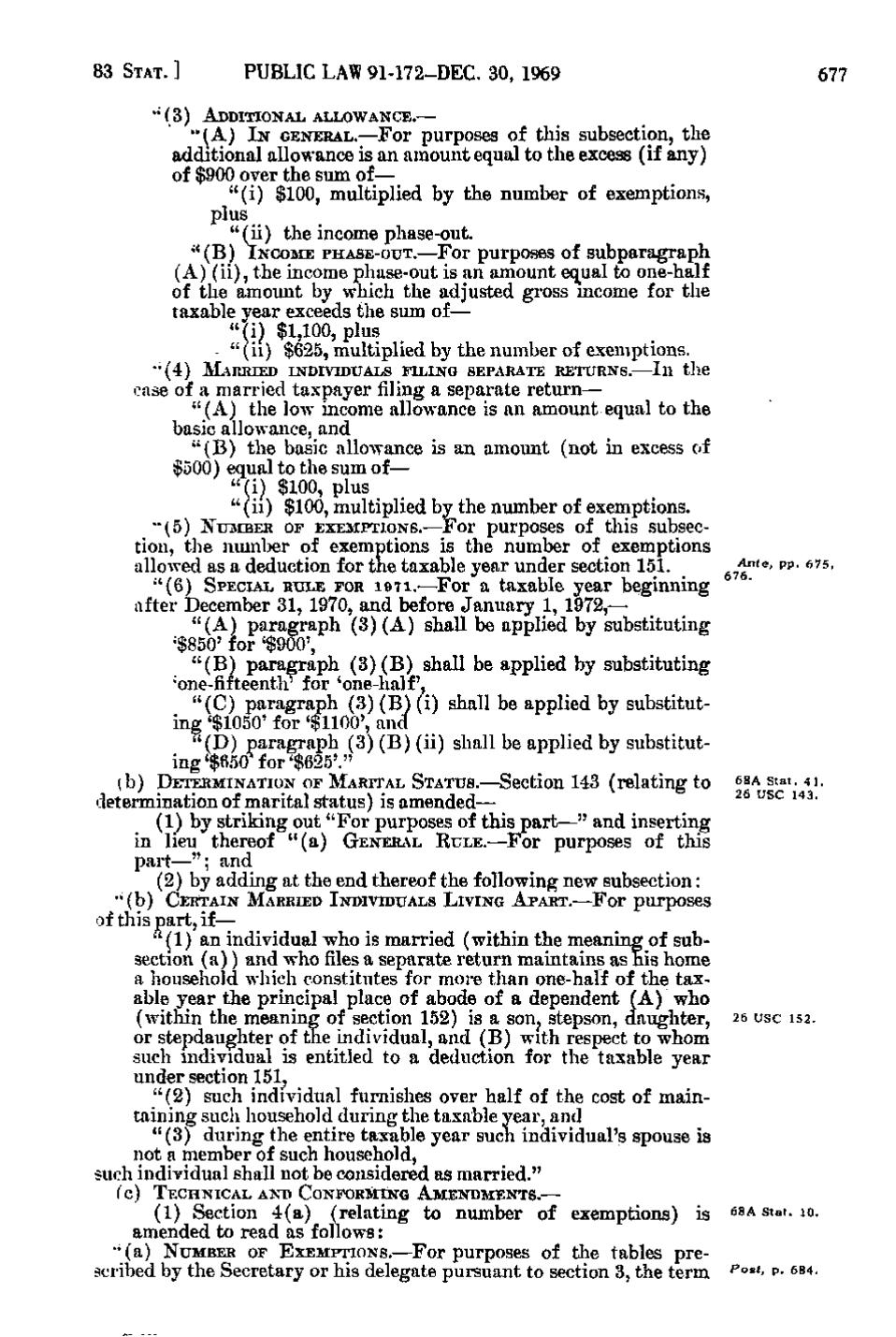

83 STAT. ] "(3)

PUBLIC LAW 91-172-DEC. 30, 1969

677

ADDITIONAL ALLOWANCE.—

" (A) IN GENERAL.—For purposes of this subsection, the additional allowance is an amount equal to the excess (if any) of $900 over the sum of— "(i) $100, multiplied by the number of exemptions, plus "(ii) the income phase-out. •'(B) INCOME PHASE-OUT.—For purposes of subparagraph (A) (ii), the income phase-out is an amount eq^ual to one-half of the amount by which the adjusted gross income for the taxable year exceeds the sum of— " (i) $1,100, plus • "(ii) $625, multiplied by the number of exemptions. ••(4)

MARRIED INDIVIDUALS FILING SEPARATE RETURNS.—In

the

case of a married taxpayer filing a separate return— " (A) the low income allowance is an amount equal to the basic allowance, and " (B) the basic allowance is an amount (not in excess of $500) equal to the sum of— " (i) $100, plus _ " (ii) $100, multiplied by the number of exemptions. •*(5) NUMBER OF EXEMPTIONS.—For purposes of this subsection, the number of exemptions is the number of exemptions allowed as a deduction for the taxable year under section 151. 676"'"' ^^' ^^^' "(6) SPECIAL RULE FOR 1971.—For a taxable year beginning after December 31, 1970, and before January 1, 1972,— " (A) paragraph (3)(A) shall be applied by substituting •$850' for '$900', " (B) paragraph (3)(B) shall be applied by substituting 'one-fifteenth' for 'one-half, " (C) paragraph (3)(B)(i) shall be applied by substituting '$1050' for '$1100', and " (D) paragraph (3)(B) (ii) shall be applied by substituting'$650'for'$625'." (b) DETERMINATION OF MARriAL STATUS.—Section 143 (relating to 68Astat.4i. determination of marital status) is amended— ^^ ^^^ ^'^^' (1) by striking out "For purposes of this part—" and inserting in lieu thereof " (a) GENERAL RULE.—For purposes of this part—"; and (2) by adding at the end thereof the following new subsection: "(b)

CERTAIN MARRIED INDIVIDUALS LIVING APART.—For purposes

of this part, if— "(1) an individual who is married (within the meaning of subsection (a)) and who files a separate return maintains as his home a household which constitutes for more than one-half of the taxable year the principal place of abode of a dependent (A) who (within the meaning of section 152) is a son, stepson, daughter, or stepdaughter of the individual, and (B) with respect to whom such individual is entitled to a deduction for the taxable year under section 151, "(2) such individual furnishes over half of the cost of maintaining such household during the taxable year, and "(3) during the entire taxable year such individual's spouse is not a member of such household, such individual shall not be considered as married."

26 USC is2.

(c) TECHNICAL AND CONFORMING AMENDMENTS.—

(1) Section 4(a) (relating to number of exemptions) is amended to read as follows: '•(a) NUMBER OF EXEMPITONS.—For purposes of the tables prescribed by the Secretary or his delegate pursuant to section 3, the term

68A Stat. 10. ^°® P- ^84.

�