208

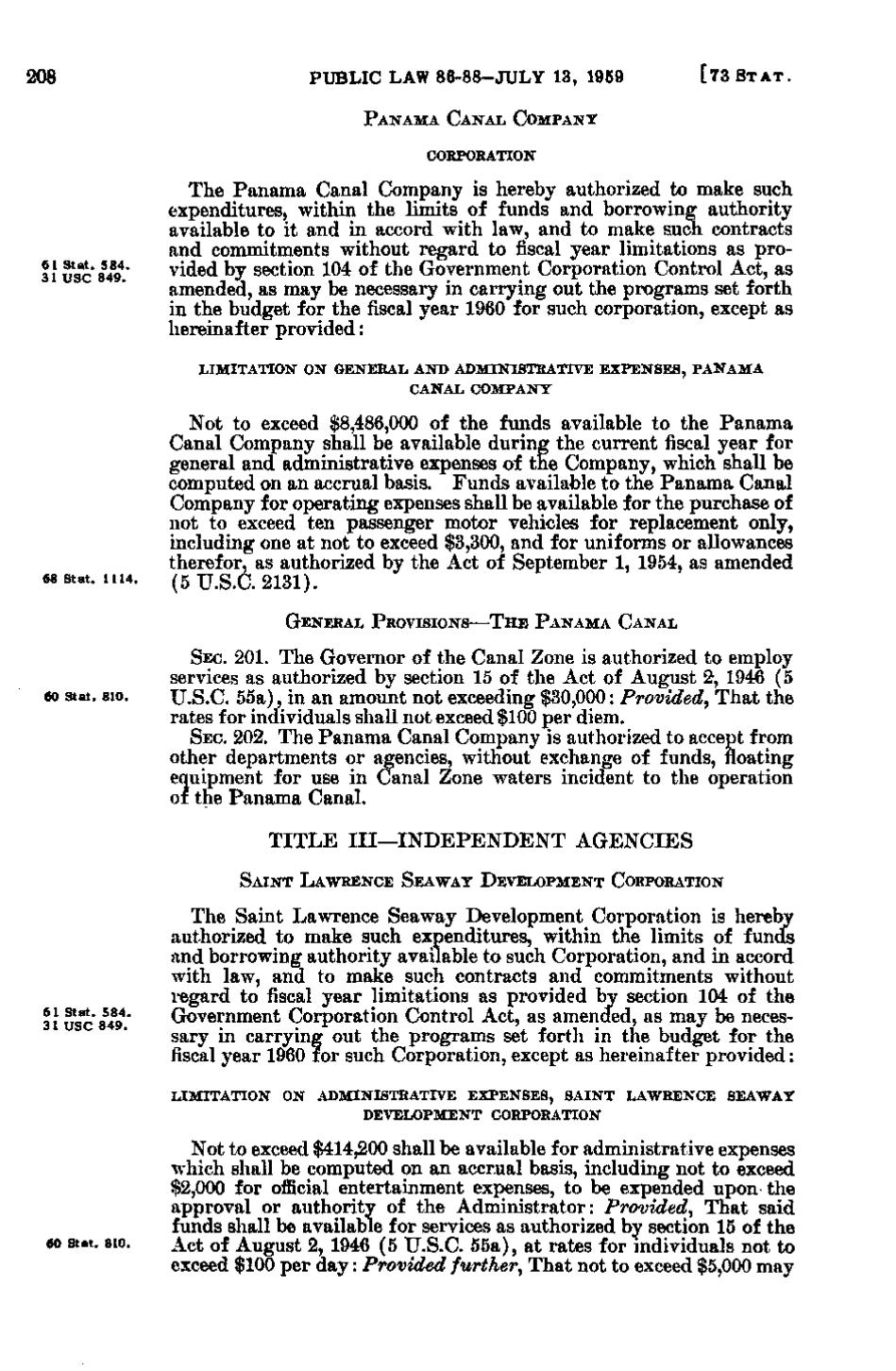

PUBLIC LAW 86-88-JULY 13, 1959

[73 S T A T.

PANAMA CANAL COMPANY CORPORATION

31 u^c* 8«*.*

The Panama Canal Company is hereby authorized to make such expenditures, within the limits of funds and borrowing authority available to it and in accord with law, and to make such contracts and commitments without regard to fiscal year limitations as provided by section 104 of the Government Corporation Control Act, as amended, as may be necessary in carrying out the programs set forth in the budget for the fiscal year 1960 for such corporation, except as hereinafter provided: LIMITATION ON GENERAL AND ADMINISTRATIVE EXPENSES, PANAMA CANAL COMPANY

68 Stat. 1114.

Not to exceed $8,486,000 of the funds available to the Panama Canal Company shall be available during the current fiscal year for general and administrative expenses of the Company, which shall be computed on an accrual basis. Funds available to the Panama Canal Company for operating expenses shall be available for the purchase of not to exceed ten passenger motor vehicles for replacement only, including one at not to exceed $3,300, and for uniforms or allowances therefor, as authorized by the Act of September 1, 1954, as amended (5 U.S.C. 2131). GENERAL PROVISIONS—THE PANAMA CANAL

60 Stat. 810.

SEC. 201. The Governor of the Canal Zone is authorized to employ services as authorized by section 15 of the Act of August 2, 1946 (5 U.S.C. 55a), in an amount not exceeding $30,000: Provided, That the rates for individuals shall not exceed $100 per diem. SEC. 202. The Panama Canal Company is authorized to accept from other departments or agencies, without exchange of funds, floating equipment for use in Canal Zone waters incident to the operation of the Panama Canal. TITLE III—INDEPENDENT AGENCIES SAINT LAWRENCE SEAWAY DEVELOPMENT CORPORATION

31 us^c 8^V'

The Saint Lawrence Seaway Development Corporation is hereby authorized to make such expenditures, within the limits of funds and borrowing authority available to such Corporation, and in accord with law, and to make such contracts and commitments without regard to fiscal year limitations as provided by section 104 of the Government Corporation Control Act, as amended, as may be necessary in carrying out the programs set forth in the budget for the fiscal year 1960 for such Corporation, except as hereinafter provided: LIMITATION

ON

ADMINISTRATIVE

EXPENSES,

SAINT

LAWRENCE

SEAWAY

DEVELOPMENT CORPORATION

60 Stat. 810.

Not to exceed $414,200 shall be available for administrative expenses which shall be computed on an accrual basis, including not to exceed $2,000 for official entertainment expenses, to be expended upon the approval or authority of the Administrator: Provided, That said funds shall be available for services as authorized by section 15 of the Act of August 2, 1946 (5 U.S.C. 55a), at rates for individuals not to exceed $100 per d a y: Provided further, That not to exceed $5,000 may

�