SOO 84 Stat. 2060. 26 USC 47.

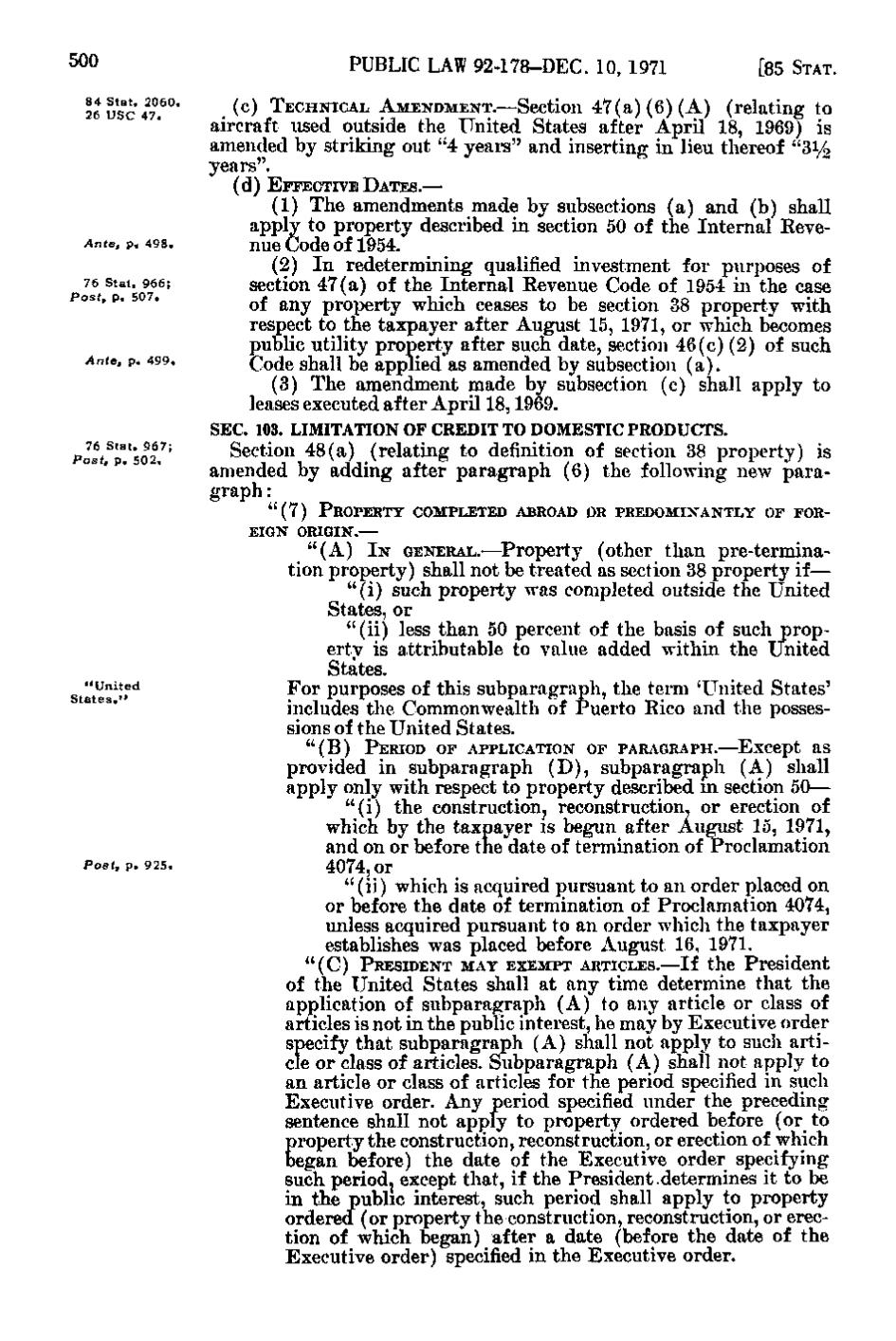

P U B L I C LAW 9 2 - 1 7 8 - D E C. 10, 1971 (c) TECHNICAL AMENDMENT.—Section 47(a)(6)(A)

[85 STAT. (relating to

aircraft used outside the United States after April 18, 1969) is amended by striking out "4 years" and inserting in lieu thereof "31/^ years". (d) EFFECTIVE DATES.—

Ante, p. 498. 76 p. 507. Post, Stat.^966;

Ante, p. 499.

Post^^V'soiJ'

(1) The amendments made by subsections (a) and (b) shall apply to property described in section 50 of the Internal Revenue Code of 1954. (2) I n redetermining qualified investment for purposes of section 47(a) of the Internal Revenue Code of 1954 in the case of any property which ceases to be section 38 property with respect to the taxpayer after August 16, 1971, or which becomes public utility property after such date, section 46(c)(2) of such Code shall be applied as amended by subsection (a). (3) The amendment made by subsection (c) shall apply to leases executed after April 18, 1969. SEC. 103. LIMITATION OF CREDIT TO DOMESTIC PRODUCTS. Section 48(a) (relating to definition of section 38 property) is amended by adding after paragraph (6) the following new paragraph: " (7) PROPERTY COMPLETED ABROAD OR PREDOMINANTLY o r FOREIGN ORIGIN.—

"United

" (A) IN GENERAL.—Property (other than pre-termination property) shall not be treated as section 38 property if— "(i) such property was completed outside the United States, or "(ii) less than 50 percent of the basis of such property is attributable to value added within the United States. Por purposes of this subparagraph, the term 'United States' includes the Commonwealth of Puerto Rico and the possessions of the United States. "(B)

Post, p. 925.

PERIOD OF APPLICATION OF PARAGRAPH.—Except as

provided in subparagraph (D), subparagraph (A) shall apply only with respect to property described in section 50— " (i) the construction, reconstruction, or erection of which by the taxpayer is begun after August 15, 1971, and on or before the date of termination of Proclamation 4074, or "(ii) which is acquired pursuant to an order placed on or before the date of termination of Proclamation 4074, unless acquired pursuant to an order which the taxpayer establishes was placed before August 16, 1971. " (C) PRESIDENT MAY EXEMPT ARTICLES.—If the President

of the United States shall at any time determine that the application of subparagraph (A) to any article or class of articles is not in the public interest, he may by Executive order specify that subparagraph (A) shall not apply to such article or class of articles. Subparagraph (A) shall not apply to an article or class of articles for the period specified in such Executive order. Any period specified under the preceding sentence shall not apply to property ordered before (or to property the construction, reconstruction, or erection of which began before) the date of the Executive order specifying such period, except that, if the President determines it to be in the public interest, such period shall apply to property ordered (or property the construction, reconstruction, or erection of which began) after a date (before the date of the Executive order) specified in the Executive order.

�