Dl44

SUBJECT INDEX

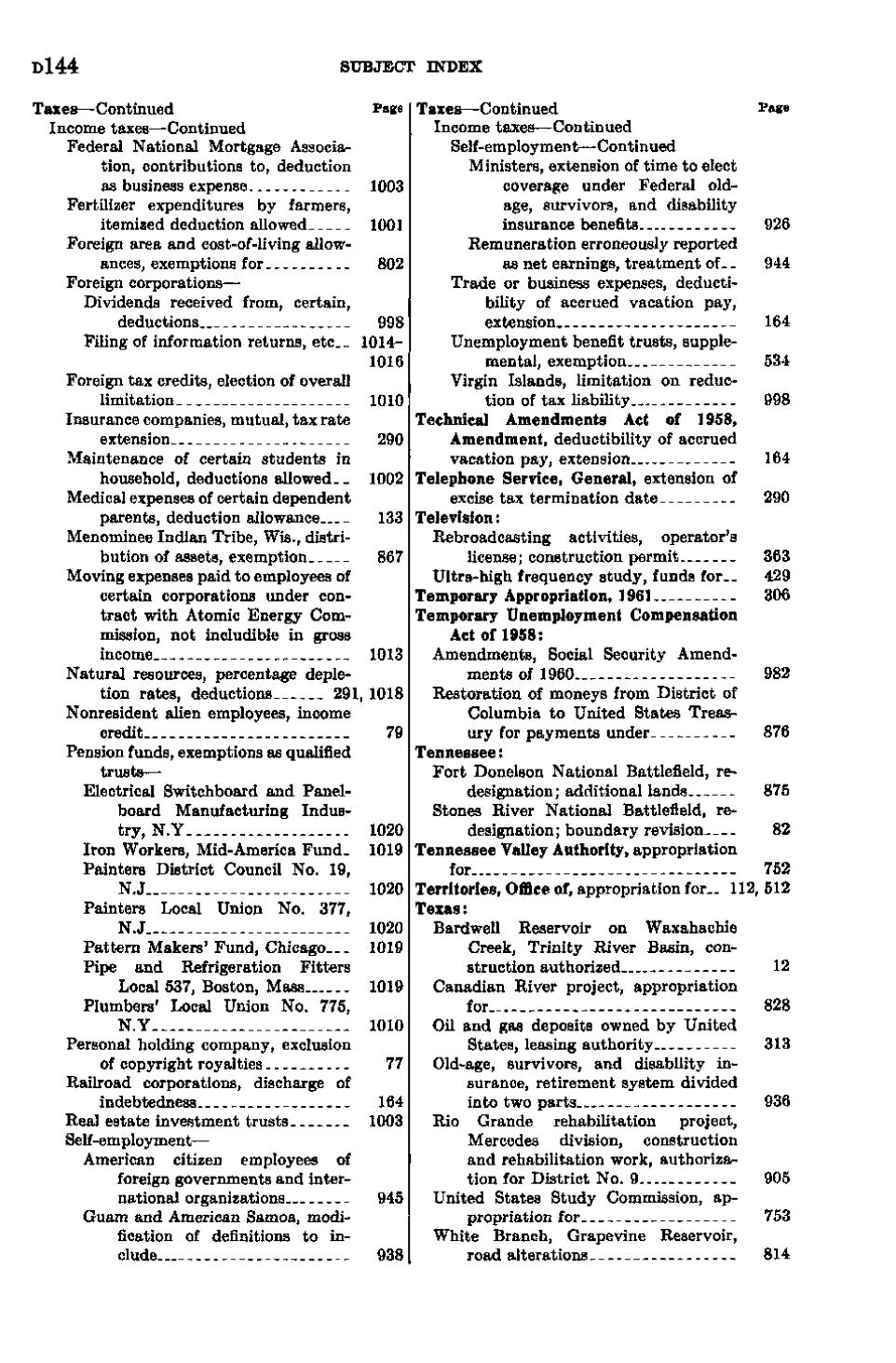

Taxes—Continued Page Income taxes—Continued Federal National Mortgage Association, contributions to, deduction as business expense 1003 Fertilizer expenditures by farmers, itemized deduction allowed 1001 Foreign area and cost-of-living allowances, exemptions for 802 Foreign corporations— Dividends received from, certain, deductions 998 Filing of information returns, etc__ 10141016 Foreign tax credits, election of overall limitation 1010 Insurance companies, mutual, tax rate extension 290 Maintenance of certain students in household, deductions allowed-_ 1002 Medical expenses of certain dependent parents, deduction allowance 133 Menominee Indian Tribe, Wis., distribution of assets, exemption 867 Moving expenses paid to employees of certain corporations under contract with Atomic Energy Commission, not includible in gross income 1013 Natural resources, percentage depletion rates, deductions 291, 1018 Nonresident alien employees, income credit 79 Pension funds, exemptions as qualified trusts— Electrical Switchboard and Panelboard Manufacturing Industry, N.Y 1020 Iron Workers, Mid-America Fund. 1019 Painters District Council No. 19, N.J 1020 Painters Local Union No. 377, N.J 1020 Pattern Makers' Fund, Chicago--- 1019 Pipe and Refrigeration Fitters Local 537, Boston, Mass 1019 Plumbers' Local Union No. 775, N.Y 1010 Personal holding company, exclusion of copyright royalties 77 Railroad corporations, discharge of indebtedness 164 Real estate investment trusts 1003 Self-employment— American citizen employees of foreign governments and international organizations 945 Guam and American Samoa, modification of definitions to include 938

Taxes—Continued Page Income taxes—Continued Self-employment—Continued Ministers, extension of time to elect coverage under Federal oldage, survivors, and disability insurance benefits 926 Remuneration erroneously reported as net earnings, treatment of- _ 944 Trade or business expenses, deductibility of accrued vacation pay, extension 164 Unemployment benefit trusts, supplemental, exemption 534 Virgin Islands, limitation on reduction of tax liability 998 Technical Amendments Act of 1958, Amendment, deductibility of accrued vacation pay, extension 164 Telephone Service, General, extension of excise tax termination date 290 Television: Rebroadcasting activities, operator's license; construction permit 363 Ultra-high frequency study, funds for.. 429 Temporary Appropriation, 1961 306 Temporary Unemployment Compensation Act of 1958: Amendments, Social Security Amendments of 1960 982 Restoration of moneys from District of Columbia to United States Treasury for payments under 876 Tennessee: Fort Donelson National Battlefield, redesignation; additional lands 875 Stones River National Battlefield, redesignation; boundary revision 82 Tennessee Valley Authority, appropriation for 752 Territories, Office of, appropriation for._ 112, 512 Texas: Bardwell Reservoir on Waxahachie Creek, Trinity River Basin, construction authorized 12 Canadian River project, appropriation for 828 Oil and gas deposits owned by United States, leasing authority 313 Old-age, survivors, and disability insurance, retirement system divided into two parts 936 Rio Grande rehabilitation project, Mercedes division, construction and rehabilitation work, authorization for District No. 9 905 United States Study Commission, appropriation for 753 White Branch, Grapevine Reservoir, road alterations 814

�