972

PUBLIC LAW 8 7 - 8 3 4 - O C T. 16, 1962 "(B)

26 USC 7122.

[76 STAT.

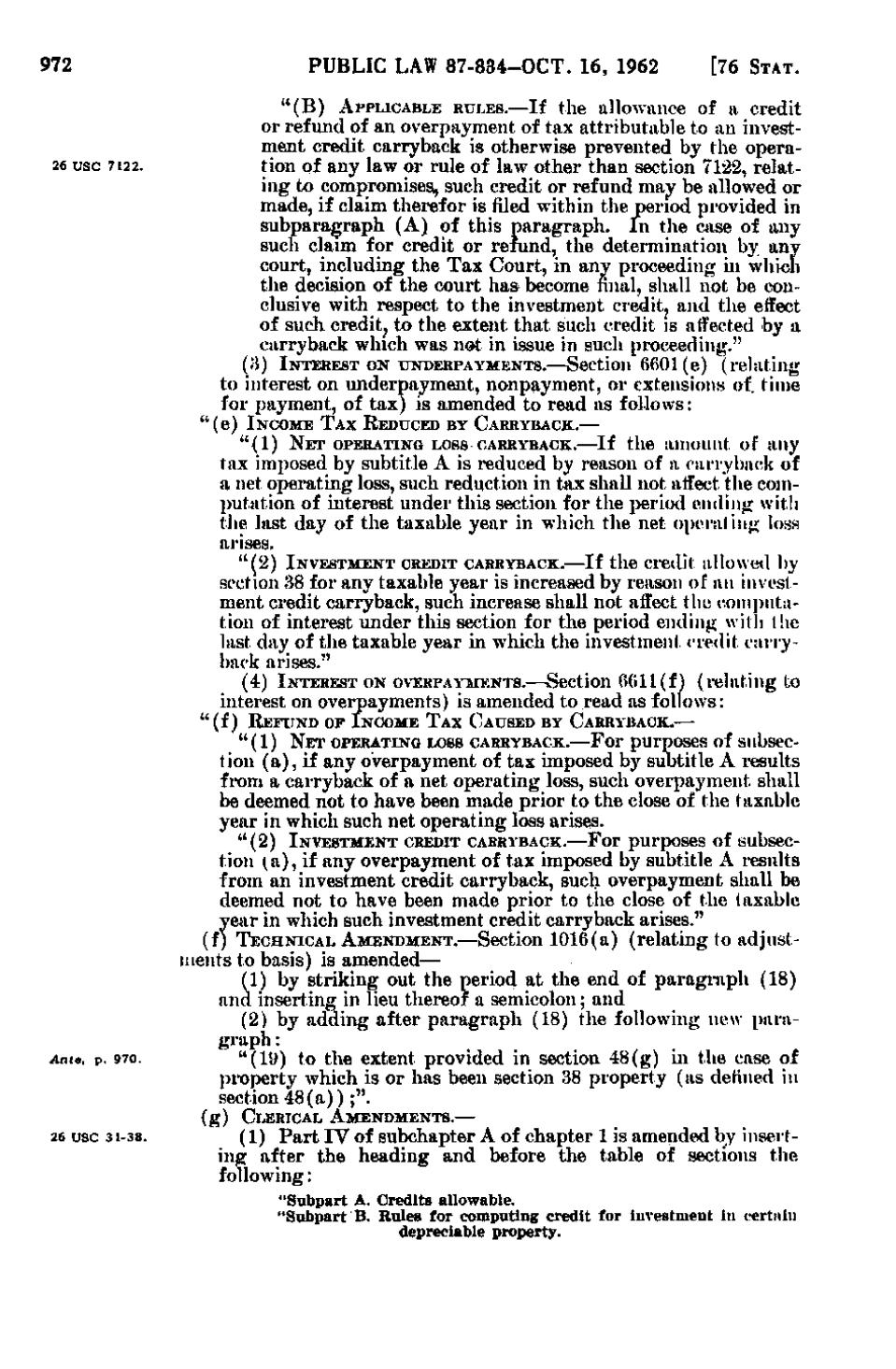

APPLICABLE RULES.—If the allowance of a credit

or refund of an overpayment of tax attributable to an investment credit carryback is otherwise prevented by the operation of any law or rule of law other than section 7122, relating to compromises, such credit or refund may be allowed or made, if claim therefor is filed within the period provided in subparagraph (A) of this paragraph. I n the case of any such claim for credit or refund, the determination by any court, including the Tax Court, in any proceeding in which the decision of the court has become final, shall not be conclusive with respect to the investment credit, and the effect of such credit, to the extent that such credit is affected by a carryback which was not in issue in such proceeding." (8) INTEREST ON UNDERPAYMENTS.—Section 6601(e) (rehiting to interest on underpayment, nonpayment, or extensions of time for payment, of tax) is amended to read as follows: " (e) INCOME TAX REDUCED BY CARRYBACK.— "(1) N E T OPERATING LOSS CARRYBACK.—If the amount of any

tax imposed by subtitle A is reduced by reason of a carrybaclc of a net operating loss, such reduction in tax shall not affect the computation of interest under this section for the period ending with the last day of the taxable year in which the net operating loss arises. " (2) INVESTMENT CREDIT CARRYBACK.—If the credit allowed by

section 38 for any taxable year is increased by reason of an investment credit carryback, such increase shall not affect the coiTiputation of interest under this section for the period ending with t!jc last day of the taxable year in which the investment credit carryback arises." (4) INTEREST ON OVERPAYMENTS.—Section 6611(f) (relating to interest on overpayments) is amended to read as follows: " (f) REFUND or INCOME TAX CAUSED BY CARRYBACK.— "(1) NET OPERATING LOSS CARRYBACK.—For purposes of subsec-

tion (a), if any overpayment of tax imposed by subtitle A results from a carryback of a net operating loss, such overpayment shall be deemed not to have been made prior to the close of the taxable year in which such net operating loss arises. " (2) INVESTMENT CREDIT CARRYBACK.—For purposes of subsec-

Ante, p. 970.

tion (a), if any overpayment of tax imposed by subtitle A results from an investment credit carryback, such overpayment shall be deemed not to have been made prior to the close of the taxable year in which such investment credit carryback arises." (f) TECHNICAL AMENDMENT.—Section 1016(a) (relating to adjustments to basis) is amended— (1) by striking out the period at the end of paragraph (18) and inserting in lieu thereof a semicolon; and (2) by adding after paragraph (18) the following new paragraph: "(l*"^) fo the exteut provided in section 48(g) in the case of property which is or has been section 38 property (as defined in section 48(a));". (g) CLERICAL AMENDMENTS.—

26 USC 31-38.

(1) Part IV of subchapter A of chapter 1 is amended by inserting after the heading and before the table of sections the following: "Subpart A. Credits allowable. "Subpart B. Rules for computing credit for investment in eertnin depreciable property.

�