66

PUBLIC LAW 89-368-MAR. 15, 1966

26 USC 64U

26 USC 4251.

[80 STAT.

(^) CONFORMING AMENDMENT.—Section 6412(a)(1) (relating to floor stocks refunds on passenger automobiles, etc.) is amended by striking out "January 1, 1966, 1967, 1968, or 1969," and inserting in lieu thereof "January 1, 1966, April 1, 1968, or January 1, 1969,". (c) EFFECTIVE DATE.—The amendment made by subsection (a) shall apply with respect to articles sold after the date of the enactment of this Act. SEC. 202. COMMUNICATION SERVICES. ^g^^ POSTPONEMENT OF RATE REDUCTIONS.—Section 4251 (relating

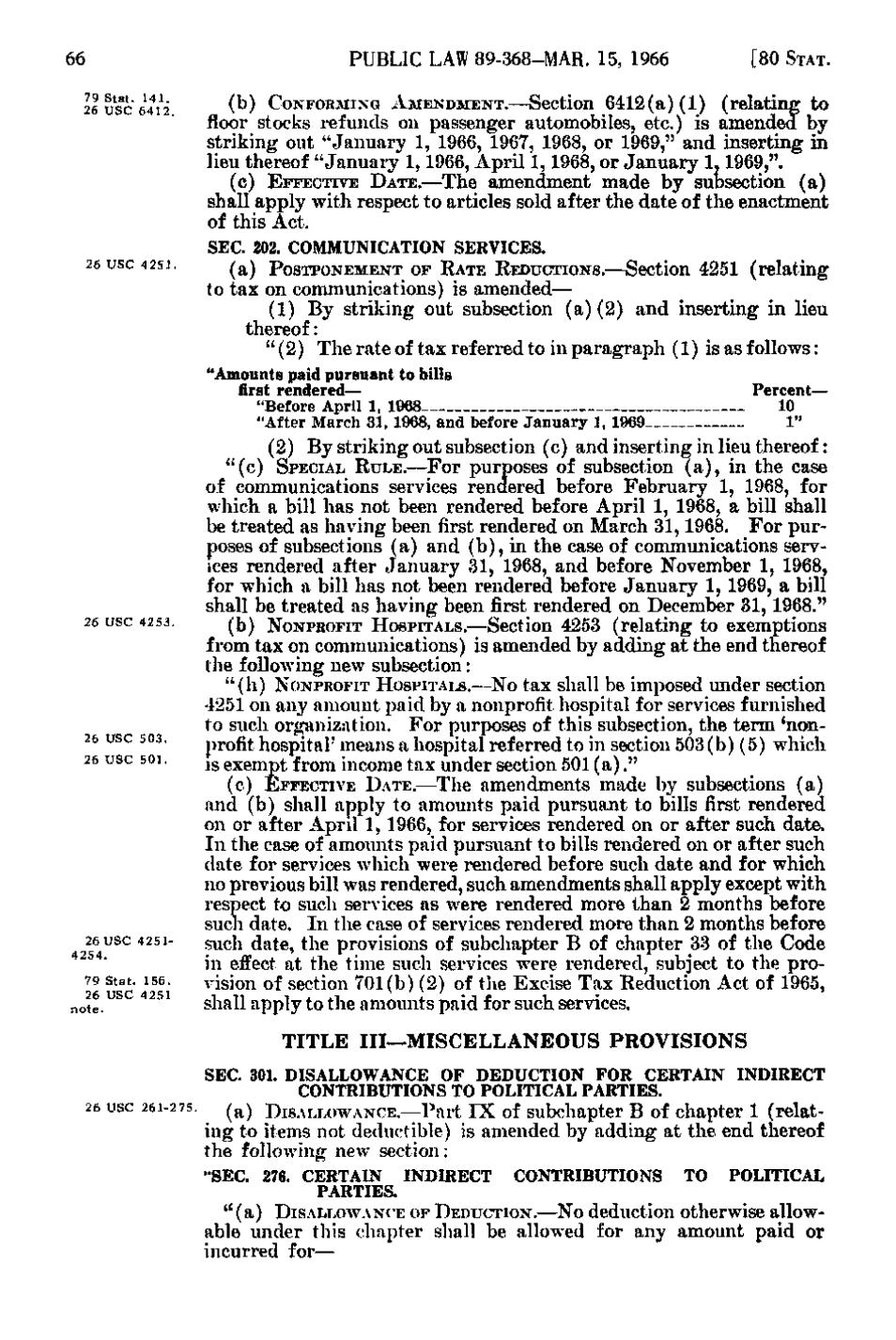

to tax on communications) is amended— (1) By striking out subsection (a)(2) and inserting in lieu thereof: " (2) The rate of tax referred to in paragraph (1) is as follows: "Amounts paid pursuant to bills first rendered— "Before April 1, 1968 "After March 31, 1968, and before January 1, 1969

26 USC 42 53.

26 USC 503. 26 USC 501.

26 USC 4251-

4254.

79 Stat. 156. note.

Percent— 10 1"

(2) By striking out subsection (c) and inserting in lieu thereof: "(c) SPECIAL RULE. — For purposes of subsection (a), in the case of communications services rendered before February 1, 1968, for which a bill has not been rendered before April 1, 1968, a bill shall be treated as having been first rendered on March 31, 1968. For purposes of subsections (a) and (b), in the case of communications services rendered after January 31, 1968, and before November 1, 1968, for which a bill has not been rendered before January 1, 1969, a bill shall be treated as having been first rendered on December 31, 1968." ^^^ NONPROFIT HospiTALS.—Section 4253 (relating to exemptions from tax on communications) is amended by adding at the end thereof the following new subsection: " (h) NONPROFIT HOSPITALS.—No tax shall be imposed under section 4251 on any amount paid by a nonprofit hospital for services furnished to such organization. For purposes of this subsection, the term 'nonprofit hospital' means a hospital referred to in section 503(b)(5) which is exempt from income tax under section 501(a). " (c) EFFECTIVE DATE.—The amendments made by subsections (a) and (b) shall apply to amounts paid pursuant to bills first rendered on or after April 1, 1966, for services rendered on or after such date. In the case of amounts paid pursuant to bills rendered on or after such date for services which were rendered before such date and for which no previous bill was rendered, such amendments shall apply except with respect to such services as were rendered more than 2 months before such date. I n the case of services rendered more than 2 months before suci^ date, the provisions of subchapter B of chapter 33 of the Code in effect at the time such services were rendered, subject to the proA'ision of section 701(b)(2) of the Excise Tax Reduction Act of 1965, shall apply to the amounts paid for such services. TITLE III—MISCELLANEOUS PROVISIONS

SEC. 301. DISALLOWANCE OF DEDUCTION FOR CERTAIN INDIRECT CONTRIBUTIONS TO POLITICAL PARTIES. 26 USC 261-275. ^^^ DiSALLowANCE.—Part IX of Subchapter B of chapter 1 (relating to items not deductible) is amended by adding at the end thereof the following new section: "SEC. 276. CERTAIN INDIRECT CONTRIBUTIONS TO POLITICAL PARTIES. " (a) DISALLOWANCE OF DEDUCTION.—No deduction otherwise allow-

able under this chapter shall be allowed for any amount paid or incurred for—

�