716

26 USC 355.

Ante, p. 715.

PUBLIC LAW 91-172-DEC. 30, 1969

[83

STAT.

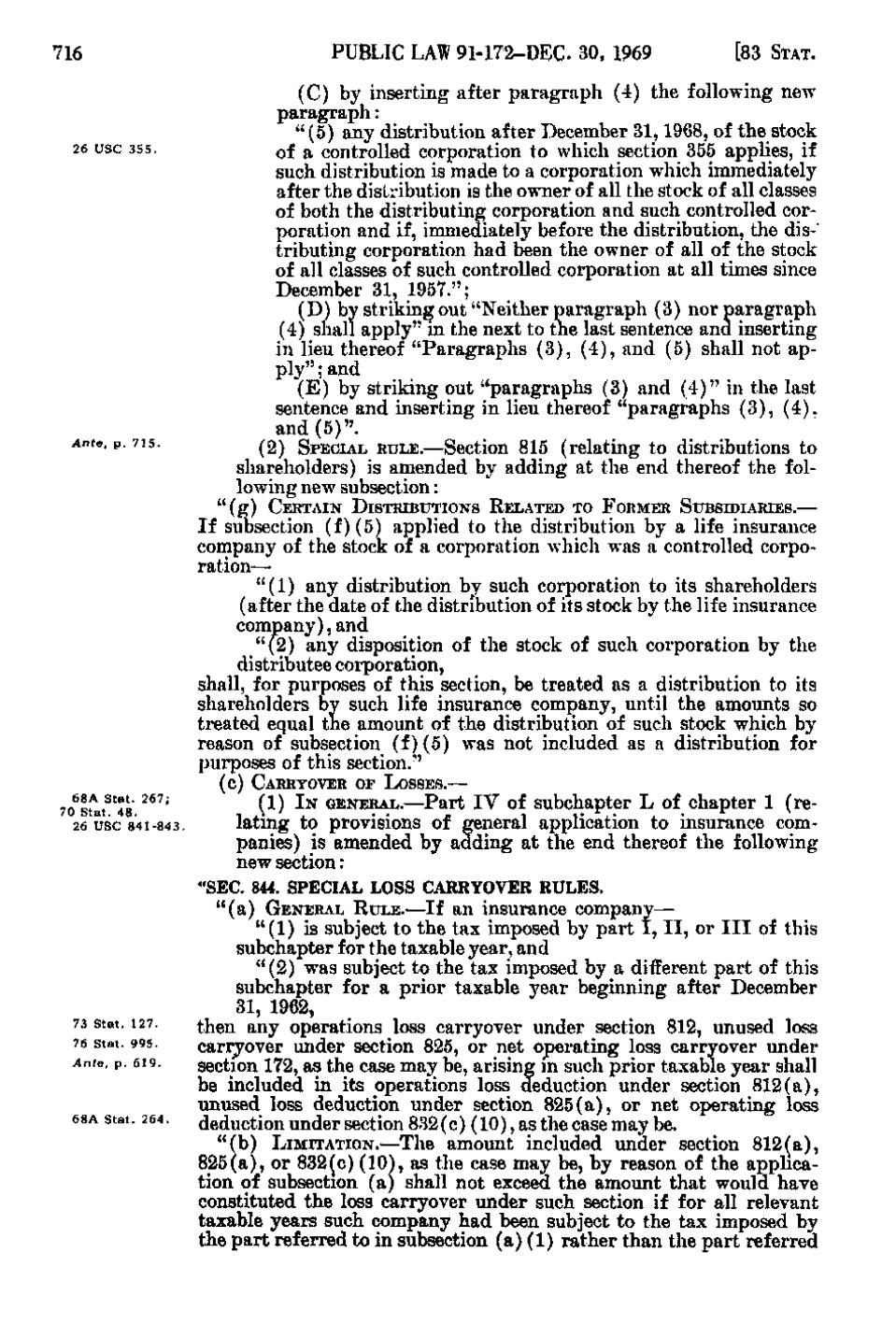

(C) by inserting after paragraph (4) the following new paragraph: "(5) any distribution after December 31, 1968, of the stock Qf a controlled corporation to which section 355 applies, if such distribution is made to a corporation which immediately after the distribution is the owner of all the stock of all classes of both the distributing corporation and such controlled corporation and if, immediately before the distribution, the dis-' tributing corporation had been the owner of all of the stock of all classes of such controlled corporation at all times since December 31, 1957."; (D) by striking out "Neither paragraph (3) nor paragraph (4) shall apply" in the next to the last sentence and inserting in lieu thereof "Paragraphs (3), (4), and (5) shall not apply"; and (E) by striking out "paragraphs (3) and (4) " in the last sentence and inserting in lieu thereof "paragraphs (3), (4), and (5)". ^2) SPECIAL RULE.—Section 815 (relating to distributions to shareholders) is amended by adding at the end thereof the following new subsection: " (g) CERTAIN DISTRIBUTIONS RELATED TO FORMER SUBSIDIARIES.—

If subsection (f)(5) applied to the distribution by a life insurance company of the stock of a corporation which was a controlled corporation— "(1) any distribution by such corporation to its shareholders (after the date of the distribution of its stock by the life insurance company), and "(^2) any disposition of the stock of such corporation by the distributee corporation, shall, for purposes of this section, be treated as a distribution to its shareholders by such life insurance company, until the amounts so treated equal the amount of the distribution of such stock which by reason of subsection (f)(5) was not included as a distribution for purposes of this section." (c) CARRYOVER or LOSSES.—

7o^stlt^*48 ^^^ 26 USC 841-843.

{^^ ^^ GENERAL.—Part IV of subchapter L of chapter 1 (relating to provisions of general application to insurance companies) is amended by adding at the end thereof the following new section: "SEC. 844. SPECIAL LOSS CARRYOVER RULES. " (a) GENERAL RULE. — I f an insurance company—

73 Stat. 127. 76 Stat. 995. Ante, p. 619. 68A Stat. 264.

"(1) is subject to the tax imposed by part I, II, or III of this subchapter for the taxable year, and "(2) was subject to the tax imposed by a different part of this subchapter for a prior taxable year beginning after December 31, 1962, ^J^QJ^ ^uy operations loss carryover under section 812, unused loss carryovcT under section 825, or net operating loss carryover under section 172, as the case maj be, arising in such prior taxable year shall be included in its operations loss deduction under section 812(a), unused loss deduction under section 825(a), or net operating loss deduction under section 832(c) (10), as the case may be. " (b) LIMITATION.—The amount included under section 812(a), 825(a), or 832(c) (10), as the case may be, by reason of the application of subsection (a) shall not exceed the amount that would have constituted the loss carryover under such section if for all relevant taxable years such company had been subject to the tax imposed by the part referred to in subsection (a)(1) rather than the part referred

�