80 STAT.]

PUBLIC LAW 89-809-NOV. 13, 1966

1557

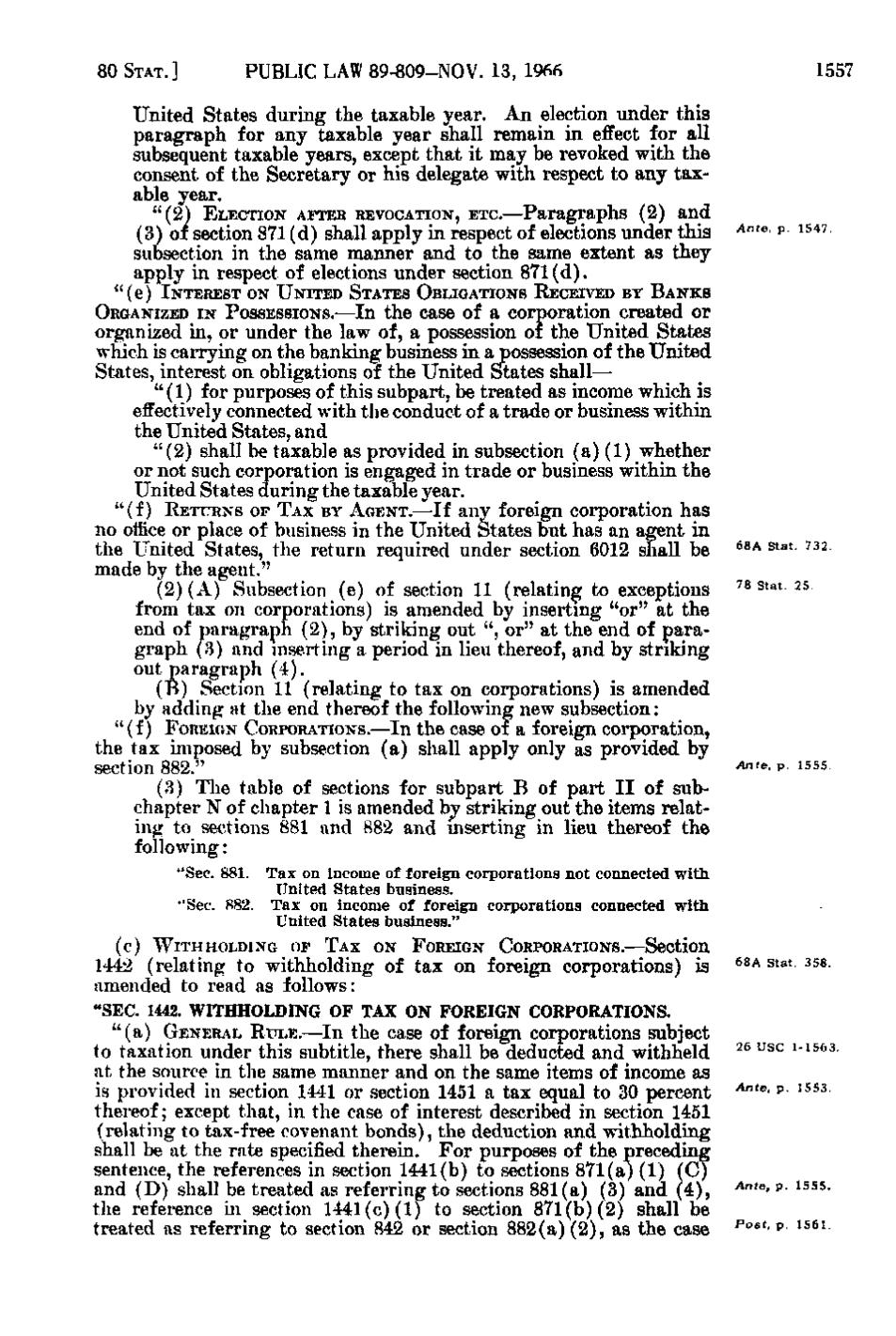

United States during the taxable year. An election under this paragraph for any taxable year shall remain in effect for all subsequent taxable years, except that it may be revoked with the consent of the Secretary or his delegate with respect to any taxable year. "(2)

ELECTION AFTER REVOCATION, ETC.—Paragraphs (2)

and

(3) of section 871(d) shall apply in respect of elections under this subsection in the same manner and to the same extent as they apply in respect of elections under section 871(d).

^"^e, p. 1547.

"(e) INTEREST ON UNITED STATES OBLIGATIONS RECEIVED BY BANKS ORGANIZED I N POSSESSIONS.—In the case of a corporation created or

organized in, or under the law of, a possession of the United States which is carrying on the banking business in a possession of the United States, interest on obligations of the United States shall— " (1) for purposes of this subpart, be treated as income which is effectively connected with the conduct of a trade or business within the United States, and "(2) shall be taxable as provided in subsection (a)(1) whether or not such corporation is engaged in trade or business within the United States during the taxable year. "(f) RETURNS OF TAX BY AGENT.—If any foreign corporation has no office or place of business in the United States but has an agent in the United States, the return required under section 6012 shall be made by the agent." (2)(A) Subsection (e) of section 11 (relating to exceptions from tax on corporations) is amended by inserting "or" at the end of paragraph (2), by striking out ", or" at the end of paragraph (3) and inserting a period in lieu thereof, and by striking out paragraph (4). (B) Section 11 (relating to tax on corporations) is amended by adding at the end thereof the following new subsection: " (f) FOREIGN CORPORATIONS.—In the case of a foreign corporation, the tax imposed by subsection (a) shall apply only as provided by section 882." (3) The table of sections for subpart B of part II of subchapter N of chapter 1 is amended by striking out the items relating to sections 881 and 882 and inserting in lieu thereof the following:

^^^ ^'^* ^2. ^^ ^*^* ^^•

^ ' « ' P- isss.

"Sec. 881. Tax on income of foreign corporations not connected with United States business. "Sec. 882. Tax on income of foreign corporations connected with United States business." (c) WITHHOLDING OF TAX ON FOREIGN CORPORATIONS.—Section

1442 (relating to withholding of tax on foreign corporations) is amended to read as follows:

^^^ ^*^' ^^^

"SEC. 1442. WITHHOLDING OF TAX ON FOREIGN CORPORATIONS. " (a) GENERAL RULE. — I n the case of foreign corporations subject

to taxation under this subtitle, there shall be deducted and withheld at the source in the same manner and on the same items of income as is provided in section 1441 or section 1451 a tax equal to 30 percent thereof; except that, in the case of interest described in section 1451 (relating to tax-free covenant bonds), the deduction and withholding shall be at the rate specified therein. For purposes of the preceding sentence, the references in section 1441(b) to sections 871(a)(1)(C) and (D) shall be treated as referring to sections 881(a)(3) and (4), the reference in section 1441(c)(1) to section 871(b)(2) shall be treated as referring to section 842 or section 882(a)(2), as the case

^^ "^*-^ risea. ^"'^' ^ ^^^^

^"'®' P- ^^^^• ^°^^' ^ ^^^^

�