1668 26 USC 7121. 26 USC 7122.

PUBLIC LAW 86-866-8EPT. 2, 1968

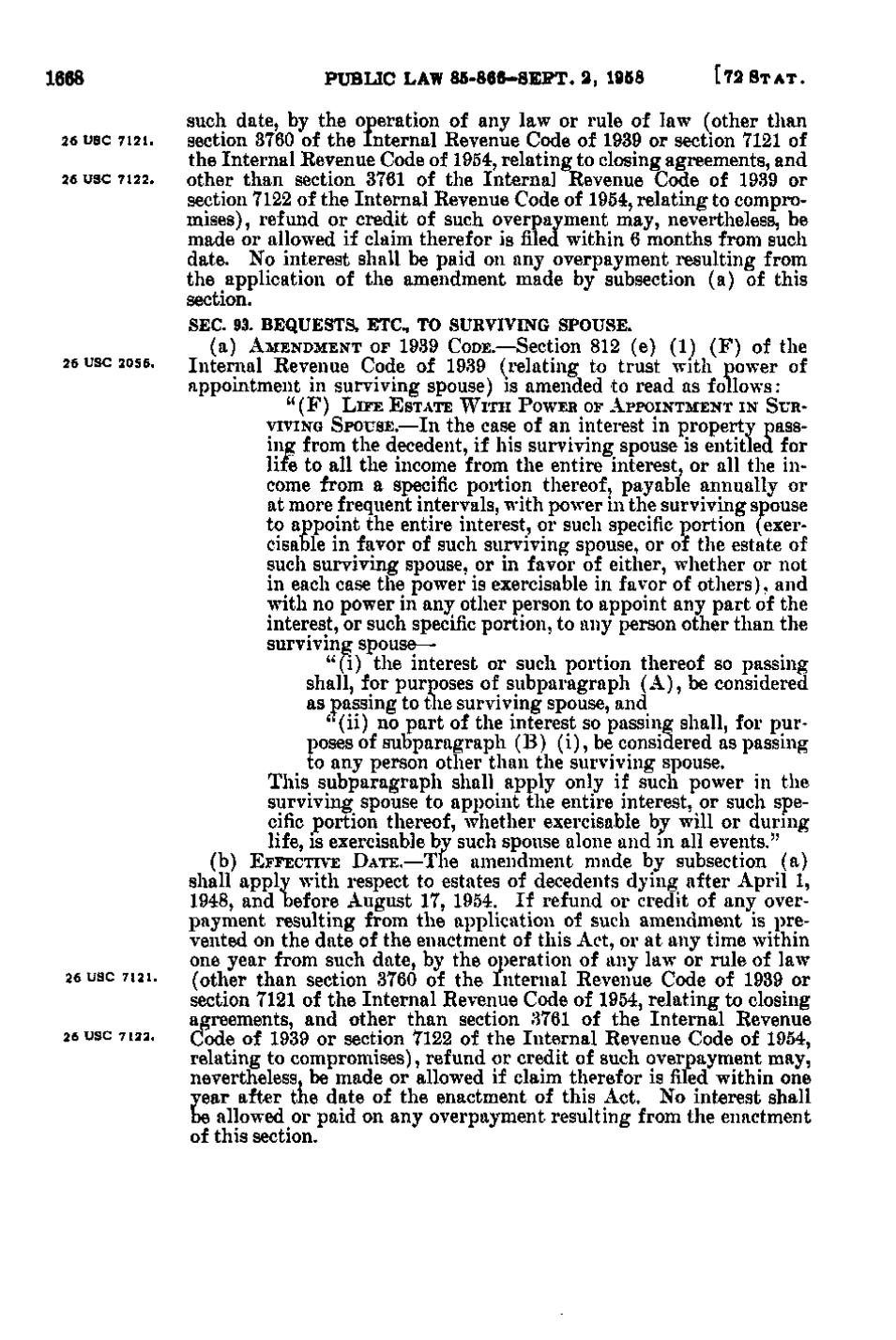

such date, by the operation of any law or rule of law (other than section 3760 of the Internal Revenue Code of 1939 or section 7121 of the Internal Revenue Code of 1954, relating to closing agreements, and other than section 3761 of the Interna] Revenue Code of 1939 or section 7122 of the Internal Revenue Code of 1954, relating to compromises), refund or credit of such overpayment may, nevertheless, be made or allowed if claim therefor is filed within 6 months from such date. No interest shall be paid on any overpayment resulting from the application of the amendment made by subsection (a) of this section. SEC. 93. BEQUESTS, ETC., TO SURVIVING SPOUSE. (a)

26 USC 2056.

[72 S T A T.

AMENDMENT OF 1939 CODE.—Section 812(e)

(1)

(F)

of

the

Internal Revenue Code of 1939 (relating to trust with power of appointment in surviving spouse) is amended to read as follows: " (F) L I F E ESTATE W I T H POWER or APPOINTMENT I N SURVIVING SPOUSE.—In the case of an interest in property pass-

26 USC 7121. 26 USC 7122.

ing from the decedent, if his surviving spouse is entitled for life to all the income from the entire interest, or all the income from a specific portion thereof, payable annually or at more frequent intervals, with power in the surviving spouse to appoint the entire interest, or such specific portion (exercisable in favor of such surviving spouse, or of the estate of such surviving spouse, or in favor of either, whether or not in each case the power is exercisable in favor of others), and with no power in any other person to appoint any part of the interest, or such specific portion, to any person other than the surviving spouse— "(i) the interest or such portion thereof so passing shall, for purposes of subparagraph (A), be considered as passing to the surviving spouse, and "(ii) no part of the interest so passing shall, for purposes of subparagraph (B)(i), be considered as passing to any person other than the surviving spouse. This subparagraph shall apply only if such power in the surviving spouse to appoint the entire interest, or such specific portion thereof, whether exercisable by will or during life, is exercisable by such spouse alone and in all events." (b) EFFECTIVE DATE.—The amendment made by subsection (a) shall apply with respect to estates of decedents dying after April 1, 1948, and before August 17, 1954. If refund or credit of any overpayment resulting from the application of such amendment is prevented on the date of the enactment of this Act, or at any time within one year from such date, by the operation of any law or rule of law (other than section 3760 of the Internal Revenue Code of 1939 or section 7121 of the Internal Revenue Code of 1954, relating to closing agreements, and other than section 3761 of the Internal Revenue Code of 1939 or section 7122 of the Internal Revenue Code of 1954, relating to compromises), refund or credit of such overpayment may, nevertheless, be made or allowed if claim therefor is filed within one year after the date of the enactment of this Act. No interest shall be allowed or paid on any overpayment resulting from the enactment of this section.

�