990

Post, p.992. Post, p.992. Post, p. 994.

Post, p. 995.

PUBLIC LAW 8 7 - 8 3 4 - O C T. 16, 1962

[76 STAT.

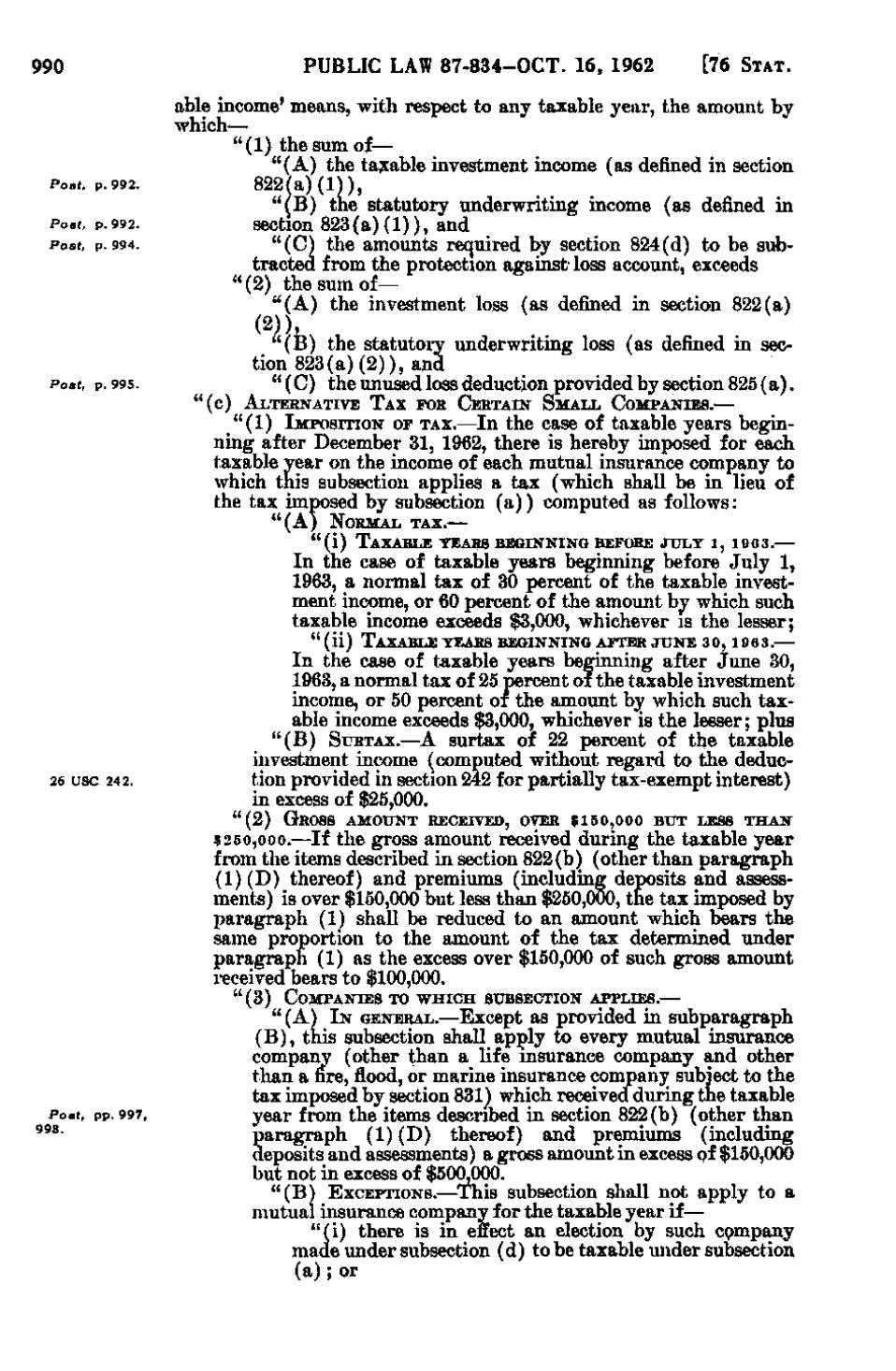

able income' means, with respect to any taxable year, the amount by which— "(1) the sum of— " (A) the taxable investment income (as defined in section 822(a)(1)), " (B) the statutory underwriting income (as defined in section 8 2 3 (a)(1)), and " (C) the amounts required by section 824(d) to be subtracted from the protection against loss account, exceeds "(2) the sum of— " (A) the investment loss (as defined in section 822(a) (2)), " (B) the statutory underwriting loss (as defined in section 823(a)(2)), and " (C) the unused loss deduction provided by section 825(a). " (c) ALTERNATIVE TAX FOR CERTAIN SMALL COMPANIES.— "(1) IMPOSITION OF TAX.—In the case of taxable years

beginning after December 31, 1962, there is hereby imposed for each taxable year on the income of each mutual insurance company to which this subsection applies a tax (which shall be in lieu of the tax imposed by subsection (a)) computed as follows: " (A) NORMAL TAX.— " (i) TAXABLE YEARS BEGINNING BEFORE J U L Y i, i 9 6 3. —

I n the case of taxable years beginning before July 1, 1963, a normal tax of 30 percent of the taxable investment income, or 60 percent of the amount by which such taxable income exceeds $3,000, whichever is the lesser; " ( i i) TAXABLE YEARS B E G I N N I N G AFTER J U N E 3 O, 19 6 3. —

26 USC 242.

I n the case of taxable years beginning after June 30, 1963, a normal tax of 25 percent of the taxable investment income, or 50 percent of the amount by which such taxable income exceeds $3,000, whichever is the lesser; plus " (B) SURTAX.—A surtax of 22 percent of the taxable investment income (computed without regard to the deduction provided in section 242 for partially tax-exempt interest) in excess of $25,000. " (2) GROSS AMOUNT RECEIVED, OVER $I5O,OOO BUT LESS THAN

.$250,000.—If the gross amount received during the taxable year from the items described in section 822(b) (other than paragraph (1)(D) thereof) and premiums (including deposits and assessments) is over $150,000 but less than $250,000, the tax imposed by paragraph (1^ shall be reduced to an amount which bears the same proportion to the amount of the tax determined under paragraph (1) as the excess over $150,000 of such gross amount received bears to $100,000. " (3) COMPANIES TO WHICH SUBSECTION APPLIES.—

Post, pp.997, ^^*-

" (A) IN GENERAL.—Except as provided in subparagraph (B), this subsection shall apply to every mutual insurance company (other than a life insurance company and other than a fire, flood, or marine insurance company subject to the tax imposed by section 831) which received during the taxable year from the items described in section 822(b) (other than paragraph (1)(D) thereof) and premiums (including deposits and assessments) a gross amount in excess of $150,000 but not in excess of $500,000. " (B) EXCEPTIONS.—This subsection shall not apply to a mutual insurance company for the taxable year if— "(i) there is in effect an election by such company made under subsection (d) to be taxable under subsection (a); or

�