86

STAT.]

PUBLIC LAW 92-603-OCT. 30, 1972

1395

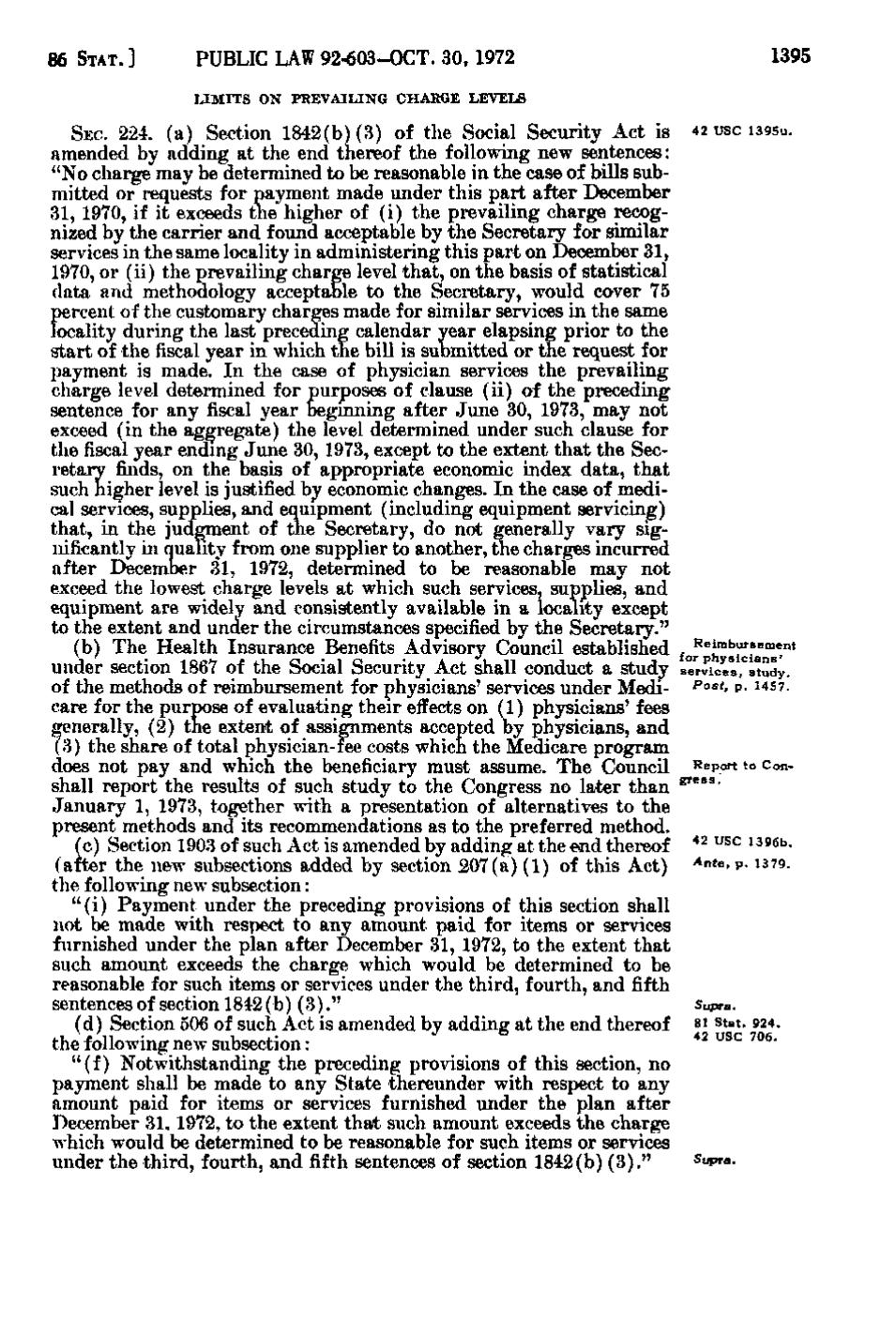

LIMITS ON PREVAILING CHARGE LEVELS

SEC. 224. (a) Section 1842(b)(3) of the Social Security Act is 42 USC 139Su. amended by adding at the end thereof the following new sentences: "No charge may be determined to be reasonable in the case of bills submitted or requests for payment made under this part after December 31, 1970, if it exceeds the higher of (i) the prevailing charge recognized by the carrier and found acceptable by the Secretary for similar services in the same locality in administering this part on December 31, 1970, or (ii) the prevailing charge level that, on the basis of statistical data and methodology acceptable to the Secretary, would cover 75 percent of the customary charges made for similar services in the same locality during the last preceding calendar year elapsing prior to the start of the fiscal year in which the bill is submitted or the request for payment is made. In the case of physician services the prevailing charge level determined for purposes of clause (ii) of the preceding sentence for any fiscal year beginning after June 30, 1973, may not exceed (in the aggregate) the level determined under such clause for the fiscal year ending June 30, 1973, except to the extent that the Secretary finds, on the basis of appropriate economic index data, that such higher level is justified by economic changes. In the case of medical services, supplies, and equipment (including equipment servicing) that, in the judgment of the Secretary, do not generally vary significantly in quality from one supplier to another, the charges incurred after December 31, 1972, determined to be reasonable may not exceed the lowest charge levels at which such services, supplies, and equipment are widely and consistently available in a locality except to the extent and under the circumstances specified by the Secretary." (b) The Health Insurance Benefits Advisory Council established foreimbursement physicians' under section 1867 of the Social Security Act shall conduct a study services, study. of the methods of reimbursement for physicians' services under Medi- Post, p. 1457. care for the purpose of evaluating their effects on (1) physicians' fees generally, (2) the extent of assignments accepted by physicians, and (3) the share of total physician-fee costs which the Medicare program does not pay and which the beneficiary must assume. The Council Report to Conshall report the results of such study to the Congress no later than gress. January 1, 1973, together with a presentation of alternatives to the present methods and its recommendations as to the preferred method. (c) Section 1903 of such Act is amended by adding at the end thereof 42 USC 1396b. (after the new subsections added by section 207(a.) (1) of this Act) Ante, p. 1379. the following new subsection: " (i) Payment under the preceding provisions of this section shall not be made with respect to any amount paid for items or services furnished under the plan after December 31, 1972, to the extent that such amount exceeds the charge which would be determined to be reasonable for such items or services under the third, fourth, and fifth sentences of section 1842(b)(3)." Supra. (d) Section 506 of such Act is amended by adding at the end thereof 81 Stat. 924. 42 USC 706. the following new subsection: " (f) Notwithstanding the preceding provisions of this section, no payment shall be made to any State thereunder with respect to any amount paid for items or services furnished under the plan after December 31. 1972, to the extent that such amount exceeds the charge which would be determined to be reasonable for such items or services Supra. under the third, fourth, and fifth sentences of section 1842(b)(3)."

�