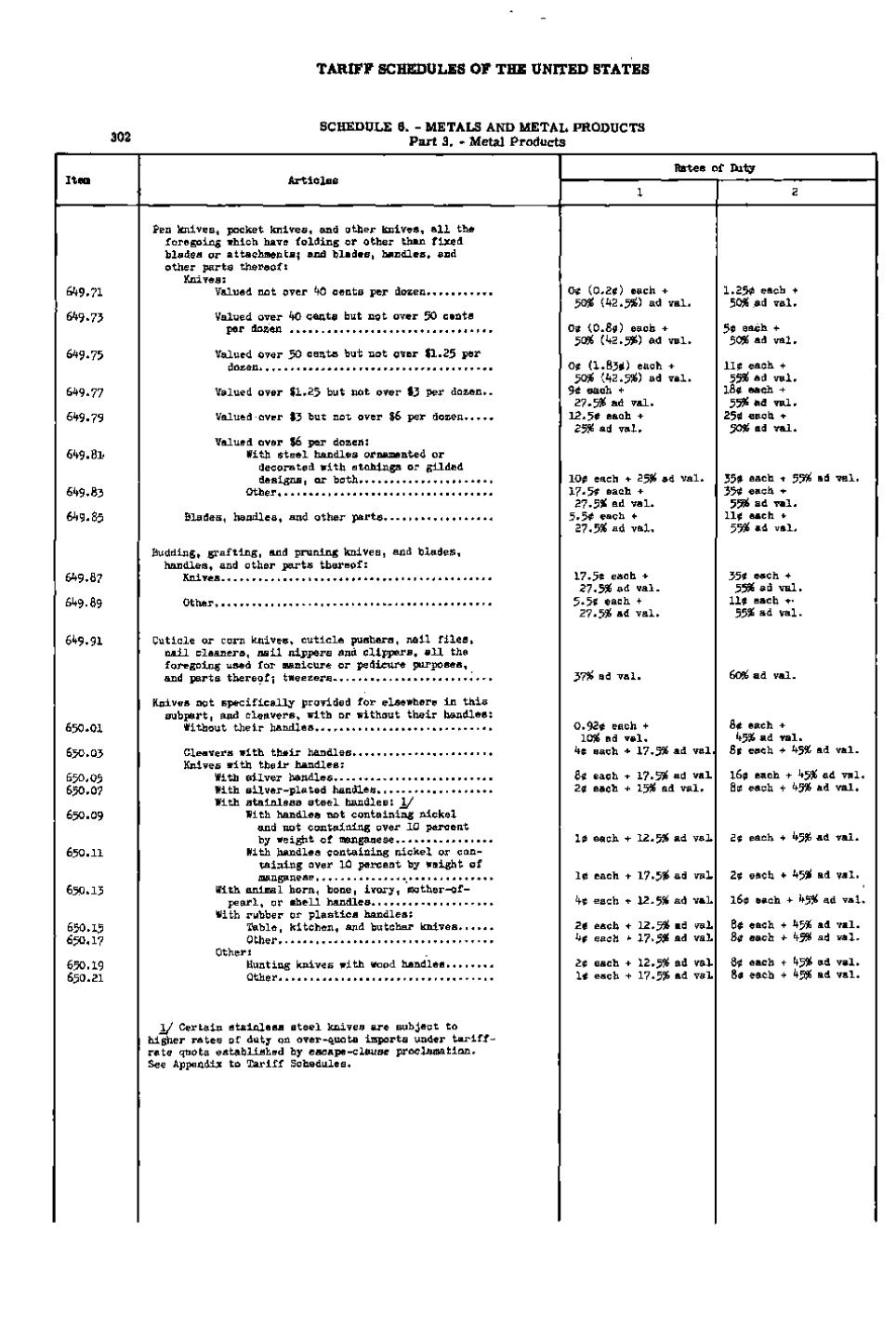

TARIFF SCHEDULES OF THE UNITED STATES

SCHEDULE 6. - METALS AND METAL PRODUCTS Part 3. - Metal Products

302

Rates of Duty

Pen knives, pocket knives, and other knives, all the foregoing which have folding or other than fixed blades or attachments; and blades, handles, and other parts thereof: Knives: Valued not over 40 cents per dozen Valued over 40 cents but not over 5 0 cents per dozen

649.73

Valued over 50 cents but not over $1.25 per dozen

6^*9.75

6'+9.77

Valued over $1.25 but not over $3 per dozen..

649.79

Valued over $3 but not over 86 per dozen Valued over $6 per dozen: With steel handles ornamented or decorated with etchings or gilded designs, or both Other

649.81-

649.83 649.85

649.87 649.89

649.91

650.01 650.03 650.05 650.07

650.09

650.11

650.13 650.15 650.17 650.19 650.21

Blades, handles, and other parts

Budding, grafting, and pruning knives, and blades, handles, and other parts thereof: Knives Other

Cuticle or corn knives, cuticle pushers, nail files, nail cleaners, nail nippers and clippers, all the foregoing used for manicure or pedicure purposes, and parts thereof; tweezers Knives not specifically provided for elsewhere in this subpart, and cleavers, with or without their handles: Without their handles Cleavers with their handles Knives with their handles: With silver handles With silver-plated handles With stainless steel handles: 1/ With handles not containing nickel and not containing over 10 percent by weight of manganese With handles containing nickel or containing over 10 percent by weight of manganese , With animal horn, bone, ivory, mother-ofpearl, or shell handles With rubber or plastics handles: Table, kitchen, and butcher knives Other Other: Hunting knives with wood handles Other

1/ Certain stainless steel knives are subject to higher rates of duty on over-quota imports under tariffrate quota established by escape-clause proclamation. See Appendix to Tariff Schedules.

0^ (0.2?) each + 5056 (42.55^) ad val.

1.250 each + 5 0 % ad val.

00 (0.80) each + 5 0 % (42.5^) ad val.

50 each + 5 0 % ad val.

0<t (1.83?) each + 505^ (42.556) ad val. 90 each + 27.5% ad val. 12.50 each + 255^ ad val.

110 each + 5 5 % ad val. 180 each + 5 5 % ad val. 250 each + 5 0 % ad val.

100 each + 2 5 % ad val. 17.50 each + 27.55^ ad val. 5.50 each + 27.55^ ad val.

350 each + 5 5 % ad val. 350 each + 5 5 % ad val. 110 each + 5 5 % ad val.

17.50 each + 27.55^ ad val. 5.50 each + 27.5% ad val.

350 each + 5 5 % ad val. 110 each +• 5 5 % ad val.

J)7% ad val.

0.920 each + 1 0 % ad val. 40 each + 17-5% ad val

80 each + 4 5 % ad val. 80 each + 4 5 % ad val.

80 each + 17.5% ad vaL 20 each + 1 5 % ad val.

160 each + 4 5 % ad val. 80 each + 4 5 % ad val.

10 each + 12.5% ad vaL

20 each + 4 5 % ad val.

10 each + 17.5% ad vaL

20 each + 4 5 % ad val.

40 each + 12.5% ad val

160 each + 4 5 % ad val.

20 each + 12.5% ad val 40 each + 17.5% ad val.

80 each + 4 5 % ad val. 80 each + 4 5 % ad val.

20 each + 12.5% ad vaL 10 each + 17.5^ ad vaL

80 each + 4 5 % ad val. 80 each + 4 5 % ad val.

�