73 S T A T. ]

555

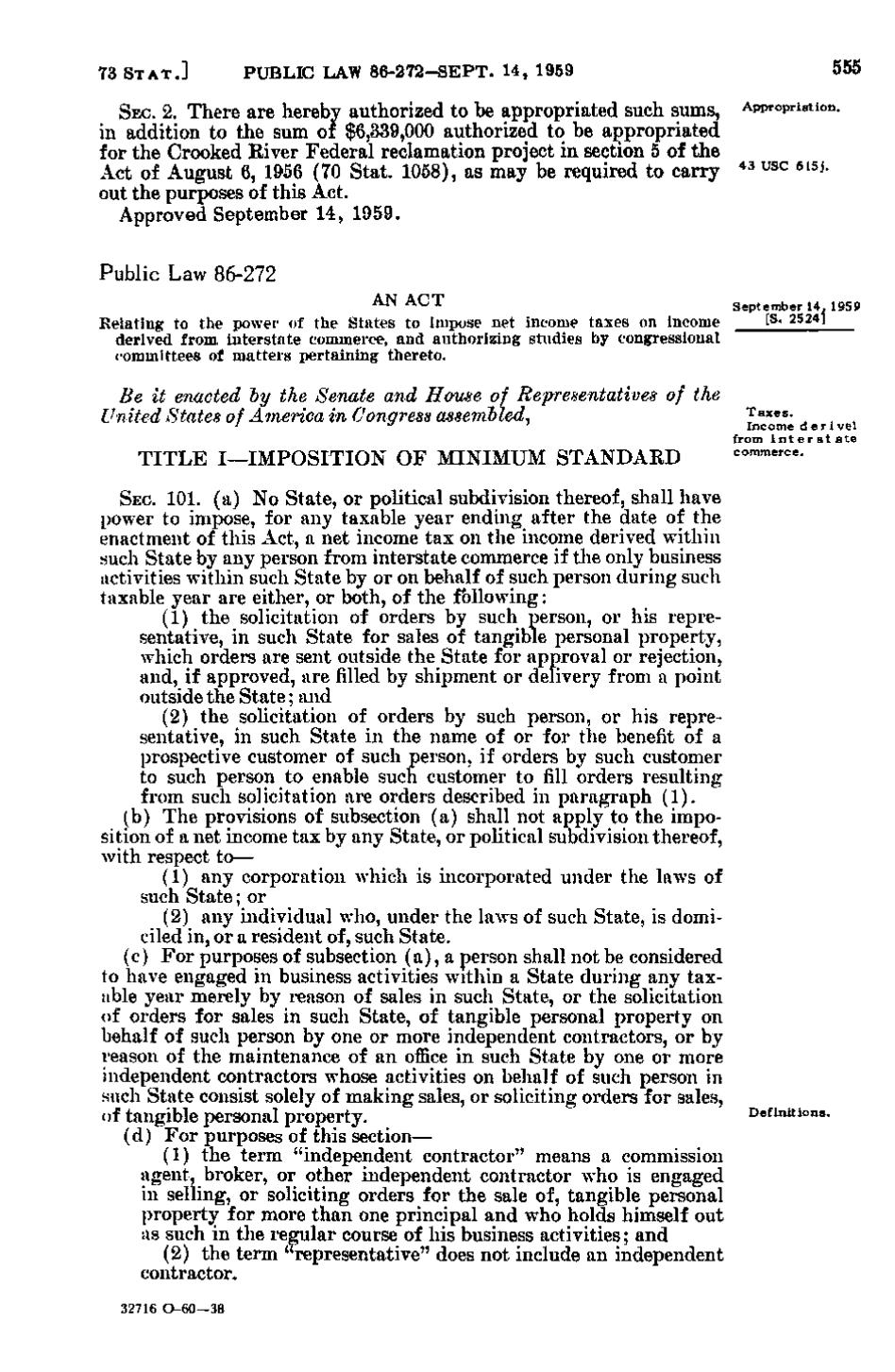

PUBLIC LAW 86-272-SEPT. 14, 1959

SEC. 2. There are hereby authorized to be appropriated such sums, Appropriation. in addition to the sum of $6,339,000 authorized to be appropriated for the Crooked River Federal reclamation project in section 5 of the Act of August 6, 1956 (70 Stat. 1058), as may be required to carry 43 USC 615j. out the purposes of this Act. Approved September 14, 1959. Public Law 86-272 AN ACT Relating to the power of the States to impose net income taxes on income derived from interstate commerce, and authorizing studies by congressional committees of matters pertaining thereto.

Be it enacted by the Senate and House of Representatives United States of America in Congress assembled,

[s. 2524]

of the

TITLE I—IMPOSITION OF MINIMUM STANDARD SEC. 101. (a) No State, or political subdivision thereof, shall have power to impose, for any taxable year ending after the date of the enactment of this Act, a net income tax on the income derived within such State by any person from interstate commerce if the only business activities within such State by or on behalf of such person during such taxable year are either, or both, of the following: (1) the solicitation of orders by such person, or his representative, in such State for sales of tangible personal property, which orders are sent outside the State for approval or rejection, and, if approved, are filled by shipment or delivery from a point outside the State; and (2) the solicitation of orders by such person, or his representative, in such State in the name of or for the benefit of a prospective customer of such person, if orders by such customer to such person to enable such customer to fill orders resulting from such solicitation are orders described in paragraph (1). (b) The provisions of subsection (a) shall not apply to the imposition of a net income tax by any State, or political subdivision thereof, with respect to— (1) any corporation which is incorporated under the laws of such State; or (2) any individual who, under the laws of such State, is domiciled in, or a resident of, such State. (c) For purposes of subsection (a), a person shall not be considered to have engaged in business activities within a State during any taxable year merely by reason of sales in such State, or the solicitation of orders for sales in such State, of tangible personal property on behalf of such person by one or more independent contractors, or by reason of the maintenance of an office in such State by one or more independent contractors whose activities on behalf of such person in such State consist solely of making sales, or soliciting orders for sales, of tangible personal property. (d) For purposes of this section— (1) the term "independent contractor" means a commission agent, broker, or other independent contractor who is engaged in selling, or soliciting orders for the sale of, tangible personal property for more than one principal and who holds himself out as such in the regular course of his business activities; and (2) the term "representative" does not include an independent contractor. 32716 O-60—38

September 14, 1959

Taxes. Income d e r i vel from i n t e r s t a t e commerce.

Definitions.

�