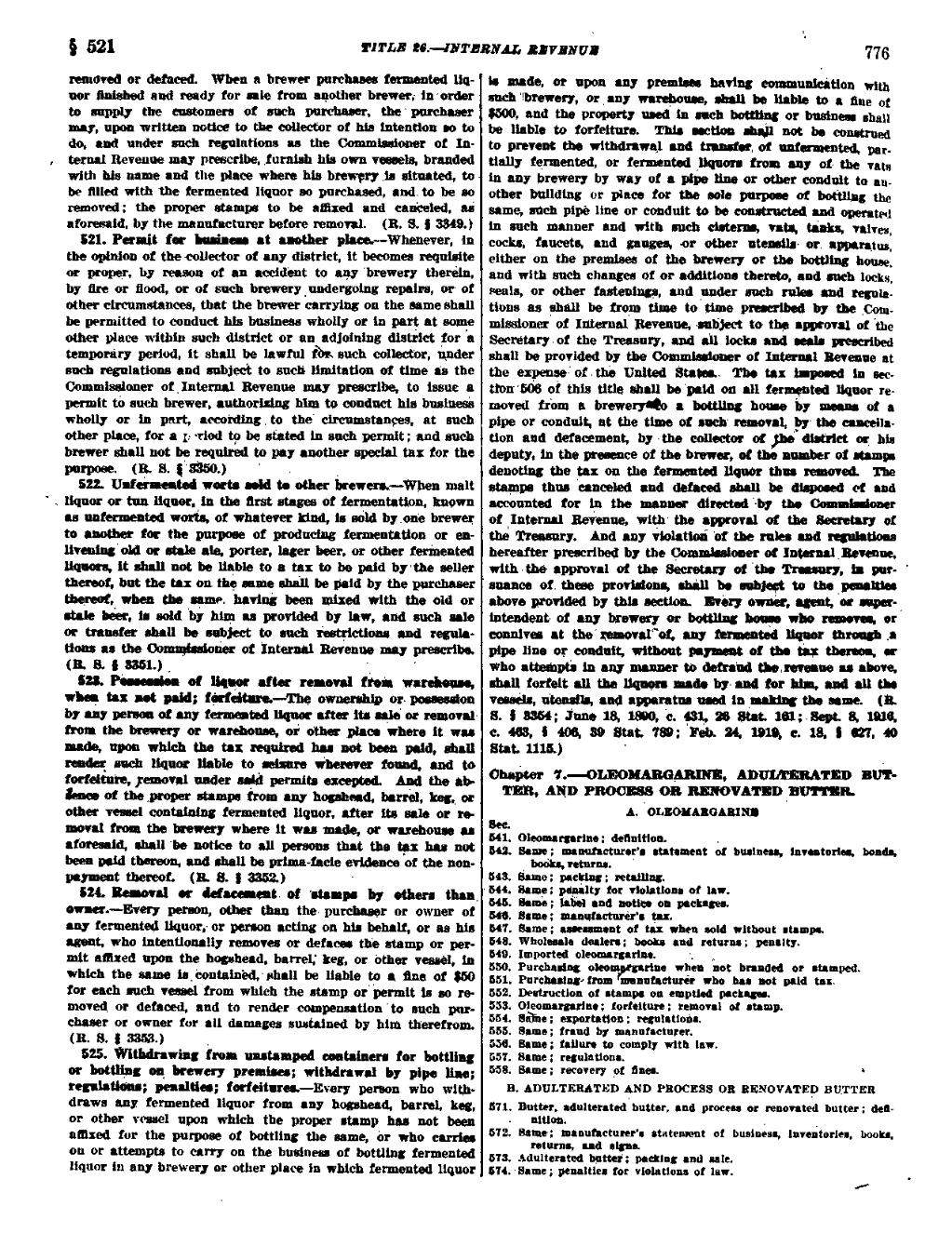

§ 521 Y rzno ze.-mm removed or defaeed. when a brewer pnrchoem fermented liqnor finished and rmdy for sale from another brewer; in order to enpply the customers of ouch purchaser, the " purchaser may, upon written to of his intention so to do, and under such regulations no the G@mi&ioner of In- ., ternal Revenue may preeerlbe.·.furnish his own vweels; branded with his name and the place where his brewery ja situated, to he mlecl with (the fermented liquor so purchased, and, to be eo removed; the proper stamps to be eared and canoelod. he aforesaid, hy the manufacturer before removal. (R. S; 5 3349.) S21. Pumit for hoaiuus at another place.·——Whenever, in tm opinion of theeoliector of district, it becomes requisite or by reason of an accident to any fbrewery therein, by nre or Hmd, or of such brewery hndergolng repairs, or- of other circnmetancw, that the brewer carrying on the same shall he permitted to conduct his business wholly or in part at some other place within such district or an adjoining district for a temporery period, it shall be lawful ‘@ such collector, under such regulations and subject to such limitation ot. time do the Commissioner of __lntem•.l Revenue may prescribe, to issue e permit to such brewer, authorizing him to conduct- his buslueso wholly or in port, aoeording to the circumstances, at such other place, for a 1:T!'i0d to be stated in such permit; and snch brewer shall not required to my another special tax · for the perm (1¥~S-@6-) _·Y "_ _ 522. Unfermented wort: sold to other brcjwen.+When xnalt ‘ liquor or tan liqner, in the nrst. of fermentation, known as nnfermenred worta, of whatever kind, — is sold by one brewer to another for the purpose of producing fermentation -0r enllvwingold or stnleoale, porter, lager beer, or other fermented Boom it ahall not°·be. lieble to a tax ho be by the seller thereof, but the tax on the mme shell be paid by purchaser · thereof, wha the aasneg having been mixed with the old or etale beer, is wld by him aa provided by lnw," and such, sale or tranaiwc shall; be subject to snob _ restrictions and regulations as the Gom oner. of Internal Revenue may prescribe » .523. of after remonlcwfroin warehouu, when tax not ‘ paid; forfétue.-·-The . ownership or. pos@lon by any person of any ferwted liquor after? ite sale or- removal from the brewery or warehouse, or otbx place where lt was mdenponwmchtmtaxrcquhedhunotbeenpaid, mall rmdq sow liquor eliableto ctw riherever found, and to forfeibnre, rmoval nnder permits exceptm. the eblma of the proper stamps from any hwshend, barrel, keg, or other veml containing fermented liquor, after its sale or removal from the brewmy where it was made, or warehoum as afommld, shell be notice to all persons that the tex has not been paid tmreon, and shall be primwfacie evidence of the nonmymmt thereof. (R. 8. I 3352.) " — 1 _ __ 524. w e val u defawent. of stamps by others than o1ner.·——-Every person, than the- purchaser or owner of any fermentx liquor; or person acting on his behalf, or als his agwt, who intentionally removes or defecen the stamp or permit e&xcd npon the howhmd, barrel; keg, or other vessel, in whichthe same ln_conto,ln€d.‘ shall be liable to a hue., of $50 for each ouch vmeel from which the stamp or permit is eo removed or defaeed, end, to render compensation `to ouch purchaser or owner for all damages sustained by him therefrom. (B.S;·§3353.) · ,_ ‘ 525. Wiihdfliting from nnstamped containers for bottling or bottling m, brewery premises; withdrawal by pipe line } e regulations; penalhoa; forfeitnru.———··E$·ery person who withdraws any fermented liquor from any hoghead, barrel, keg, or other vmel upon o which the proper stamp has not been nmxed for the www of bottling the name, or who carries on or attempts to entry on the business of bottling fermented liquor in any brewery or other place ln which _ ferinented liquor

mzvu. zaymvvs 776 is made; for upon my pmm having cwunicdtion with such Wbrvewery, or _ any wamkouse, be fiam to a ¤né of $500, and the property used in such bcttmzg or businw shan be liable — to forfeiture. ‘ This iection thai}- RM be cohxmm -1:0 przvcnt the withdrnwql and tnustm at pm-- tially fermented, or termntod {wm any Gi- the mtg ~ in my fm-ewery by way ot a mm line or other cenduit. tu xmother bhilding 01* place for the Ami; ptu' of botiling the _ lsam¢=z,.¤uch_pipé like or conduit to be and operated in guch maxmér and with such ciztgrm, vnu, tdnka, valves, cocks, fahcets, and gauges, pr other wtémils (if, awtmtus, either qu `the premism of theibmewcry or the bmling home, and with such changes of or ddditicus thereto, and such locks, seals, or other fastening; and Wunder such rules md: reguxations as phall be irqrm time to time prescribed by the _Com· » .missicner of Internal Revenue, -ml$$ect to tm spawn; at 'thé ·Secmtary..b£ the Trxsury; and nil locks? and mls mscribed shall be provided by the Com M of Revémze at the expense-`afsthb United Sta$.. tpx imwsed in sectmu’506 qt this title gba!} be `paidpu nil fumgmted liquor rcmoved ” Irbm a` brewcrylc n bottling ‘ house by mam at a

pipe o1·‘-ccnduigat the time of smh remorsl, tbg cancellation and Lglcfacemcmt, by the collector ctjba mtrict mj his

_ deputy; in the pr&cc of the brewer, at tm number of stamps denoting the gx on {ha 1ermted"liq¤¢1·°thm removed. The stamps thus ‘ canceled and détuced shalt cmp& ci um accounted for lin the manner directed -’-by “ the Cmmiwmr of \Int¢§¤g1 _ Revenue, .wi§h· the approval ct the Secmmry oi the Trwshry. And any vtopticé ‘cf·the mb; and reguhdens ' hereafter prescribed by thq `Gommmwner at Iutuial Revenue, , witlrthe approval ct the-Secretary of the Tn•mry, in pur? suanco ot; these provision; quill be gubjegt to the m•1¤as abéva provided by this section. aww, ngwt, at mpay intendent- of my hxewery. cr bottling kms who zmenn, as °¢0I1DiV&_ gt `thd tcmovsl“ot, any it@ted th a

pipe Hub or conduit, without psyw; ct the tax tmvm, mj

who atmmph im any muzmr to defraud m, mawnué ¤_ shove, l Bhqll {qrfeit dll the liqwtn made by? and tar nil the vassélb, uteagils, ang! apparamq new in makin the am. (H. -;8. S 3354; June 18, 1&0, (2. $31, 26 Stat. 1®.;.S@t. 8, 1218; ·c. 463; { Stat. 7%; Feb. 24, 1918, c. 18, I Q7, 40 ,8t§t. 1115.)

.-·0LEOMABG4RINE,· ADUI4‘lE%A’l‘ED BUT-

TER, AND PROO® OR RENOVATED _BUTR.»· ' A,. OLEOHARGARIIQI Sec. é ; " 541. Oleomnrgnrims; dehnition. . . = { _ 542. Same; niamxtixcturorfa statement at business, inveniarlen, bonds. ‘ i l'Qt\ll'R8._ y ` 543. Same; pac§i¤g; retailing. . · 544. Samp: pezpalty for violations of luv. · 545. Same; {alibi um notice on packages. 548.. Same; ‘ma m;tacturér’• _ _ — 547. Same; aslcmmant of tax when sold without stamps. ·548. Wholesala dealers; backs and returns; penalty. 6 549. Importedoleomsrgarine. __ _ 550. Pmjchanins. oleqmrptzariua when not branded cr ntnmpcd. 551. P,ur¢ha•i:i;»trom smnutgcturér who `hu not paid tax. 552. Deutmction of stamps on emptiw packages. 5553. Oleoma.rg9.rine;· forfeiture; rgmovnl of stamp. 554. S¤Tzi;e;-exportavmn; regulations. ‘ sas.-sme; fraud by manufacturer. ' 556. Same; {allure tc comply with lawl 557. Same ; m|u1ati0¤s. 558. $ame; recovery pt Sues. · ·· B. ADULTERATED AND PROC$SS OR RENGVATEQ BUTTER 51*1. Butter, sdulterated buttar,‘ and proceés or renovated butter; de§— , ·. ultima. . _ ‘ 572. Same; mn¤ufnctmeer’s statement ct business, inventories, books, returns, and guns. - ‘ · 573. Adultented buttefy packing and sale. 674. Bama; penalties for yiolations of law. _