82 STAT. ]

PUBLIC LAW 90-364-JUNE 28, 1968

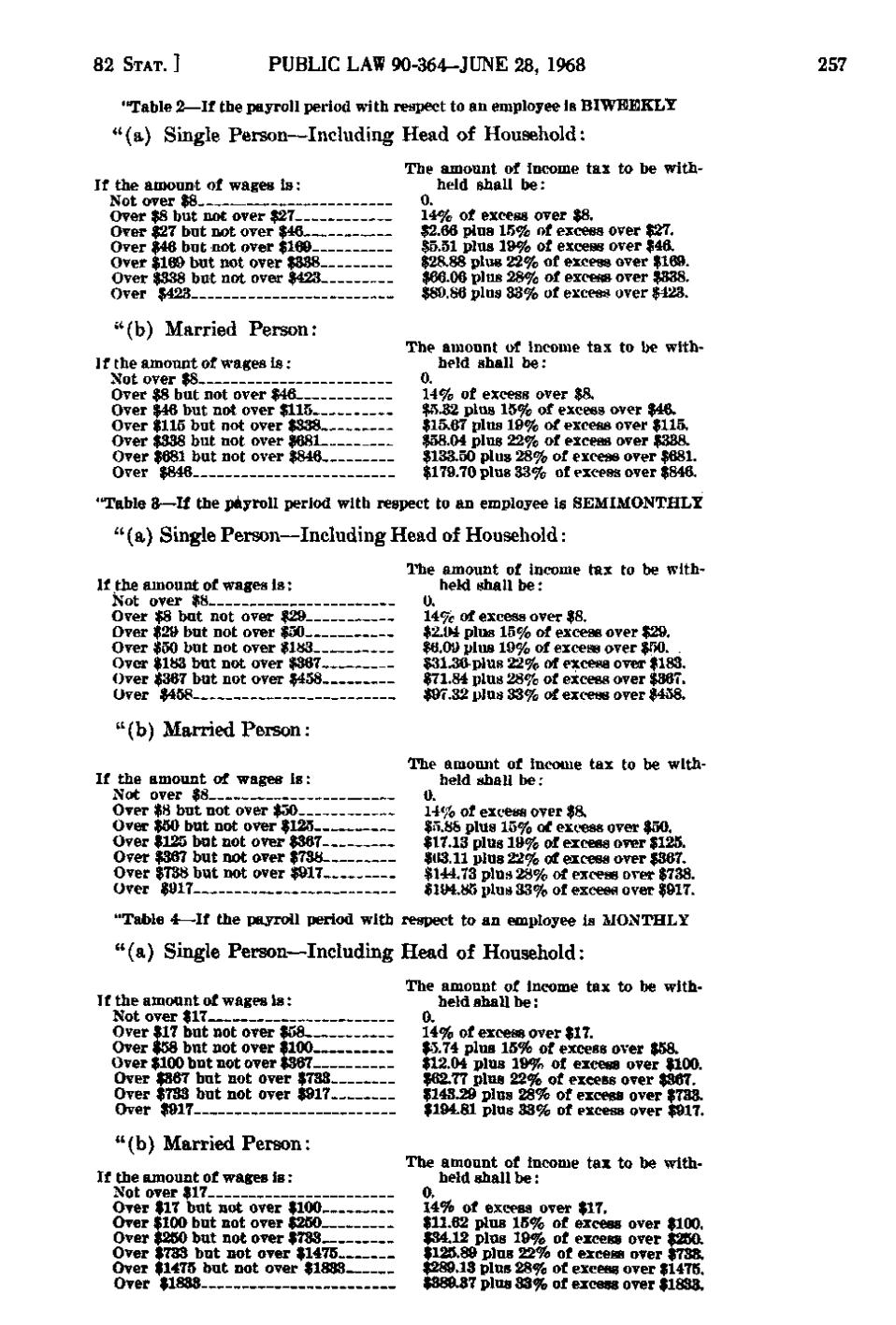

"Table 2—If the payroll period with respect to an employee is BIWEEKLY

"(a) Single Person—Including Head of Household: If the amount of wages i s: Not over $8 Over $8 but not over $27 Over $27 but not over $46 Over $46 but not over $16!> Over $169 but not over $338 Over $338 but not over $423 Over $423

The amount of income tax to be withheld shall be: 0. 14% of excess over $8. $2.66 plus 15% of excess over $27. $5.51 plus 19% of excess over $46. .$28.88 plus 22% of excess over $169. $66.06 plus 28% of excess over $338. $89.86 plus 33% of excess over $423.

"(b) Married Person: If the amount of wages is: Not over $8 Over $8 but not over $46 Over $46 but not over $115 Over $115 but not over $338 Over $338 but not over $681 Over $681 but not over $846 Over $846

The amount of income tax to be withheld shall be: 0. 14% of excess over $8. $5.32 plus 15% of excess over $46. $15.67 plus 19% of excess over $115. .$58.04 plus 22% of excess over $338. $133.50 plus 28% of excess over $681. $179.70 plus 33% of excess over $846.

"Table 3—If the piiyroll period with respect to an employee is SEMIMONTHLY

" (a) Single Person—Including Head of Household: If the amount of wages is: Not over $8 Over $8 but not over $29 Over $29 but not over $50 Over $50 but not over $183 Over $183 but not over $367 Over $367 but not over $458 Over $458

The amount of income tax to be withheld shall be: 0. 14% of excess over $8. $2.94 plus 15% of excess over $29. $6.09 plus 19% of excess over $50.. $31.36 plus 22% of excess over $183. $71.84 plus 28% of excess over $367. $97.32 plus 33% of excess over $458.

"(b) Married Person: If the amount of wages is: Not over $8 Over $8 but not over $50 Over $50 but not over $125 Over $125 but not over $387 Over $367 but not over $738 Over $738 but not over $917 Over $917

The amount of income tax to be withheld shall be: 0. 14% of excess over $8. $5.88 plus 15% of excess over $50. $17.13 plus 19% of excess over $125. $63.11 plus 22% of excess over $367. $144.73 plus 28% of excess over $738. $194.85 plus 33% of excess over $917.

"Table 4—If the payroll period with respect to an employee is MONTHLY

"(a) Single Person—Including Head of Household: If the amount of wages i s: Not over $17 Over $17 but not over $58 Over $58 but not over $100 Over $100 but not over $367 Over $367 but not over $733 Over $733 but not over $917 Over $917

The amount of income tax to be withheld shall be: 0. 14% of excess over $17. $5.74 plus 15% of excess over $58. $12.04 plus 19% of excess over $100. $62.77 plus 22% of excess over $367. $143.29 plus 28% of excess over $733. $194.81 plus 33% of excess over $917.

"(b) Married Person: If the amount of wages is: Not over $17 Over $17 but not over $100 Over $100 but not over $250 Over $250 but not over $733 Over $733 but not over $1475 Over $1475 but not over $1833 Over $1833

The amount of income tax to be withheld shall be: 0. 14% of excess over $17. $11.62 plus 15% of excess over $100. $34.12 plus 19% of excess over $250. $125.89 plus 22% of excess over $733. $289.13 plus 28% of excess over $1475. $389.37 plus 33% of excess over $1833.

257

�