74

STAT.]

PUBLIC LAW 86-778-SEPT. 13, 1960

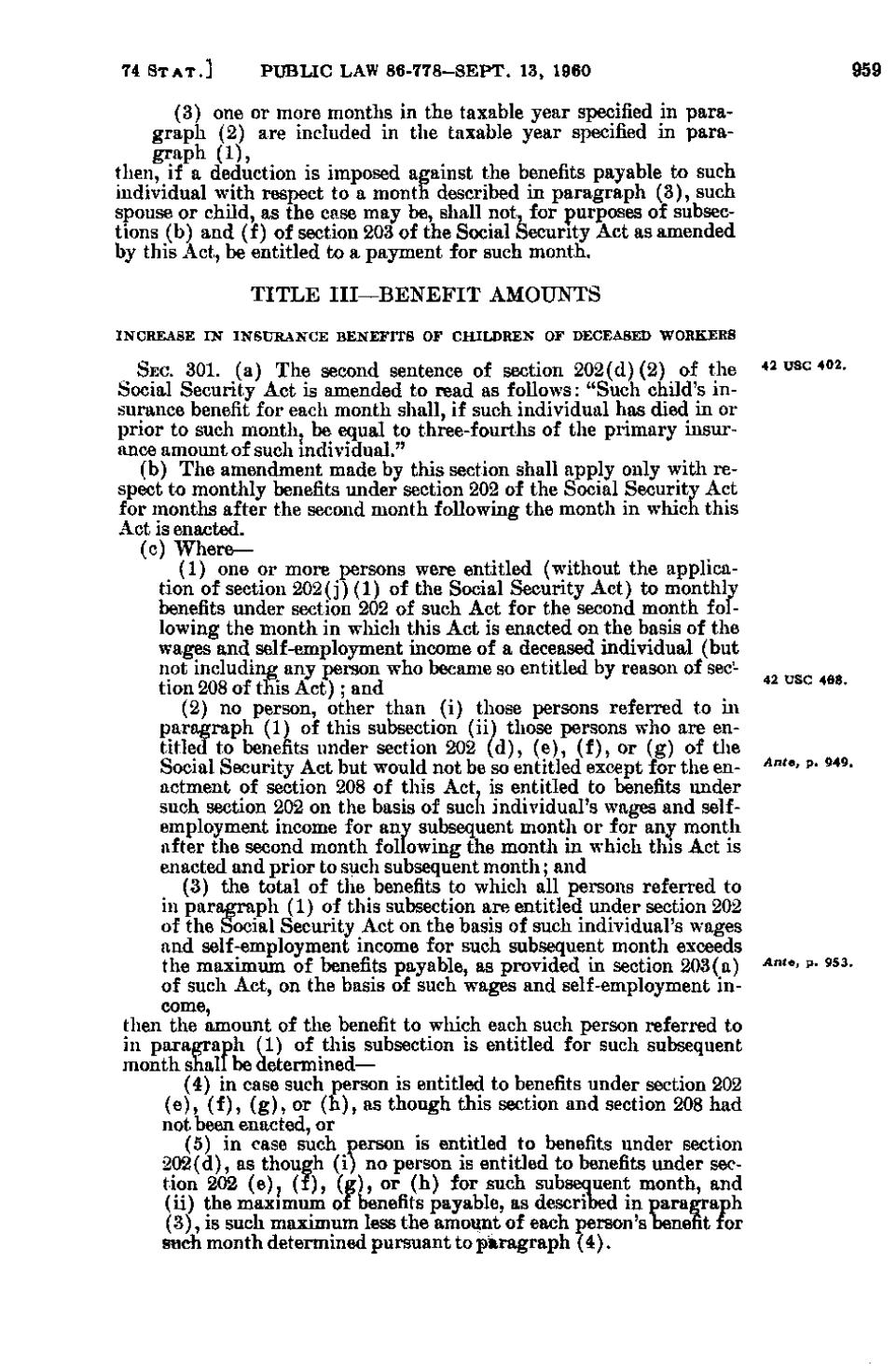

(3) one or more months in the taxable year specified in paragraph (2) are included in the taxable year specified in paragraph (1), then, if a deduction is imposed against the benefits payable to such individual with respect to a month described in paragraph (3), such spouse or child, as the case may be, shall not, for purposes of subsections (b) and (f) of section 203 of the Social Security Act as amended by this Act, be entitled to a payment for such month, TITLE III — B E N E F I T AMOUNTS I N C R E A S E I N INSURANCE B E N E F I T S OF C H I L D R E N OF DECEASED WORKERS

SEC. 301. (a) The second sentence of section 202(d)(2) of the 42 USC 402. Social Security Act is amended to read as follows: "Such child's insurance benefit for each month shall, if such individual has died in or prior to such month, be equal to three-fourths of the primary insurance amount of such individual." (b) The amendment made by this section shall apply only with respect to monthly benefits under section 202 of the Social Security Act for months after the second month following the month in which this Act is enacted. (c) Where— (1) one or more persons were entitled (without the application of section 202(j)(1) of the Social Security Act) to monthly benefits under section 202 of such Act for the second month following the month in which this Act is enacted on the basis of the wages and self-employment income of a deceased individual (but not including any person who became so entitled by reason of section 208 of this Act); and ^"^ "^ ^®*(2) no person, other than (i) those persons referred to in paragraph (1) of this subsection (ii) those persons wio are entitled to benefits under section 202(d), (e), (f), or (g) of the Social Security Act but would not be so entitled except for the en- Ante, p. 949. actment of section 208 of this Act, is entitled to benefits under such section 202 on the basis of such individual's wages and selfemployment income for any subsequent month or for any month after the second month following the month in which this Act is enacted and prior to such subsequent month; and (3) the total of the benefits to which all persons referred to in paragraph (1) of this subsection are entitled under section 202 of the Social Security Act on the basis of such individual's wages and self-employment income for such subsequent month exceeds the maximum of benefits payable, as provided in section 203(a) Ante, p. 953. of such Act, on the basis of such wages and self-employment income, then the amount of the benefit to which each such person referred to in paragraph (1) of this subsection is entitled for such subsequent month shall be determined— (4) in case such person is entitled to benefits under section 202 (e), (f), (g), or (h), as though this section and section 208 had not been enacted, or (5) in case such person is entitled to benefits under section 202(d), as though (i) no person is entitled to benefits under section 202(e), (f), (g), or (h) for such subsequent month, and (ii) the maximum of benefits payable, as described in paragraph (3), is such maximum less the amount of each person's benefit for such month determined pursuant to paragraph (4).

�