120

73 Stat. 115. 26 USC 802.

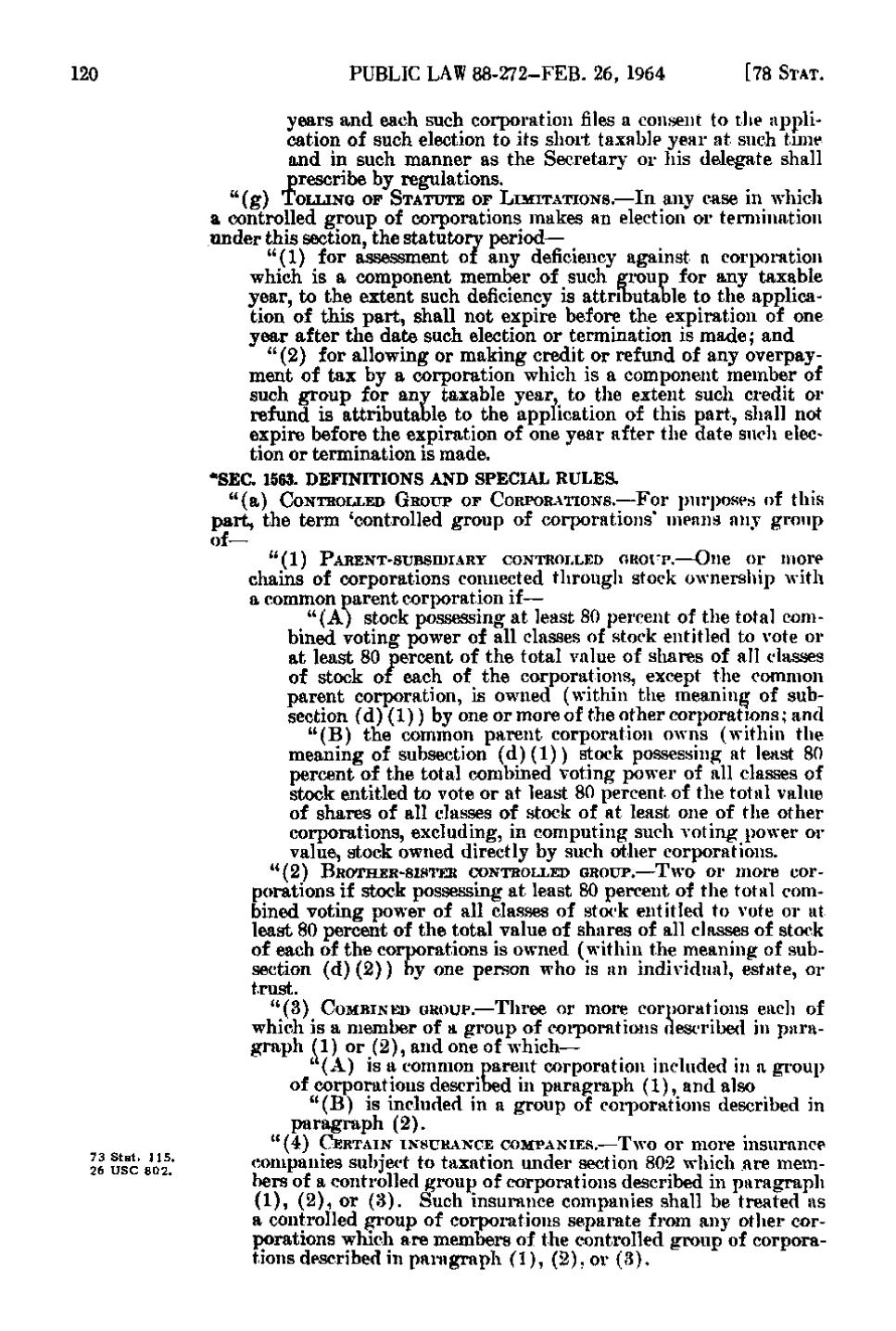

PUBLIC LAW 88-272-FEB. 26, 1964

[78 STAT.

years and each such corporation files a consent to the application of such election to its short taxable year a t such time and in such manner as the Secretary or his delegate shall prescribe by regulations. " (g) TOLLING OP STATUTE OF LIMITATIONS.—In any case in which a controlled group of corporations makes an election or termination under this section, the statutory period— "(1) for assessment of any deficiency against a corporation which is a component member of such group for any taxable year, to the extent such deficiency is attributalble to the application of this part, shall not expire before the expiration of one year after the date such election or termination is made; and "(2) for allowing or making credit or refund of any overpayment of tax by a corporation which is a component member of such group for any taxable year, to the extent such credit or refund is attributaole to the application of this part, shall not expire before the expiration of one year after the date such election or termination is made. -SEC. 1563. DEFINITIONS AND SPECIAL RULES. " (a) CONTROLLED GROUP OP CORPORATIONS.—For purposes of this part, the term 'controlled group of corporations* means any group of— "(1) PARENT-suBsmiARY CONTROLLED GROUP.—One or uiore chains of corporations connected through stock ownership with a common parent corporation if— " (A) stock possessing at least 80 percent of the total combined voting power of all classes of stock entitled to vote or at least 80 percent of the total value of shares of all classes of stock of each of the corporations, except the common parent corporation, is owned (within the meaning of subsection (d)(1)) by one or more of the other corporations; and " (B) the common parent corporation owns (within the meaning of subsection (d)(1)) stock possessing at least 80 percent of the total combined voting power of all classes of stock entitled to vote or at least 80 percent of the total value of shares of all classes of stock of at least one of the other corporations, excluding, in computing such voting power or value, stock owned directly by such other corporations. "(2) BROTHER-SISTER CONTROLLED GROUP.—Two or more corporations if stock possessing at least 80 percent of the total combined voting power of all classes of stock entitled to vote or at least 80 percent of the total value of shares of all classes of stock of each of the corporations is owned (within the meaning of subsection (d)(2)) by one person who is an individual, estate, or trust. "(3) COMBINED GROUP.—Three or more corporations each of which is a member of a group of corporations described in paragraph (1) or (2), and one of which— " (A) is a common parent corporation included in a group of corporations described in paragraph (1), and also " (B) is included in a group of corporations described in paragraph (2). "(4) CERTAIN INSURANCE COMPANIES.—Two or more insurance companies subject to taxation under section 802 which are members of a controlled group of corporations described in paragraph (1), (2), or (3). Such insurance companies shall be treated as a controlled group of corporations separate from any other corporations which are members of the controlled group of corporations described in paragraph (1), (2), or (3).

�